Breadcrumb Trail Links

A review of property markets and borrowers shows that risks are stable and, in some cases, improving

Published on June 19, 2023 • Last updated 17 hours ago • 4 minutes reading time

Using data from the Organization for Economic Co-operation and Development, a group of 38 economies, the IMF has found that Canada, Australia, Norway and Sweden are most at risk of mortgage defaults. Photo by Tyler Anderson/National Post

Using data from the Organization for Economic Co-operation and Development, a group of 38 economies, the IMF has found that Canada, Australia, Norway and Sweden are most at risk of mortgage defaults. Photo by Tyler Anderson/National Post

article content

Statements from normally credible sources about the heightened risks in Canada’s housing market have alarmed consumers, investors, lenders and policymakers alike, but perhaps the pictures they paint should not be taken at face value.

advertising 2

This ad has not yet loaded, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive items from Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and more.

- Daily content from the Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from the Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the paper edition that you can view, share, and comment on on any device.

- Daily puzzles including the New York Times crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive items from Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and more.

- Daily content from the Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from the Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the paper edition that you can view, share, and comment on on any device.

- Daily puzzles including the New York Times crossword.

Register to unlock more articles

Create an account or log in to continue your reading experience.

- Access items from across Canada with one account.

- Share your thoughts and join the discussion in the comments.

- Enjoy additional articles per month.

- Receive email updates from your favorite authors.

article content

For example, the International Monetary Fund (IMF) ranked Canada’s real estate market as the riskiest of the 27 developed economies in North America and Europe. The IMF found that countries with high levels of household debt and variable rate mortgages have “increased risk of default”.

Top stories from financial posts

By clicking the subscribe button, you consent to receiving the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for registering!

article content

But a quick look at the state of housing markets and borrowers in Canada reveals a stable and even improving picture in risk metrics, leading us to wonder what prompted such concern from the IMF, which is the lender for many troubled countries of last resort is .

A far less alarming picture of Canadian finances and housing markets was recently released by the Bank of Canada.

The central bank said it was aware of “elevated household debt and high house prices” so it was important to keep a close eye on developments in risk metrics. However, a review of these metrics suggests that the increase in financial vulnerabilities may have more to do with rising interest rates than rising house prices. Also, some risk indicators point to an improvement rather than a decline.

article content

advertising 3

This ad has not yet loaded, but your article continues below.

article content

An improving indicator is the number and quality of new mortgages. Mortgage origination peaked in the first quarter of 2021 after rising sharply since the second quarter of 2020. While house prices continued their upward trend in 2021, mortgage issuance fell in the first quarter of 2023 to 132,672 in the first quarter of 2023 from a peak of 282,272 in the first quarter of 2023.

Adjustable-rate mortgages rose during the pandemic from 9.15 percent in the first quarter of 2020 to 54 percent of new originations in the first quarter of 2022. Since the peak, adjustable-rate mortgages have fallen to pre-pandemic levels, with a significant increase in fixed-rate mortgages issued in the first quarter of this year accounted for 87 percent of new contracts.

advertising 4

This ad has not yet loaded, but your article continues below.

article content

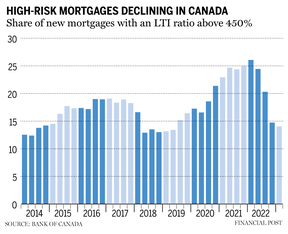

Another risk metric that’s heading in the right direction is the proportion of new mortgages with a loan-to-income (LTI) ratio greater than 450 percent, an indicator of high-risk mortgages. High LTI mortgages peaked in the first quarter of 2022 but have since fallen to pre-pandemic levels. Investors represent the smallest segment of high-LTI borrowers, much smaller than first-time and repeat home buyers.

The loan-to-value ratio (LTV) is another indicator of high-risk home borrowers, who borrow up to 95 percent of home value. The higher the LTV, the higher the risk. The proportion of new high-LTV mortgages has been declining since 2020, with less than 5% of new mortgage originations in Q1 2023 having an LTV of 95% or more.

advertising 5

This ad has not yet loaded, but your article continues below.

article content

However, some risk metrics have deteriorated recently. For example, the proportion of household income devoted to new mortgage debt has increased sharply since early 2022.

But this metric — also called the debt service ratio (DSR) — has more to do with rising interest rates than rising house prices. The DSR remained stable (and even declined for first-time homebuyers) even as house prices rose rapidly from 2014 to 2021.

Another deteriorating indicator is the proportion of indebted households that are at least 60 days in arrears on their payments, which rose to 2.28 percent in the first quarter of 2023 from just under 2 percent in the third quarter of 2021.

But we’re not panicking about this data for two reasons. First, the 0.41 percentage point increase is worrying, but not alarming. Second, the current mortgage arrears rate is 0.12 percent, the lowest since 2014. The increase in arrears, while modest, is due to installment loans that are not necessarily tied to housing markets.

advertising 6

This ad has not yet loaded, but your article continues below.

article content

Since the pandemic began, the proportion of homes bought by investors has increased from 22 percent to 27 percent. Some find this worrying, but we think differently. Investor-borrowers rank lower than first-time or repeat home buyers on risk metrics such as LTV and LTI ratios. The increase in the number and proportion of heavily indebted borrowers is unlikely to improve overall risk indicators.

The Bank of Canada image offers a reassuring picture of household balance sheets and how Canadians manage and service their debt. According to the IMF, what made Canada the riskiest real estate market?

Simply put, the IMF analysis is not a product of the advanced macroeconometric research for which the institution is known. Instead, a ranking and coloring exercise was undertaken to present a chart that relied more on colored pencils than analysis.

advertising 7

This ad has not yet loaded, but your article continues below.

article content

-

The average house price in Canada is increasing year on year, a tipping point

-

The housing stock grew faster than the population in Vancouver, Toronto

-

Canadian mortgage growth is the weakest in 20 years

Continued inflation and interest rate hikes are likely to add to the uncertainty, leading to higher risk as a result. The question is: will Canadian borrowers continue to manage their debt responsibly if interest rates continue to rise?

A prudent approach for borrowers and lenders is not to overextend and be alert to unexpected loss of income due to job losses. Debt is a four letter word, after all, so extreme caution should be exercised when relying on it.

Murtaza Haider is Professor of Real Estate Management and Director of the Urban Analytics Institute at Toronto Metropolitan University. Stephen Moranis is a real estate industry veteran. They can be found on the Haider-Moranis Bulletin website at www.hmbulletin.com.

article content

Share this article on your social network

Comments

Postmedia strives to maintain a vibrant but civil discussion forum and encourages all readers to voice their views on our articles. It can take up to an hour for comments to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve turned on email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update to a comment thread you follow, or when a user you follow makes a comment. For more information and details on how to customize your email settings, see our Community Guidelines.