Breadcrumb trail links

The reference price for homes remains almost unchanged in June

Published on July 12, 2024 • Last updated 12 hours ago • 3 minutes reading time

You can save this article by registering for free here. Or log in if you already have an account.

A “For Sale” sign in front of a house in Vancouver. Photo by Jennifer Gauthier/Bloomberg Files

A “For Sale” sign in front of a house in Vancouver. Photo by Jennifer Gauthier/Bloomberg Files

Article content

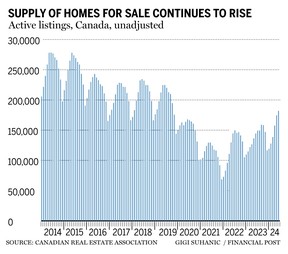

The Canadian Real Estate Association (CREA) released its June report today, showing another increase in inventory and a benchmark home price of $717,700, virtually unchanged from the previous month. The 0.1 percent price increase was the first increase in 11 months, but was still 3.4 percent below the year-ago level.

At the end of June, there were about 180,000 properties listed for sale on Canada's Multiple Listing Service, up 26 percent from a year ago. Despite this increase, the current number of listings is below the historical average of around 200,000 for this time of year. Seasonally adjusted, the number of listings at the end of June was up slightly by 0.5 percent from the end of May, indicating a possible slowdown in the national inventory build.

Display 2

This ad hasn't loaded yet, but your article will continue below.

THIS CONTENT IS FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news from your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from the Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from the Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition for viewing on any device, sharing and commenting.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news from your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from the Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from the Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition for viewing on any device, sharing and commenting.

- Daily puzzles, including the New York Times Crossword.

REGISTER / LOGIN TO UNLOCK MORE ARTICLES

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Look forward to additional articles every month.

- Get email updates from your favorite authors.

Sign in or create an account

or

Article content

New listings increased 1.5 percent in June compared to the previous month, driven primarily by the Greater Toronto Area and the Lower Mainland of British Columbia. However, the national increase in new listings was less than the increase in sales for the month, resulting in a decrease in the national sales-to-new listings ratio from 52.8 percent in May to 53.9 percent in June. This ratio remains close to the long-term average of 55 percent, indicating balanced market conditions, as a sales-to-new listings ratio between 45 and 65 percent is typically consistent with a balanced real estate market.

James Mabey, Chairman of CREA, highlighted the different experiences of buyers in different regions of Canada.

“In the second half of 2024, it is widely expected that buyers will slowly and gradually return to the real estate market,” Mabey said. “Depending on where in Canada they are, these buyers will have a very different buying experience, from multiple offers in places like Calgary to the largest offer in over a decade in places like Toronto.”

Top Stories

Thanks for registering!

Article content

Display 3

This ad hasn't loaded yet, but your article will continue below.

Article content

Gillian Oxley, founder of Oxley Real Estate in Toronto, said the increased supply in Toronto has led to a change in buyer behavior.

“If you don't have that pressure of multiple offers, maybe you go back to the house a second time. Maybe you go back a third time. Maybe you look a little more closely at how much storage space there is. There has been a shift in the time consideration, which then makes buyers more thoughtful. There's just a time consideration that buyers didn't have in 2021. They didn't have the luxury of time,” Oxley said.

Nationally, there were 4.2 months of inventory at the end of June 2024, up from 4.3 months at the end of May. This represents the first month-over-month inventory decline for 2024. The long-term average is around five months of inventory, suggesting that while there is more inventory than last year, it is still relatively tight by historical standards.

Overall, sales rose by 3.7 percent in June after seasonal adjustment, but remained 9.4 percent below the previous year's level.

Economist Rishi Sondhi of Toronto Dominion Bank believes the market has not yet felt any impact from the Bank of Canada's latest move.

Display 4

This ad hasn't loaded yet, but your article will continue below.

Article content

“The Bank of Canada's recent interest rate cut had virtually no impact on the Canadian housing market in June… the market is still grappling with serious affordability issues,” Sondhi said in a note to clients.

However, Oxley believes the rate cut has given the market a long-missing sense of optimism.

“We all held our breath and waited, and even if it was only a quarter of a percent, at least it said, 'Okay, here we go,'” she said.

Sondhi expects further rate cuts later in the year, but is more cautious about affordability.

Editor's recommendations

-

The Bank of Canada hopes for weaker inflation, including in the USA

-

Condo listings are soaring in Toronto, but families are struggling to find a home

-

High housing costs cause young Canadians to move away

“We actually believe markets will be stronger in the second half of the year as the economy holds up and more meaningful interest rate relief is provided. However, tight affordability conditions are likely to limit the extent of improvement,” Sondhi said.

• Email: shcampbell@postmedia.com

Bookmark our website and support our journalism: Don't miss out on the business news you need to know – bookmark financialpost.com and sign up for our newsletters here.

Article content

Share this article on your social network