Breadcrumb Trail Links

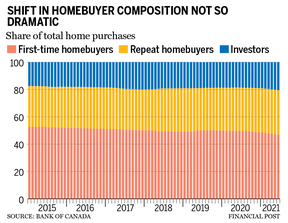

Despite the recent shift in growth rates, market shares held by FTHBs, repeat buyers, and investors have remained broadly stable since 2014

Many believe the recent escalation in Toronto and Vancouver home prices is being driven by investors. Photo by Brian Thompson/Postmedia Network Files

Many believe the recent escalation in Toronto and Vancouver home prices is being driven by investors. Photo by Brian Thompson/Postmedia Network Files

content of the article

According to a new report from the Bank of Canada, first-time homebuyers still account for nearly half of housing transactions in Canada, despite record house price increases in recent years.

display

This ad has not yet loaded, but your article continues below.

content of the article

Central bank economists Mikael Khan and Yang Xu combined the anonymized mortgage origination data provided by state-regulated financial institutions with credit bureaus from Transunion of Canada Inc. to create an information-rich new database that attempts to answer questions about who is behind the home purchase stuck frenzy in canada during pandemic.

The report categorized homebuyers as First Time Homebuyers (FTHBs), repeat homebuyers whose new mortgage issuance coincided with the cancellation of an older mortgage, and investors who were issued multiple mortgages.

Data for mortgages issued from 2014 through the first half of 2021 shows FTHBs were the largest cohort of homebuyers, acquiring one in two homes sold. Thirty-one percent of home purchases were made by repeat home buyers, while investors bought a little less than one in five homes with a mortgage.

display

This ad has not yet loaded, but your article continues below.

content of the article

Even at 19.1 percent, investors represent a large segment of the market, but that’s partly because the data includes mortgages for new and repeat home sales. Investors are critical to sustaining the new home market as they fund the construction phase and may not have urgent rental needs like active buyers in the resale market. As a result, investors are likely to have a smaller share of the resale market.

Many believe the recent escalation in Toronto and Vancouver home prices is being driven by investors. However, Bank of Canada data showed that its largest market share was in Ottawa-Gatineau, where more than one in four mortgages were issued to investors in the second quarter of 2021. Toronto came in second at 23.9 percent for mortgaged home purchases. Investors also claimed larger market shares in Calgary, Edmonton, Hamilton and Victoria than in Vancouver at 20.4 percent.

display

This ad has not yet loaded, but your article continues below.

content of the article

The central bank report warns that investors could be a source of instability by “exacerbating boom-bust cycles” and points to the rapid growth in investor-led buying during the pandemic. But the unknown unknowns in the data and analysis raise pertinent questions, including how the Bank of Canada identifies investors.

Owning multiple home mortgages, for example, doesn’t necessarily make you an investor, notes Will Dunning, an economist and industry veteran. As far as we know, some multiple mortgage holders during the pandemic were parents signing their children’s mortgages, helping them with their first home purchase.

Year-on-year growth in new mortgages was fairly similar for all three market segments through Q3 2020. But starting in the fourth quarter, purchases by investors and repeat buyers grew faster than FTHBs.

display

This ad has not yet loaded, but your article continues below.

content of the article

-

Canada cannot simply navigate its way out of its housing problem

-

Canada needs a fresh approach to building much-needed new homes

-

Housing markets in Canada continue to defy gravity and the pandemic

Despite the recent shift in growth rates, the market shares of FTHBs, repeat buyers and investors have remained broadly stable since 2014. The change in market shares was noticeable during the pandemic as the proportion of investors and repeat buyers rose while FTHB slightly declined to buy.

The report does not explain the reasons behind the shift in market share during the pandemic. But given the K-shaped recovery that favored certain cohorts more than others, it’s likely that investors with an average age of 50 were among the segment of the labor market that has rallied well during the pandemic. FTHBs were much younger in comparison, with an average age of 36 years.

display

This ad has not yet loaded, but your article continues below.

content of the article

The report also raises concerns about Canada’s growing debt, noting that FTHBs had the “highest loan-to-income (LTI) ratio” at the time of inception. In comparison, repeat buyers and investors had a much smaller proportion of their most recent mortgages that exceeded the same limit.

Comparing the LTI ratios for all mortgages, and not just the most recent one, investors seem to be carrying a disproportionate debt burden relative to their incomes. More than 44 percent of all mortgages issued to investors were above the 450 percent LTI threshold, while about 23.8 percent of FTHBs and repeat buyers exceeded the same debt ratio.

One final piece of interesting data worth noting is that the proportion of non-urban homes purchased by investors residing in 11 major Canadian cities increased to 5.5 percent from three percent of the total investor purchases nearly doubled in 2014-15 due to travel restrictions The pandemic forced many to explore local recreation destinations.

Murtaza Haider is Professor of Real Estate Management at Ryerson University. Stephen Moranis is a real estate industry veteran. They can be reached at the Haider-Moranis Bulletin website, www.hmbulletin.com.

Share this article on your social network

display

This ad has not yet loaded, but your article continues below.

Financial post top stories

By clicking the subscribe button, you agree to receive the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking the unsubscribe link at the bottom of our emails. Postmedia Network Inc | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for registering!

Remarks

Postmedia strives to maintain a vibrant but civilized forum for discussion and encourages all readers to share their views on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve turned on email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update on a comment thread you follow, or when a user you follow comments follows. For more information and details on how to customize your email settings, see our Community Guidelines.