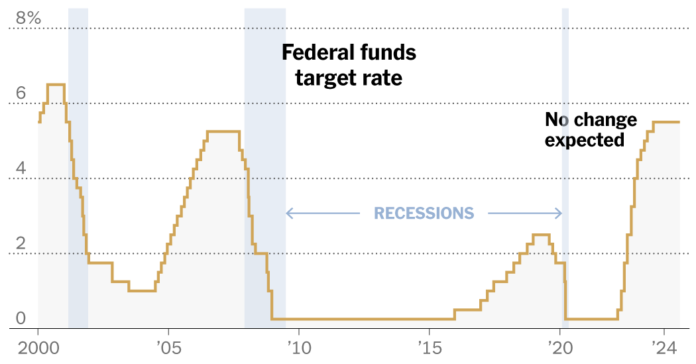

Federal Reserve officials are widely expected to leave their benchmark interest rate unchanged on Wednesday, keeping it at a two-decade high of 5.3 percent for the 12th consecutive month in an effort to slow economic growth and curb inflation.

But investors will be most curious about what happens next with borrowing costs. Economists and traders generally expect Fed officials to cut their benchmark interest rate at their next meeting in September. Wall Street will be watching closely for clues about what's to come in both the Fed's statement at 2 p.m. and a subsequent press conference with Jerome H. Powell, the central bank's chairman.

While few economists expect a clear signal about when a rate cut will occur – the Fed is trying to keep its options open – many believe policymakers will at least leave open the possibility of a rate cut at the next meeting, which ends Sept. 18. And Powell will certainly face questions about how policymakers think about possible actions after that. Here's what to look for.

Watch for changes in the Fed's statement.

The Fed's statement, a slowly evolving document that Fed officials release after each two-day meeting, currently says that Fed policymakers expect to keep interest rates stable until they have “gained greater confidence that inflation is declining in a sustained manner.”

Michael Feroli, chief U.S. economist at JP Morgan, wrote in his preview that the statement could potentially undergo a small but significant change: Officials could change “greater confidence” to “further confidence” or a similar rewording. That would be a sign that policymakers are becoming more familiar with the inflation backdrop.

There's a reason for this growing confidence. After proving surprisingly stubborn in early 2024, inflation is cooling again. The latest report showed that the Fed's preferred index rose just 2.5 percent for the year through June – still faster than the central bank's 2 percent target, but much slower than that measure's recent peak in 2022, which was above 7 percent.

Although the Fed publishes economic forecasts once a quarter to show how the central bankers believe inflation and interest rates will develop, this meeting does not include forecasts. The next forecasts will be published in September.

Therefore, investors will rely on Mr Powell's statement and press conference as they try to understand the Fed's future course.

The Fed chairman could provide some insight into the outlook.

Many economists believe that Powell will likely avoid committing the Fed to any concrete commitments, even though market prices have settled on a September rate change. Some investors are even betting on a sharp cut of half a percentage point instead of the usual quarter.

“The market may be disappointed if it expects Powell to commit to a rate cut in September,” said Oscar Munoz, chief U.S. macro strategist at TD Securities. “They're almost there – but they want to see a few more data releases.”

According to Munoz, the Fed would only cut interest rates significantly in September if the labor market situation suddenly and unexpectedly worsened.

The timing of the interest rate cut depends on incoming data.

Until then, the question of when and how much the Fed will cut interest rates this year will depend on two new pieces of data: the further development of inflation and the further development of the labor market.

On inflation, some economists believe that only a small additional improvement in the two most important indicators – the consumer price index and the personal consumption expenditure index – would be needed to prompt the Fed to change interest rates.

“We suspect that an acceptable consumer price index report for July would likely be enough to force a rate cut in September,” Goldman Sachs economists wrote in their note previewing the Fed meeting.

But Fed officials have made it clear that they are also closely monitoring developments in the labor market. If the situation worsens, that could increase their urgency to cut interest rates. The central bankers will receive two new labor market reports before their September meeting, with the July figures coming on Friday.

“They don’t want to take the strength of the labor market for granted,” says Karen Dynan, a Harvard professor and former chief economist at the Treasury Department during the Obama administration.

Another big question: How quickly will interest rates fall?

Both labor market and inflation data will likely provide insight into how quickly interest rates will fall over the next few years. While the first cut is currently the focus, investors are also wondering what will come after that.

In its June economic forecasts, the Fed assumed that policymakers could cut interest rates about every other meeting once meetings begin. That would bring interest rates down to 4.1 percent by the end of next year and to 3.1 percent by the end of 2026.

Whether the expected pace materializes “will likely depend mainly on the labor market, which has been sending mixed signals of late,” as well as the government's tax and spending policies after the presidential election in November, Goldman Sachs economists wrote in their preview. Hotter economic conditions would slow the Fed's cuts, while a more pronounced slowdown could accelerate them.

At his press conference this week, Powell may face questions about how the Fed will think about cutting interest rates after a first step. So far, Fed officials have focused more on explaining what it would take for them to even begin lowering borrowing costs.

“They know the first cut will be important – it will signal the start of an easing cycle,” said Munoz of TD Securities.