Nobel Prize winner in economics Joseph Stiglitz is calling for the US Federal Reserve to cut interest rates by half a percentage point at the upcoming meeting. He accuses the US Federal Reserve of going “too far and too fast” in tightening monetary policy and exacerbating the inflation problem.

His comments come ahead of the key release of U.S. jobs data on Friday, with investors closely watching the nonfarm payrolls figure for August for clues about the size of an expected rate cut this month. The jobs data release is scheduled for 8:30 a.m. ET.

Strategists generally believe that the most likely outcome of the Fed's September 17-18 meeting will be a 25 basis point rate cut, although speculation of a 50 basis point cut has increased in recent days.

One basis point is 0.01 percentage points.

Stiglitz, who received the Nobel Prize in 2001 for his market analysis, is joining forces with JPMorgan's chief US economist to call for a sharp interest rate cut this month.

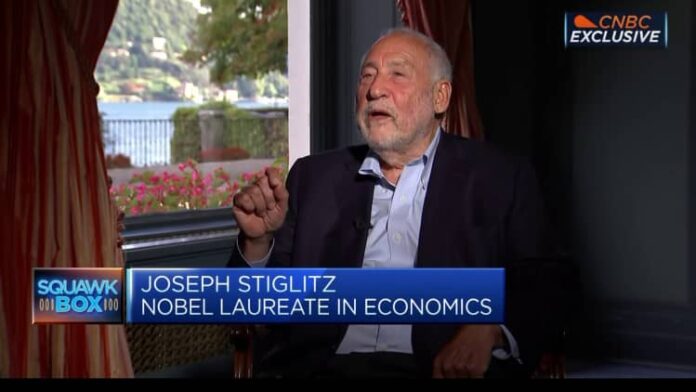

“I have criticized the Fed for going too far and too fast,” Stiglitz told CNBC's Steve Sedgwick on Friday at the annual Ambrosetti Forum in Cernobbio, Italy.

Stiglitz said it was “really important” that the Fed had normalized interest rates. He added that it was a mistake for the Federal Reserve to keep the benchmark interest rate near zero for such a long period since 2008.

“But then they went a step further and reached the current interest rate level. I think that put the economy at risk without providing much benefit. Ironically, it actually made inflation worse because if you look more closely at the causes of inflation, you find that a big factor is the housing sector,” Stiglitz said.

American economist and 2001 Nobel Prize winner in economics Joseph Stiglitz attends the Trento Economy Festival 2023 at the Sociale Theater in Trento, Italy on May 27, 2023.

Roberto Serra – Iguana Press | Getty Images Entertainment | Getty Images

“When you think about how we deal with the problem of the housing shortage that is driving up inflation – do you think that raising interest rates, making it harder for real estate developers to build more homes and homeowners to buy more homes, is going to solve the housing shortage? No, it's going in exactly the wrong direction,” he continued.

“So I think they have contributed to the problem of inflation. Even though their models don't work that way and they don't look at things as closely as they should, their models tell them: [to] “We need to look at the weaknesses of the economy and that is why we should lower interest rates.”

The Fed's key interest rate is currently in a range between 5.25% and 5.5%.

If he were a Fed policymaker, Stiglitz would vote for a deeper rate cut at the central bank's September meeting, “because I think they've gone too far and it would actually help with the inflation and employment issue.”

Asked if this meant he thought a 50 basis point rate cut was on the table regardless of the August nonfarm payrolls figures, Stiglitz replied, “Yes.”

A Federal Reserve spokesman declined to comment.

Bets rise on a half-point reduction

Market participants are firmly pricing in a rate cut at the Fed's next policy-setting meeting. Shortly after the release of the Job Openings and Labor Turnover (JOLTS) report on Wednesday, bets on a half-percentage point cut increased.

The data showed that the number of job openings in the US fell to its lowest level in three and a half years in July, which was seen as another sign of a slowdown in the labor market.

According to the CME Group's FedWatch tool, traders are currently calculating a probability of around 59 percent for a 25 basis point interest rate cut in September, while 41 percent are expecting a 50 basis point cut. Just over a week ago, the probability of a 50 basis point cut was 34 percent.

Not everyone agrees that a significant interest rate cut is necessary this month.

George Lagarias, chief economist at Forvis Mazars, said that while no one could guarantee the extent of the Fed's rate cut at its September meeting, he was “firmly” on the side of those in favor of a quarter-percentage point cut.

“I see no urgency for the 50 [basis point] cut,” Lagarias told CNBC's “Squawk Box Europe” on Thursday.

“The 50 [basis point] A rate cut could send the wrong signal to the markets and the economy. It could send a signal of urgency and that could prove to be a self-fulfilling prophecy,” he continued.

“So it would be very dangerous if they went there without a specific reason. Unless an event occurs that puts the markets under pressure, there is no reason to panic.”