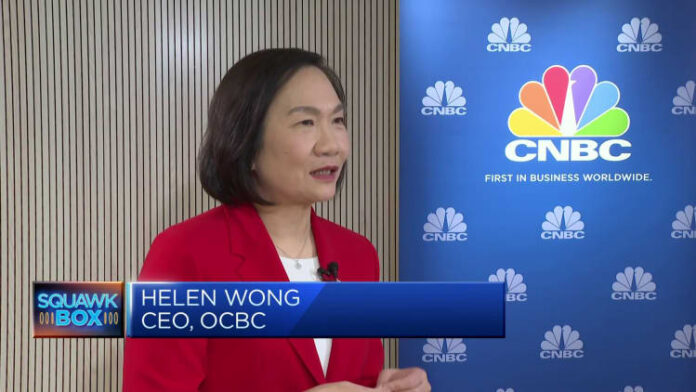

Singapore’s Oversea Chinese Banking Corporation has its sights set on “longer-term opportunities” in Greater China and Southeast Asia and expects the strategy to add $2.2 billion in revenue by 2025, CEO Helen Wong told CNBC on Monday.

Southeast Asia’s second-largest bank announced on Monday that it will unify its brand across its core Greater China markets — including Hong Kong and Macau — and Southeast Asia.

“If you look at macroeconomic trends, Greater China and ASEAN together will continue to contribute more to global GDP growth,” Wong told CNBC, referring to the 10-member bloc of the Association of Southeast Asian Nations.

“If you look at trade numbers over the past four years, China and ASEAN are growing at a compound annual growth rate of 13%,” she added. The compound annual growth rate is a measure of the annual return on an investment over a period of time, assuming profits are reinvested at the end of each year.

In a media release, Wong said “the impact of China’s post-pandemic reopening, the rise of ASEAN for the China Plus One strategy and other geopolitical factors” have boosted potential business flows between the two regions.

Though the OCBC has seen economic growth slow in some countries in the region, Wong said she is confident she can capitalize on the growth if she “joins our forces.”

Oversea-Chinese Banking Corp signage (OCBC) at the OCBC Center in Singapore on Wednesday 3 August 2022.

Edwin Koo | Bloomberg | Getty Images

This will be achieved by improving how it treats customers digitally, as well as improving the way the bank records customers and deals, she said, without giving further details.

She also pointed out that OCBC and its affiliates serve the seven largest markets in ASEAN and have a presence in 17 cities in the Greater China region, including Hong Kong, Macau and Taiwan, as well as the partnership with Bank of Ningbo.

Outlook for 2023

When asked about the bank’s prospects for the next half of 2023, Wong said it will “probably be quite stable.”

She said the high interest rate environment has helped interest income, although fee income has fallen as investors are reluctant to invest due to the uncertain economic environment.

But OCBC has other revenue streams that could help growth, such as insurance revenue, Wong said.

However, she also acknowledged that there may be uncertainty as interest rates could potentially remain at current levels or be “slightly higher”.

As such, OCBC needs to be alert to the potential for its loan portfolio to be impacted by persistently high interest rates. Even if interest rates remain high, customers “are likely to be somewhat cautious in their investment activities,” emphasized Wong.

Stock chart icon Stock chart icon

As a regional bank — the second largest in Southeast Asia — OCBC also saw cash inflows from the collapse of US regional banks earlier in the year.

“Whenever there are changes or weaknesses in certain parts of the industry, there is a flight to quality. So since we’re a highly rated bank in Asia, we’re seeing some of the new money pouring in,” she said.

However, the goal isn’t just to get the money flowing in, but to keep it with OCBC.

Wong emphasized that the bank should ask itself: “Is there a lesson from this? How does this actually affect customers? Are we able to serve customers even when money comes in?”

OCBC shares are up almost 9% over the past 12 months to close at 12.30 Singapore dollars on Monday.