The Biden administration on Tuesday announced additional restrictions on the sale of advanced semiconductors by American companies, tightening restrictions imposed last October to limit China’s advances in supercomputing and artificial intelligence.

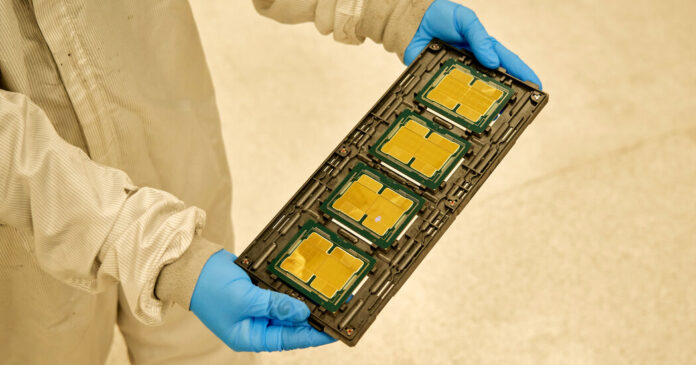

The rules are likely to stop most shipments of advanced semiconductors from the US to Chinese data centers that use them to make artificial intelligence models. A growing number of U.S. companies seeking to sell advanced chips or the machinery used to make them to China must notify the government of their plans or obtain a special license.

To prevent the risk of advanced U.S. chips entering China through third countries, the United States will also require chipmakers to obtain licenses to ship to dozens of other countries subject to U.S. arms embargoes.

The Biden administration argues that China’s access to such advanced technology is dangerous because it could help the country’s military in tasks such as guiding hypersonic missiles, building advanced surveillance systems or cracking top-secret U.S. codes. Leading AI experts have warned that the technology, if not handled properly, could pose an existential threat to humanity.

But artificial intelligence also has valuable commercial applications, and the tighter restrictions could impact Chinese companies that have tried to develop AI chatbots, such as ByteDance, TikTok’s parent company, or internet giant Baidu, industry analysts said. In the longer term, the restrictions could also weaken China’s economy as AI transforms industries from retail to healthcare.

The restrictions are also likely to impact sales to China by U.S. chipmakers such as Nvidia, AMD and Intel. Some chipmakers generate up to a third of their revenue from Chinese buyers and have pushed back against tougher restrictions in recent months.

U.S. officials said the rules would exempt chips intended solely for use in commercial applications, such as smartphones, laptops, electric vehicles and gaming systems. Most rules take effect within 30 days, but some take effect sooner.

In a statement, the Semiconductor Industry Association, which represents major chipmakers, said it was reviewing the impact of the updated rules.

“We recognize the need to protect national security and believe that maintaining a healthy U.S. semiconductor industry is an essential part of achieving this goal,” the group said. “Overly broad, one-sided controls risk harming the U.S. semiconductor ecosystem without improving national security by encouraging foreign customers to look elsewhere.”

An Nvidia spokesperson said the company has complied with all applicable regulations and does not expect a significant near-term impact to its financial results given the global demand for Nvidia products.

In a call with reporters on Monday, a senior administration official said that the United States has seen people trying to circumvent the previous rules and that recent breakthroughs in generative AI have given regulators more insight into how the so-called large language models work had it been developed and used.

Gina M. Raimondo, the Commerce Secretary, said the changes were made “to ensure that these rules are as effective as possible” and that she expects the rules to be updated at least annually as technology advances.

Regarding the People’s Republic of China, she said: “The goal is the same as it always has been, which is to restrict the People’s Republic of China’s access to advanced semiconductors that could enable breakthroughs in artificial intelligence and advanced computers critical to the People’s Republic of China’s military applications.” Meaning are.” ”

She added: “Control of technology is more important than ever in the context of national security.”

The stricter rules could anger Chinese officials as the Biden administration seeks to improve relations and prepare for a possible meeting between President Biden and China’s supreme leader Xi Jinping next month in California.

The Biden administration is trying to counter China’s increasing domination of many cutting-edge technologies by pumping money into new chip factories in the United States. At the same time, it seeks to impose strict but narrow limits on the export of technology to China that could serve military purposes, while allowing free trade in other goods. U.S. officials describe the strategy as protecting American technology through “a small yard and a high fence.”

But figuring out which technologies actually pose a threat to national security is a contentious task. Major semiconductor companies have argued that overly restrictive trade bans could deprive them of the revenue they need to invest in new factories and research facilities in the United States.

Some critics say the restrictions could also fuel China’s efforts to develop alternative technologies and ultimately weaken U.S. influence globally. Chinese researchers have made significant progress in developing domestic versions of advanced chips, but experts say the country remains years behind Western capabilities.

The changes announced Tuesday appear to have a particularly significant impact on Nvidia, the biggest beneficiary of the artificial intelligence boom.

In response to the Biden administration’s first major restrictions on artificial intelligence chips a year ago, Nvidia developed new chips, the A800 and H800, for the Chinese market that were slower but still made by Chinese companies for training AI models could be used. A senior administration official said the new rules would limit those sales.

Nvidia has said China typically generates 20 to 25 percent of the company’s data center revenue, which includes chips that enable AI and other products. Analysts said growing global demand for Nvidia chips for use in AI could allow the company to offset losses by selling to other markets. But worries about the impact of new performance limits on a broader range of Nvidia chips caused its share price to fall more than 3 percent on Tuesday.

The government also placed two Chinese chip design companies and their subsidiaries – units of Moore Threads Technology and Biren Technology – on an “entity list” that requires U.S. companies to get special permission before supplying materials to them.

The United States also said it would create a new “gray list” that would require manufacturers of certain less advanced chips to notify the government if they sell them to China, Iran or other countries subject to a U.S. arms embargo.

“What strikes me is the significant expansion of the countries to which a license is now required to export,” said Emily Benson, an analyst at the Center for Strategic and International Studies, a Washington think tank.

The rules did not appear to restrict Chinese companies’ access to foreign cloud services from Amazon and Microsoft. The government had been considering cracking down on the deal in recent months because Chinese companies had used such services as a kind of backdoor to access advanced artificial intelligence chips outside China. But Ms. Benson said such action could come later in the form of an executive order.

In a note to clients last week, Julian Evans-Pritchard, head of China economics at research firm Capital Economics, said the impact of the controls would become clearer as non-Chinese companies bring more advanced versions of their current products to market.

“The result is that China’s ability to reach the technological frontier in developing large-scale AI models is hampered by U.S. export controls,” Evans-Pritchard wrote. That could have broader implications for China’s economy, he added, because “we believe AI has the potential to be a game-changer in productivity growth over the next few decades.”

Don Clark contributed reporting.