Breadcrumb trail links

Effects will probably only be felt in some time

Published 04 September 2024 • Last updated 3 days ago • 4 minutes reading time

You can save this article by registering for free here. Or log in if you already have an account.

According to real estate experts, interest rates are still not low enough to stimulate activity in the housing market again. Photo by Brian Thompson /Brantford Exhibitors

According to real estate experts, interest rates are still not low enough to stimulate activity in the housing market again. Photo by Brian Thompson /Brantford Exhibitors

Article content

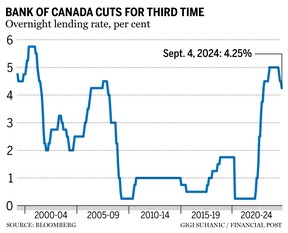

On Wednesday, the Bank of Canada cut its benchmark interest rate for the third consecutive day by 25 basis points to 4.25 percent. Economists are forecasting further rate cuts by the central bank for the rest of the year and into 2025. Here's what experts have to say about the impact of the cuts on Canada's housing markets:

“It will take several more cuts”: Rates.ca

Display 2

This ad hasn't loaded yet, but your article will continue below.

THIS CONTENT IS FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news from your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from the Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from the Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition for viewing on any device, sharing and commenting.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news from your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from the Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from the Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition for viewing on any device, sharing and commenting.

- Daily puzzles, including the New York Times Crossword.

REGISTER / LOGIN TO UNLOCK MORE ARTICLES

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Look forward to additional articles every month.

- Get email updates from your favorite authors.

Sign in or create an account

or

Article content

The fact that the Bank of Canada is further lowering its overnight interest rate is good news, but the effects on the housing market will probably take some time to become apparent, says Victor Tran, mortgage and real estate expert at Rates.ca.

According to insurance comparison website Rates.ca, for every 25 basis point decrease, a homeowner with an adjustable rate mortgage can expect to see their monthly payments reduced by about $15 per $100,000 of mortgage.

Tran said fixed-rate mortgage holders would not feel the impact of any rate cuts until they renew.

He noted that housing market activity in major metropolitan areas such as Toronto and Vancouver has not increased nearly as much as expected in recent months. Despite earlier rate cuts, mortgage rates remain quite high, he added.

Even a one-percent reduction in current mortgage rates would not lead to a significant increase in purchasing power given persistently high home prices, he explained.

“Mortgage rates have not come down nearly fast enough to stimulate strong activity in the housing market. People just can't afford it,” Tran said. “It will take a significant decline in mortgage rates before we see a return of activity in the housing market.”

Top Stories

Thanks for signing up

Article content

Display 3

This ad hasn't loaded yet, but your article will continue below.

Article content

With the national average home price at about $700,000, a single percentage point reduction would likely not make a significant difference in a prospective homeowner's purchase decision, he said.

According to Rates.ca's mortgage calculator, the lowest insured interest rate for a five-year fixed rate mortgage is 4.34 percent and for a five-year variable rate mortgage is 5.4 percent.

“Will not revive the real estate market”: Nerdwallet Canada

This latest rate cut by the Bank of Canada will make things a little easier for adjustable-rate mortgage buyers, but it won't revive the housing market, says Clay Jarvis, mortgage and real estate expert at Nerdwallet Canada.

Much lower fixed rates have been available to buyers all year, and if they aren't successful, it's likely due to other factors such as high home prices, increased debt burdens, lower savings and concerns about the economy, he said. A slight drop in variable rates doesn't lower any of those market barriers, he noted.

Display 4

This ad hasn't loaded yet, but your article will continue below.

Article content

Financial Post

Financial Post

“The crucial question is whether to buy now or wait”: Royal LePage

With the recent interest rate cut, the key question for first-time home buyers is whether to buy now or wait, said Phil Soper, managing director of Royal LePage Real Estate Services Ltd.

The Bank of Canada continues its delicate balancing act, gradually easing the economic burden of high interest rates as the economy cools. With inflation now at its lowest level in three years, policymakers are turning their focus to jobs and housing, Soper noted.

On the one hand, property prices have remained broadly stable this year and affordability has improved due to lower borrowing costs, he said. But once the backlog of discouraged buyers enters the market, pent-up demand will drive prices higher.

“This fall, we can expect more cautious Canadians to take the plunge, while those willing to take the risk may wait for further rate cuts,” Soper said.

Macquarie: Housing construction remains a challenge

Despite interest rate cuts, Canada's housing market remains challenging as existing home sales are subdued and spending on renovations is declining, notes David Doyle, head of economics at Macquarie Group Ltd.

Display 5

This ad hasn't loaded yet, but your article will continue below.

Article content

Doyle said the share of consumers expecting home prices to rise has fallen in recent weeks and is below levels seen at the start of the rate hike cycle.

This looks like an embedded tightening that will worsen in 2025 and 2026, slowing home resales, renovations and discretionary consumer spending, he said.

He added that the Bank of Canada will likely have to cut interest rates to lower levels than the U.S. Federal Reserve in the next 12 months.

Bank of Montreal: Expect further rate cuts

Canadian mortgage lenders should expect further interest rate relief after borrowing costs peaked late last year, said Sal Guatieri, senior economist at the Bank of Montreal.

Douglas Porter, chief economist at BMO, said the Bank of Canada had hinted at more drastic rate cuts if inflation declined faster than expected – but said they were not surprised by recent trends.

Editor's recommendations

-

RBC admits that an interest rate war is underway

-

With interest rates falling, five-year fixed-term mortgages compete for the crown

-

Who's afraid of the big, bad adjustable rate mortgage?

Porter said the bank is likely to cut interest rates further in coming meetings. “While we expect a series of 25 basis point moves through early next year, we do not rule out a possible 50 basis point move at some point,” he added.

• Email: [email protected]

Bookmark our website and support our journalism: Don't miss out on the business news you need to know – bookmark financialpost.com and sign up for our newsletters here.

Want to know more about the mortgage market? Read Robert McLister's weekly column in the Financial Post to find out the latest trends and details on financing opportunities you can't miss.

Article content

Share this article on your social network