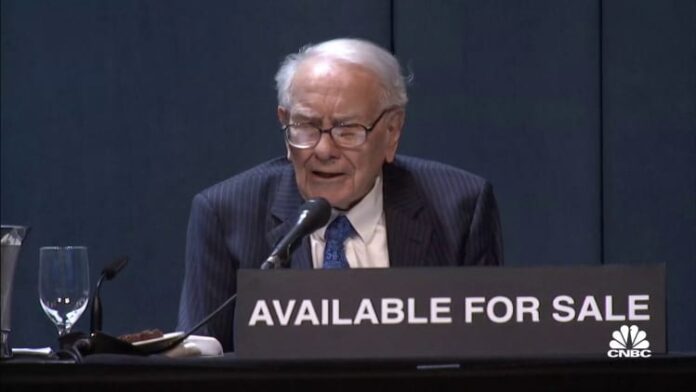

Follow our live coverage of Warren Buffett at the Berkshire Hathaway meeting.

OMAHA, Neb. — Warren Buffett said Saturday that Berkshire Hathaway doesn’t plan to take full control Western Petroleuman oil giant in which he has acquired a stake of over 20%.

“There is speculation that we are buying control, we will not be buying control,” the Oracle of Omaha said at Berkshire’s annual shareholder meeting. “We wouldn’t know what to do with it.”

In August of last year, Berkshire received regulatory approval to acquire up to a 50% stake. Since then, Buffett has steadily increased his bet, including this year by increasing the conglomerate’s stake in the Houston-based energy producer to 23.5%. The moves had fueled speculation that the 92-year-old investor could acquire the entire company.

“We’re not going to bid for control of Occidental, but we love the stocks we have,” Buffett said. “We may or may not own more going forward, but we certainly have warrants on what we got in the original deal for a very substantial amount of shares at about $59 a share and warrants last a long time, and I do.” I’m glad we have them.”

Berkshire owns $10 billion of Occidental preferred stock and has warrants to purchase an additional 83.9 million common shares for $5 billion, or $59.62 each. The warrants were acquired as part of the company’s 2019 deal, which helped fund Occidental’s purchase of Anadarko.

Occidental’s shares are down about 3% this year after more than doubling in 2022. The stock was the best-performing stock in the S&P 500 over the past year.

— CNBC’s Sarah Min contributed to the coverage.