Breadcrumb trail links

Average prices fell by 5.4%

Published on January 4, 2024 • Last updated on January 4, 2024 • 3 minutes reading time

Both benchmark and average Toronto home prices declined in 2023. Photo by National Post

Both benchmark and average Toronto home prices declined in 2023. Photo by National Post

Article content

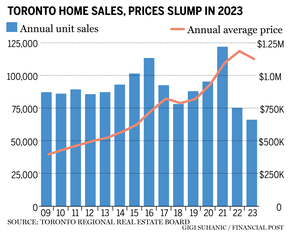

Home sales in Toronto fell to their lowest level in 13 years in 2023 as higher mortgage rates deterred buyers, according to year-end figures from the Toronto Regional Real Estate Board.

Only 65,982 homes changed hands in the last 12 months, down 12 percent from the previous year and 45.7 percent below a sales peak in 2021.

Article content

Both benchmark and average home prices declined in 2023, with the benchmark falling 0.41 percent to $1,067,200 and average prices falling 5.4 percent to $1,126,604.

Advertising 2

This ad has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

Register to unlock more articles

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the discussion in the comments.

- Enjoy additional articles per month.

- Get email updates from your favorite authors.

Article content

TRREB chief market analyst Jason Mercer said a broader selection of homes on the market has allowed buyers to negotiate lower prices in some cases.

But Tim Syrianos, principal broker and owner of Re/Max Ultimate Realty Inc., said seller jitters have limited the extent of price declines in 2023.

“These success stories are very rare because a lot of people (sellers) just didn’t want to participate,” he said.

Data released Wednesday showed Vancouver home sales in 2023 fell 10 per cent from the previous year and were nearly 25 per cent below the 10-year average.

However, property prices in the western city beat expectations and ended the year in positive territory despite the highest borrowing costs in over a decade.

Vancouver's benchmark home price was $1,168,700 in December, 1.4 per cent less than November but five per cent higher than December 2022.

As for the Toronto market in 2024, Mercer said there could be a squeeze if borrowing costs continue to fall.

Newly appointed TRREB President Jennifer Pearce was also cautiously optimistic about the coming year.

Top stories

Thanks for registering!

Article content

Advertising 3

This ad has not loaded yet, but your article continues below.

Article content

“Borrowing costs are expected to trend downward in 2024,” Pearce said. “Lower mortgage rates coupled with a relatively robust economy should lead to a rebound in home sales this year.”

On a month-over-month basis, average sales prices increased in December, while the MLS Home Price Index Composite recorded a slight decrease.

On a seasonally adjusted monthly basis, sales were higher while new listings fell for the third straight month.

Noting that this December was the first seasonal market in three years, Syrianos said the market exceeded its expectations.

“Make no mistake, it's been a tougher year with a lot of uncertainty, but if you look at the first few weeks of December, it's definitely done better than we expected,” he said.

Toronto real estate agent Cailey Heaps expects more homes will be available by the end of January and that interest rates will fall early in the second quarter of 2024.

“I expect we will see an increase in inventory starting in the third or fourth week of January and I think we will see an increase in demand over the next few weeks to about a month because I think a lot of buyers will want to forestall the supposedly increasing price pressure.”

Advertising 4

This ad has not loaded yet, but your article continues below.

Article content

Syrians expect buyers to remain hesitant.

Recommended by Editorial

-

Simple plan to increase Canada's supply of affordable housing

-

Inflation and interest rates determine the direction of the real estate market

“There will be people getting back into the market and trying to educate themselves about whether there are opportunities in the market, but it won't be a rush coming out of the gates,” he said.

He believes the Bank of Canada needs to provide assurances that rate hikes are off the table to get both buyers and sellers back in the game.

• Email: [email protected]

Bookmark our website and support our journalism: Don't miss out on the business news you need to know – bookmark Financialpost.com and sign up for our newsletter here.

Article content

Share this article on your social network