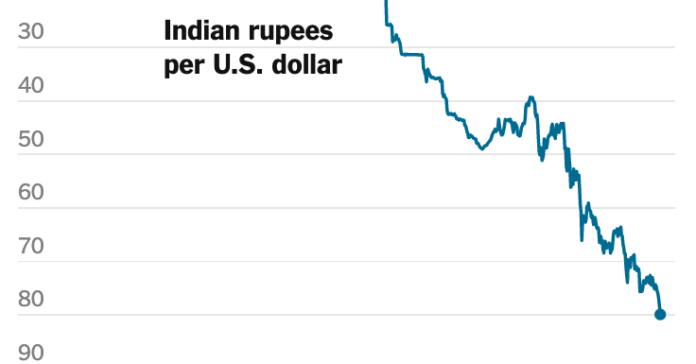

The Indian rupee hit its weakest level on record against the dollar on Tuesday, another casualty of higher energy prices and a stronger dollar.

The rupee has lost about 7 percent of its value against the dollar this year as India has spent more on importing energy sources like crude oil, natural gas and coal. The prices of these commodities rose after Russia invaded Ukraine.

Another factor behind the rupee’s fall is uncertainty about the global economy, which in turn has pushed the dollar to a 20-year high against the currencies of its major trading partners. Investors have been withdrawing money from India and other developing countries and pumping it into the United States, where the Federal Reserve is aggressively raising interest rates to tame inflation.

“A lot of this is dollar strength rather than rupee weakness,” said Rahul Bajoria, chief economist for India at Barclays. “It still feels like the rupee has done a lot better in relative terms,” he said, noting the euro and sterling’s sharper falls against the dollar.

On Tuesday, the rupee briefly crossed 80 to the dollar for the first time. According to local media reports, the Reserve Bank of India intervened in the market to hike the currency as it has in recent months.

As in much of the world, inflation has slowed economic growth in India this year. Reserve Bank officials responded with unexpected rate hikes in May and then again in June to 4.9 percent. But inflation remains around 7 percent, putting pressure on household budgets.

Prime Minister Narendra Modi’s government has cut fuel taxes and restricted exports of wheat and sugar. And it has bought more Russian oil, which has become cheaper after sanctions imposed by the United States and Europe.