Breadcrumb trail links

However, property prices continue to rise

Published on Oct 4, 2023 • Last updated 2 days ago • 4 minutes reading time

Home sales in Toronto fell sharply in September. Photo by Peter J. Thompson/National Post

Home sales in Toronto fell sharply in September. Photo by Peter J. Thompson/National Post

Article content

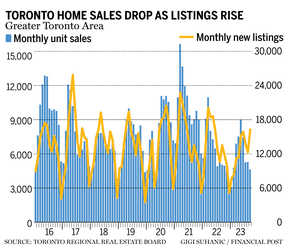

Toronto home prices rose in September, but sluggish sales and a flood of new listings could move the market back in buyers’ favor.

Monthly data released by the Toronto Regional Real Estate Board (TRREB) on Oct. 4 showed the median price rose about three per cent to $1,119,428 in September compared to the previous month. That was also around three percent more than in the same month last year.

Advertising 2

This ad has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and more.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and more.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

Register to unlock more articles

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the discussion in the comments.

- Enjoy additional articles per month.

- Get email updates from your favorite authors.

Article content

Article content

However, home sales have fallen sharply since August. Sales registered through TRREB’s MLS system decreased 12 percent month-over-month and 7.1 percent compared to September 2022. The year-on-year decline in sales was particularly noticeable for semi-detached and terraced homes.

At the same time, new entries rose sharply. In September, 16,258 new listings came onto the market, a 32 percent increase from August and 44.1 percent more than a year ago.

This puts the sales to new listings ratio (SNLR) at 28.6 percent in September, well within buyers’ market territory. The Canadian Real Estate Association (CREA) has stated that an SNLR between 40 and 60 percent indicates a balanced market. Under 40 percent suggests buyers have an advantage, while over 60 percent indicates a seller’s market.

The SNLR for the Toronto region covered by TRREB was over 60 percent as recently as March and April of this year, but has been trending downward since then. In August, according to calculations based on TRREB data, it was around 43 percent.

TRREB senior market analyst Jason Mercer suggested that buyers’ leverage may be slightly higher due to the shift.

Top stories

Thanks for registering!

Article content

Advertising 3

This ad has not loaded yet, but your article continues below.

Article content

“Sales prices for homes in the GTA remain above the low point seen in the beginning of the first quarter of 2023. However, we experienced a more balanced market during the summer and early fall, with listings increasing significantly as a percentage of sales,” Mercer said in the report. “This suggests that some buyers may benefit from greater bargaining power, at least in the short term. This could help offset the impact of high borrowing costs.”

TRREB President Paul Baron said the market outlook is very different in the short and medium term and that declining demand is expected to change by the middle of next year.

“In the short term, the consensus is that borrowing costs will remain high until mid-2024 and trend downward thereafter,” Baron said. “This suggests we should see a significant increase in demand for condominiums in the second half of next year, as lower interest rates and record population growth lead to an increase in buyer numbers.”

The belief that the Bank of Canada has completed its rate hikes was confirmed in an Oct. 4 report by Toronto-Dominion Bank economist Rishi Sondhi.

Advertising 4

This ad has not loaded yet, but your article continues below.

Article content

“We currently assume that the Bank of Canada has completed the rate hike and will begin cutting the policy rate starting in the second quarter of next year,” Sondhi said in the report.

Meanwhile, the bank’s forecast suggests a more significant and sustained decline in Canadian home sales and average prices than previously expected in its June forecast.

“In fact, both home sales and prices are expected to decline in the final quarter of this year and into the start of 2024,” Sondhi said in the report. “By the first quarter of 2024, we assume that sales and prices will have fallen by eight and six percent, respectively, compared to the second quarter of 2023. These projected setbacks pale in comparison to the 40 and 20 percent declines in sales and prices that occurred from the first quarter of 2022 to the first quarter of 2023 due to aggressive rate hikes by the Bank of Canada.”

Cameron Forbes, chief operating officer at Remax Realtron Realty Inc. in Thornhill, Ont., said that while an abundance of listings can reduce buyer competition, it doesn’t necessarily lead to big price adjustments or a significant price drop.

Advertising 5

This ad has not loaded yet, but your article continues below.

Article content

“In certain markets where more supply comes onto the market, prices certainly don’t go up, but maybe go down a little bit. I don’t see much of a price adjustment, and the reason for that is people who own homes aren’t going to sell at what they perceive to be a lower market price unless they have to.”

But Toronto real estate agent Cailey Heaps believes the balance has actually shifted in buyers’ favor.

“Buyers definitely have more power than they have in a long time,” Heaps said. “However, it depends on price and geography, as there are few micro-markets and micro-economies in the Toronto real estate market.”

similar posts

-

Making housing affordable requires at least $1 trillion

-

The Toronto real estate class action lawsuit could impact billions of dollars in commissions

-

The pause in the real estate market will continue, says Deloitte

She points out that buyers pay close attention to overall affordability when negotiating.

“Buyers factor the change in interest rates into their overall purchase price and purchasing power,” she said.

• Email: [email protected]

Bookmark our website and support our journalism: Don’t miss out on the business news you need to know – bookmark Financialpost.com and sign up for our newsletter here.

Article content

Share this article on your social network

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask that you keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. For more information and details on adjusting your email settings, see our Community Guidelines.