Breadcrumb Trail Links

The projected decline in property prices is unlikely to materialize

Published on March 21, 2023 • 4 minutes read

A home for sale in Mississauga, Ont. Photo by Peter J. Thompson/National Post Files

A home for sale in Mississauga, Ont. Photo by Peter J. Thompson/National Post Files

content of the article

A flurry of recent home forecasts paints a conflicting picture of where markets are headed, with some pointing to further declines in house prices and others pointing to a more optimistic view, leaving home buyers and sellers wondering which way the wind is blowing.

advertising 2

This ad has not yet loaded, but your article continues below.

THIS CONTENT IS FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Unlimited online access to articles from across Canada with one account

- Get exclusive access to the National Post ePaper, an electronic copy of the print edition that you can share, download, and comment on

- Enjoy behind-the-scenes insight and analysis from our award-winning journalists

- Support local journalists and the next generation of journalists

- Daily puzzles including the New York Times crossword

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Unlimited online access to articles from across Canada with one account

- Get exclusive access to the National Post ePaper, an electronic copy of the print edition that you can share, download, and comment on

- Enjoy behind-the-scenes insight and analysis from our award-winning journalists

- Support local journalists and the next generation of journalists

- Daily puzzles including the New York Times crossword

SIGN UP TO UNLOCK MORE ARTICLES

Create an account or log in to continue your reading experience.

- Access items from across Canada with one account

- Share your thoughts and join the discussion in the comments

- Enjoy additional articles per month

- Receive email updates from your favorite authors

content of the article

Oxford Economics, a financial advisory firm, recently forecast that Canadian house prices will fall 30 percent by mid-2023 from the peak seen in the first quarter of 2022. The worst-case scenario calls for a 48 percent drop from last year’s peak. but its best-case scenario, a 27 percent drop, isn’t that big either.

Financial Post top stories

By clicking the subscribe button, you agree to receive the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for registering!

content of the article

According to Oxford Economics, average house prices have fallen by 14 percent over the past year, so the projected 30 percent drop implies a significant fall in prices over the next few months. This would have serious negative consequences for the housing markets and the economy as a whole. However, we believe these projected declines are unlikely to materialize.

Our expectations for house price stability are based in part on current market data and our longstanding skepticism about the accuracy of empirical projections, which are a by-product of forecasters’ assumptions. The late George Box, a pioneer of statistical prediction, warned that all predictions (statistical models) are wrong, but some are useful. But what homebuyers and sellers need to ensure isn’t necessarily the accuracy of the forecasts, but their usefulness.

content of the article

advertising 3

This ad has not yet loaded, but your article continues below.

content of the article

According to the Canadian Real Estate Association, the nationwide average selling price in February was 18.9 percent lower than a year earlier. However, a more useful indicator is the MLS Home Price Index, which controls for the differences in size and quality in transactions made over time and adjusts for seasonal differences. That metric is down 15.8 percent since February 2022, suggesting smaller or cheaper homes have transacted more frequently since mortgage rate hikes began in early 2022.

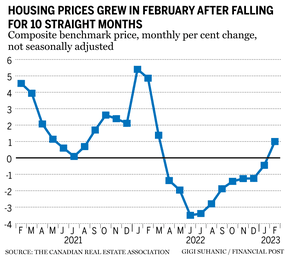

The seasonally adjusted (SA) composite selling price fell 1.1 percent in February from the previous month. This is the smallest month-on-month decline since April 2022. However, a slowdown in the rate of decline suggests house prices could reverse in the coming months. The non-seasonally adjusted composite reference price rose 1 percent month-on-month in February.

advertising 4

This ad has not yet loaded, but your article continues below.

content of the article

The composite benchmark price is an aggregated representation of housing markets across Canada. The pronounced local housing market dynamics are hidden in the national averages. For example, Calgary’s benchmark price in SA was up 1.8 percent in February from a year earlier.

The drop in national prices is primarily impacted by the relatively large drop in peak prices in the Greater Toronto Area (GTA) and other less populous cities within a two-hour drive. During the pandemic, these housing markets experienced above-average price growth. Subsequent hikes in mortgage rates have hurt prices more in southern Ontario, erasing some of the gains made during the pandemic.

A quick look at sales volumes suggests that the current decline is slowing rather than accelerating, as are prices. Sales volume in February 2023 was 40 percent lower than the peak observed a year earlier, but seasonally adjusted sales in February were 2.3 percent higher than a month earlier.

advertising 5

This ad has not yet loaded, but your article continues below.

content of the article

Again, there are clear regional disparities in sales activity, which was much more pronounced in the major housing markets than the 2.3 percent month-on-month increase in sales nationwide. For example, February sales were up 15.2 percent month-over-month in the Vancouver metro area, 8.5 percent in the GTA and 3.7 percent in the Montreal Census metro area.

Other emerging signs of a real estate market recovery are emerging. According to a recent survey by Royal LePage, 62 percent of previously frustrated buyers are expected to return to the housing market in the spring. It found that 26 percent of those who put their home buying plans on hold last year because of hikes in mortgage rates are expected to be actively looking for homes in the spring. Another 36 percent said they would go ahead with a home purchase if there were no further rate hikes. The expected return of buyers to the market is a likely reason for property price stability.

advertising 6

This ad has not yet loaded, but your article continues below.

content of the article

A longer-term view of the markets also paints a picture of resilience. Despite the fall in house prices since March 2022, prices are still much higher than three years ago. For example, the SA Composite benchmark price in February was 28.8 percent higher than three years ago.

-

Canada’s rental housing market lags behind the US, causing many problems

-

Housing demand means more condominiums, which benefits renters and investors alike

-

Quebec may have cheaper rents, but that’s because incomes are lower

Furthermore, the expected return of homebuyers in the spring selling season and a possible slower growth in new listings suggest that the decline in house prices will at least be slower, while the chances of a rise are also not negligible.

advertising 7

This ad has not yet loaded, but your article continues below.

content of the article

If job markets in Canada and the United States continue to show their recent strength and interest rates halt their upward trend, the economic slowdown could be less than forecast, leading to fewer job losses. Consequently, stable labor markets should support the stability of house prices, which will only lead to moderate to small price declines in the near future.

Murtaza Haider is Professor of Real Estate Management and Director of the Urban Analytics Institute at Toronto Metropolitan University. Stephen Moranis is a real estate industry veteran. They can be reached at the Haider-Moranis Bulletin website, www.hmbulletin.com.

Share this article on your social network

Comments

Postmedia strives to maintain a vibrant but civilized forum for discussion and encourages all readers to share their views on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve turned on email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update on a comment thread you follow, or when a user you follow comments follows. For more information and details on how to customize your email settings, see our Community Guidelines.