A better way to play with cheap puts on a probabilistic pullback in MSFT.

Microsoft (MSFT) is one of two US companies with a market capitalization in excess of $2 trillion. MSFT stock is up over 30% over the past few months after hitting a low near $220 on Jan. 6.

However, the recent blistering rally is finally starting to slow down. “Sell in May and go away” applies to Microsoft as monthly stock returns have been negative on average over the last 5 years.

Aside from the recent rally receding, here are three other very valid reasons to be a bit skeptical about continued strength in MSFT stock in the coming weeks — along with a better way to play.

Technology

Microsoft is starting to falter after failing to make fresh highs above $294. Stocks hit overbought levels on both the 9-day RSI and the Bollinger Percent B before falling. MSFT trades at a large premium to the 20-day moving average, which has historically led to pullbacks to the average. MACD just generated a sell signal.

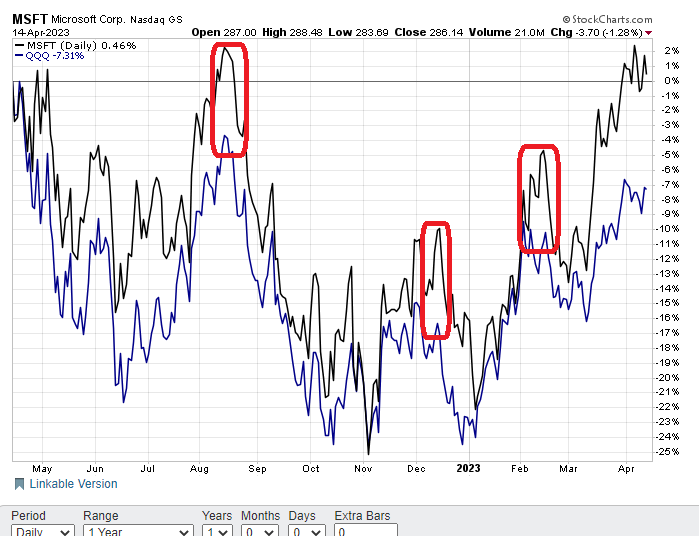

MSFT stock also looks a bit overdone by comparison. Microsoft is now showing a slight gain over the trailing 12 months while the NASDAQ 100 (QQQ) is still down over 7% over the period. Typically, MSFT and QQQ tend to move in tandem, which makes sense given that Microsoft has the largest weighting in the NASDAQ 100 ETF at 12.68%.

The performance spread difference between MSFT and QQQ has once again reached an extreme.

Expect Microsoft to come back in the coming weeks and be a major underperformer, as it has been in the past.

Evaluation

The current price-to-earnings (P/E) ratio is back above 30x and at the highest multiple of the past year. The last time it hit 30x in August marked a significant high for Microsoft stock.

It’s also well above the average P/E of 27.72 over the period. Other traditional valuation metrics such as price/revenue and price/free cash flow have seen similar increases.

It’s important to remember that interest rates have increased dramatically over the past 12 months. Normally, this would have a noticeable contractionary effect on stock valuation multiples. This makes the recent expansion in MSFT multiples even more pronounced.

Also, a $2 trillion company running these types of multiples makes it difficult to justify future growth rates due to the law of large numbers.

Implied Volatility

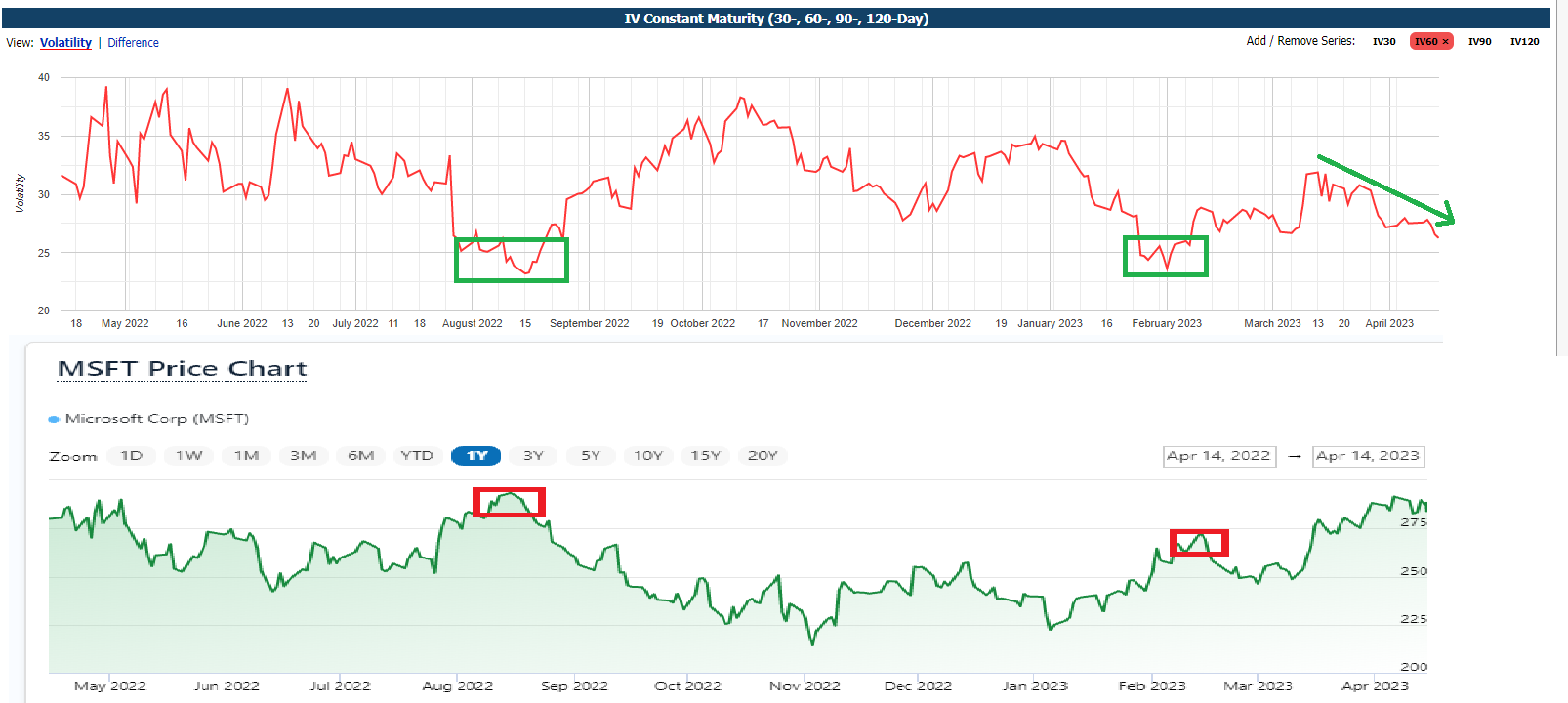

Implied volatility (IV) has fallen sharply on MSFT options over the past month. It is now at its lowest level since February and is approaching the yearly lows of last August.

Notice how IV’s lows almost exactly match recent highs in Microsoft stock. Implied volatility can be a valuable market timing tool.

Implied volatility is just another way of describing the price of options. A comparison from about a year ago helps shed some light.

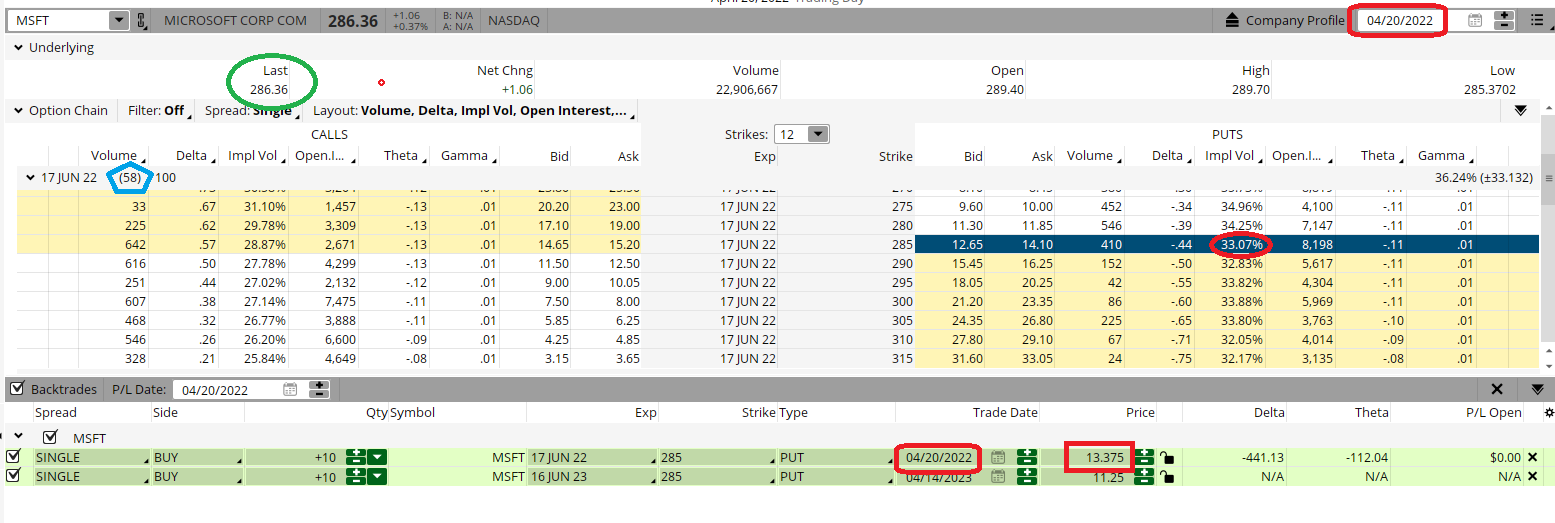

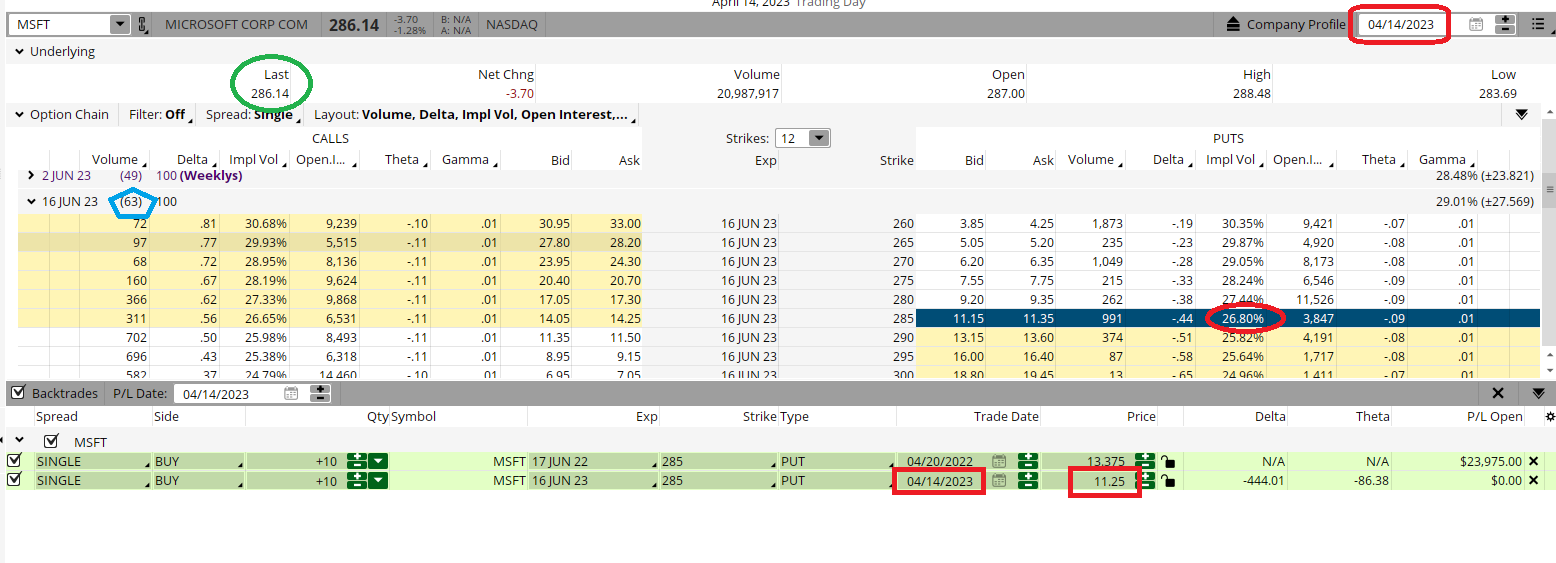

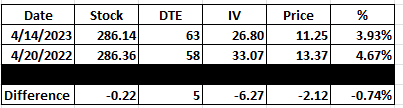

Below are the option montages for the June options from last Friday April 14 and one year ago April 20, 2022. We’ll use June’s $285 at-the-money puts for our example.

Comparison of the two:

- The stock price was almost identical – $286.14 on Friday and $286.36 a year ago on April 20. So slightly lower share price on Friday.

- Days to Expiration (DTE) were similar – 63 days from Friday and 58 days from 12 months ago. So 5 days longer until the end on Friday.

All things being equal, Friday’s $285 puts in June should be slightly more expensive than the $285 June puts a year ago as the stock price is lower and has more time to expiry.

But not all is equal – IV is much lower now (26.80) than it was a year ago (33.07). This much lower IV makes the current June puts of $285 over $2.00 cheaper than the $285 puts a year ago.

The following table summarizes everything.

The % column simply takes the option price divided by the stock price to create another useful comparison. June’s $285 puts are now less than 4% of the stock price, while the same puts would cost over 4.5% back then.

Microsoft is technically overbought and fundamentally overvalued. Low implied volatility (IV) levels are another reason to be bearish. Low IV values also mean option prices are cheaper.

Investors looking to hedge or traders looking to speculate can certainly short MSFT shares. But that can be expensive and risky.

Given the current situation, it might be better to consider a put purchase from Microsoft with a defined risk. It hasn’t been cheaper in a while, and the loss is limited to the cost of the option — what we’ve just seen is less than 4% of the cost of the stock.

POWR Options

What do you do next?

If you’re looking for the best options trades for today’s market, check out our latest presentation, How to Trade Options with the POWR Ratings. Here we show you how to consistently find the best option trades while minimizing risk.

If this appeals to you and you want to learn more about this powerful new options strategy, click below to access this updated investment presentation now:

How to trade options with the POWR ratings

All the best!

Tim Biggam

Publisher, POWR Options Newsletter

MSFT shares closed at $286.14 on Friday, down -$3.70 (-1.28%). Year-to-date, MSFT is up 19.61% versus an 8.26% gain for the benchmark S&P 500 over the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He is a regular on Bloomberg TV and writes Morning Trade Live weekly for the TD Ameritrade Network. His overriding passion is making the complex world of options more understandable and therefore more useful for the everyday trader. Tim is the editor of the POWR Options newsletter. Find out more about Tim’s background and links to his latest articles.

More…

The post Three big reasons Microsoft might be ready for a stomp appeared first StockNews.com