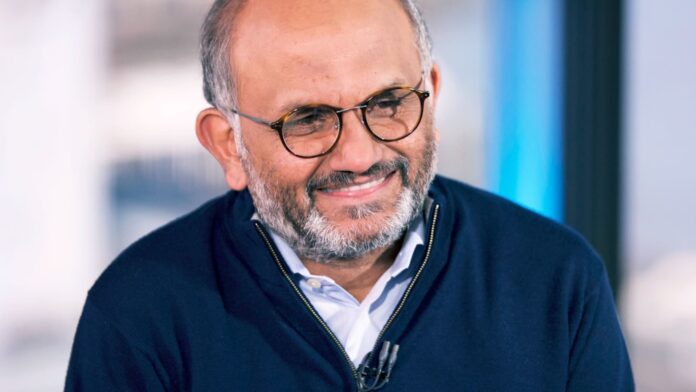

Shantanu Narayen, CEO, Adobe.

Mark Newbie | CNBC

Investors are grappling with uncertainty after a difficult September sent major averages reeling.

However, the current scenario also offers an opportunity to select stocks that could generate attractive returns despite short-term stresses.

To that end, here are five stocks that are favored by Wall Street’s top analysts, according to TipRanks, a platform that ranks analysts based on past performance.

Adobe

Software giant Adobe (ADBE) recently announced its fiscal third quarter results. The company is seeing strong subscriptions to its cloud-based software offerings.

Deutsche Bank analyst Brad Zelnick was impressed with the quarter’s results and raised his price target on ADBE shares from $550 to $610 and reiterated a Buy rating. The analyst said the results reinforced his view that Adobe is a winner in an emerging world of generative artificial intelligence.

Ahead of the results, Adobe announced the commercial availability of its generative AI offering Firefly and increased the prices of its Creative Cloud product to reflect the integration of the new AI capabilities. The analyst said this pricing strategy could drive adoption of the core Creative Cloud product with its embedded generative AI tools, which is better than selling the new features separately.

“This strategy should enable creatives to more quickly appreciate the productivity benefits of generative AI and make Firefly-powered generative AI offerings a critical part of their workflows, driving competitive differentiation and increasing the overall value of Creative Cloud,” said Zelnick.

The analyst also sees additional monetization opportunities through new standalone offerings like GenStudio.

Zelnick is ranked No. 50 among more than 8,500 analysts tracked by TipRanks. Its ratings were profitable 71% of the time, delivering an average return of 15.5% each. (See Adobe’s technical analysis on TipRanks)

Foreclosure

Zelnick is also optimistic about another cloud software provider: Foreclosure (CRM). The analyst reiterated his Buy rating on the stock with a price target of $260 following the company’s Dreamforce annual conference and investor meetings with the CEO of a Salesforce consulting partner and an executive from a global consulting firm.

He said the Dreamforce event highlighted Salesforce’s leadership in AI customer relationship management (CRM), underpinned by a combination of “trust, data and interoperability.” (See Salesforce hedge fund trading activity on TipRanks).

The analyst noted that partners’ comments on the data cloud were optimistic and based on actual demand and ongoing implementations.

“Given strong pricing power, unprecedented access to tremendous trusted data, an eventual return to front-office spending, and management’s strong focus on margins and cash flow growth, we believe Salesforce stock is on track to to outperform,” said Zelnick.

Image sharing platform Pinterest (PINS) held its investor day on September 19th. At the event, the company said it expects average annual revenue growth in the mid- to high-teens and earnings before interest, taxes, depreciation and amortization margins in the low 30 percent range for the next three to five years.

Baird analyst Colin Sebastian noted that management expects its long-term targets to improve as underlying trends improve. The analyst emphasized that the shopping experience remains central to the company’s overall strategy. Specifically, 96% of searches on Pinterest are unbranded, giving advertisers a huge opportunity to target users, with more than 50% of them using the platform to shop.

“It’s important, that Amazon “The ad integration appears to be going well and exceeding management’s initial expectations as Pinterest uses its recommendation engine to target Amazon ads to its own users,” Sebastian added.

The analyst reaffirmed a “Buy” rating on PINS stock and a $34 price target, with the valuation reflecting a rapid growth rate, an early phase of market share gains, and significant long-term cash flow generation.

Sebastian is ranked 328th out of more than 8,500 analysts tracked on TipRanks. Additionally, 54% of its reviews were profitable, with an average return of 11.7%. (See Pinterest blogger opinions and sentiment on TipRanks)

Microsoft

Tech giant Microsoft (MSFT) recently made several announcements about its Microsoft 365 Copilot, Bing, Windows and Surface products.

Goldman Sachs analyst Kash Rangan believes the developments announced by the company reflect solid execution of its Copilot product roadmap and the strength of its OpenAI partnership.

“Microsoft’s rapid time to market, strong presence across the tech stack, and well-established presence in the enterprise give us confidence that Microsoft is well positioned to drive growth based on these announcements and become a key leader in the era of genetic AI said Rangan.

The analyst believes the company should be able to capture a significant portion of its total addressable market of more than $135 billion within Microsoft 365, with additional capabilities in its Azure, Windows, Dynamics and Bing/Edge offers. He reiterated a Buy rating on MSFT with a price target of $400.

Rangan is ranked 509th among more than 8,500 analysts on TipRanks. Its ratings were profitable 58% of the time and delivered an average return of 8.5% each time. (See Microsoft Financial Statements on TipRanks)

FedEx

We end this week’s list with the logistics giant FedEx (FDX). The company recently reported fiscal first-quarter earnings that beat expectations, but saw a decline in sales due to macroeconomic headwinds. The result benefited from the company’s cost-cutting initiatives.

Evercore analyst Jonathan Chappell, ranked 156th out of more than 8,500 analysts on TipRanks, noted the improvement in the company’s full-year profit forecast despite the lower revenue outlook. The profit outlook was boosted by cost reductions under FedEx’s DRIVE program, which is targeting $1.8 billion in savings in fiscal 2024.

Chappell said FedEx has acquired about 400,000 volume packages from its nearest competitor (UPS), with a lower probability of these stock gains reversing immediately. Additionally, FedEx gained nearly 5,000 shipments per day by liquidating a key competitor (Yellow).

The analyst said: “FDX continues to build a track record of delivering on its ambitious cost reduction and efficiency goals, making the equity a unique investment opportunity should demand return.”

Chappell maintained his Buy rating on FDX and increased his price target to $291 from $276, saying FDX remains his top choice. His reviews were successful 65% of the time, with each review delivering an average return of 19.7%. (See FedEx insider trading activity on TipRanks).