Breadcrumb trail links

They lead to a slowdown in construction activity and a deterioration in supply, which harms future tenants

Published on March 18, 2024 • Last updated 13 hours ago • 5 minutes reading

Rent controls discourage the construction of new residential units, argue housing experts Murtaza Haider and Stephen Moranis. Photo by DAVID BLOOM/Postmedia

Rent controls discourage the construction of new residential units, argue housing experts Murtaza Haider and Stephen Moranis. Photo by DAVID BLOOM/Postmedia

Article content

Many housing advocates argue for rent controls as a panacea to rising rents, but a wealth of empirical evidence suggests that while such controls provide temporary relief to current tenants of controlled units, they inevitably cause long-term harm to future tenants.

This is because landlords struggling with rents that do not cover renovation costs often neglect maintenance, leading to a deterioration in the quality of housing. This neglect is not just a theoretical possibility, but a real consequence of rent control. More importantly, rent controls hinder new construction by dampening investor enthusiasm as they fear future revenue constraints.

Advertising 2

This ad has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

REGISTER / LOGIN TO UNLOCK MORE ARTICLES

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the discussion in the comments.

- Enjoy additional articles per month.

- Get email updates from your favorite authors.

Log in or create an account

or

Article content

Article content

Still, Ricardo Tranjan, an economist at the Canadian Center for Policy Alternatives, argued in a recent editorial that rent controls “do not reduce housing supply, but limit profits.” The author cited several studies from Canada and the United States in which he argued that rent controls “stabilize rent increases without negative impacts” and advocated for “reintroducing rent control in units built after 2018” in Ontario.

We reviewed the studies cited by the author and found that they all clearly show that rent controls contribute to a slowdown in rental supply, harming the very people rent advocates want to help.

For example, Tranjan said a Canada Mortgage and Housing Corp. study sponsored by KPMG LLP. (CMHC) in 2020 found “no significant evidence that rental starts were lower in markets with rent control than in markets without rent control.” However, this is more of a loss in translation than an actual statement.

The text quoted is from a four-page summary prepared by CMHC from KPMG's 90-page report. The results of the detailed report are much more nuanced and do not speak in favor of rent controls. A review of previous research led KPMG to conclude that “rent control has generally resulted in reduced rental supply due to rent controls.” This is a clear indication that rent control is affecting rental supply.

Top stories

Thanks for registering!

Article content

Advertising 3

This ad has not loaded yet, but your article continues below.

Article content

A subsequent econometric analysis by KPMG found that “the relationship between the rent deregulation regime (rent control) and the start of rent is negative; This follows the theory that rent control measures tend to deter supply because the return on investment is limited by policy.”

The comparison of rental housing construction starts in markets with and without rent control was rather inconclusive (“unclear”), which is hardly reliable evidence to argue against the negative effects of rent control on the construction of new rental apartments.

Tranjan also references a 1994 CMHC-sponsored study that found “no evidence that controls affect the responsiveness of housing starts to vacancy rates or rents.” This study is inadequate for two reasons.

Initially, the CMHC commissioned seven independent reviews of the study and found significant deficiencies. Second, an important finding was that rent controls had no impact on long-term rent growth rates. This is the exact opposite of the argument that rent controls stabilize rent increases.

But what about more recent research results? Tranjan pointed to a 2023 study published in the International Journal of Housing Policy (IJHP) that analyzed data from 16 countries to conclude that rent controls do not reduce rental housing construction.

Advertising 4

This ad has not loaded yet, but your article continues below.

Article content

We were again surprised to find that the IJHP paper painted a completely different picture. The authors said: “More restrictive rental market legislation generally has a negative impact on both new housing construction and investment.” They concluded that “the common view among economists that rent controls have a negative construction and investment effect appears to hold.”

The editorial also mentioned a 2023 letter from American economists to the Federal Housing Finance Agency that said: “The Economics 101 model, which predicts that rent regulations will have a negative impact on the housing sector, is shown by empirical studies to be false proven.”

One would assume that American economists must be solid urban empiricists for their argument to hold water. Quite the opposite. Most of the signatories were respected experts and policy advocates, but did not have much knowledge of urban economics. A fact check of the letter by the National Multifamily Housing Council in the US found numerous distorted facts, suggesting that the letter's authors may not have understood the research they cited in support of rent controls.

Advertising 5

This ad has not loaded yet, but your article continues below.

Article content

For example, the letter mentioned a 2019 study by three Stanford University professors on how rent controls helped reduce tenant exodus in San Francisco. Here the authors of the letters are not making a mistake, but rather an omission. The study was more nuanced, concluding that “while rent control prevents the displacement of established tenants in the short term, the lost rental housing supply is likely to increase market rents in the long term, ultimately undermining the law's objectives.”

The preponderance of empirical evidence supports the argument that rent controls discourage investors from investing in new supply of purpose-built rental housing. This means that the rental inventory does not grow over time in line with the demand for rental apartments. Such an imbalance between rental demand and supply leads to extremely low vacancy rates and rapidly rising rents.

Rent controls have further distorting consequences for labor markets. Those who live in rent-controlled units are less likely to move, even when better job opportunities are available elsewhere, limiting their long-term prospects in the job market.

Advertising 6

This ad has not loaded yet, but your article continues below.

Article content

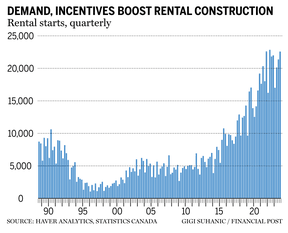

From the early 1970s to the 2000s, purpose-built rental construction declined and remained at a low level. The rent controls introduced since the mid-1970s are partly responsible for this. The recent revival of rental housing construction is welcome, but falls far short of market demands and focuses on high-quality rental housing.

For the rental housing resurgence to match the numbers seen in the early 1970s, many administrative changes will be required, such as eliminating rent control for market-based units. At the same time, the government must invest in off-market housing to support those who have been excluded from the rental market.

Recommended by Editorial

-

Housing nationalism reveals an ugly side of the affordability crisis

-

The new Ontario law for the real estate industry falls short

-

A “wartime” effort to build homes requires more than just a catalog

Providing affordable rental housing is a public sector responsibility. Shifting this burden onto the shoulders of private landlords is an example of the state shirking its responsibilities while violating the long-term interests of tenant households.

Murtaza Haider is director of Regionomics Inc., a consulting firm specializing in predictive analytics and machine learning. Stephen Moranis is a real estate industry veteran. They can be accessed on the Haider-Moranis Bulletin website at www.hmbulletin.com.

Article content

Share this article on your social network