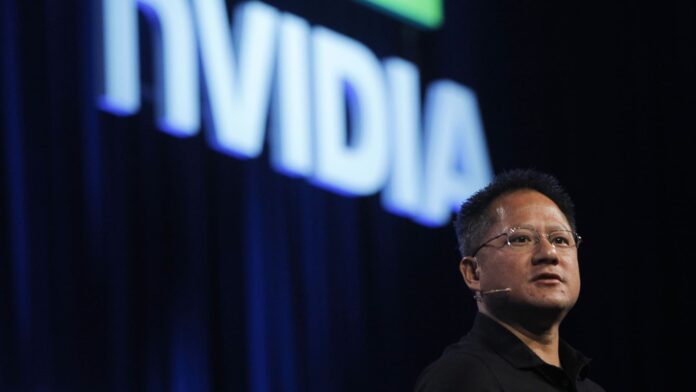

NVIDIA President and CEO Jen-Hsun Huang

Robert Galbraith | Reuters

Several key economic updates for July were released over the past week, including a strong job market, cooler-than-expected inflation and a lower fiscal deficit, all of which have kept market sentiment high.

Cheerful as investors may be with all the good news, a looming uncertainty still calls for careful investment decisions and a long-term perspective.

Here are five stocks highlighted by Wall Street’s top pros according to TipRanks, a service that ranks analysts based on their performance.

NVIDIA

Nvidia (NVDA), one of the top players in the semiconductor market, specializes in the development of graphics processors for the gaming and professional markets. It also produces system-on-chip units for the mobile computing and automotive industries. Like its peers, Nvidia has borne the brunt of the chip shortage that has disrupted the supply chain.

The company recently announced an update in which it lowered its expectations for the second quarter of fiscal 2023. Though that may have dragged the stock’s price down about 8% following the announcement, Needham analyst Rajvindra Gill noted that the stock is still about 20% off its recent low from early July. (See Nvidia Hedge Fund Trading Activity on TipRanks)

Gill has actually identified the various setbacks Nvidia is facing at the same time that are hurting its margins. For example, GPUs that are now on sale sold for two to three times the manufacturer’s suggested retail price over the past year.

Nonetheless, Gill tried to tune out the noise surrounding Nvidia’s lower estimates and look past the near-term obstacles. He noted that Nvidia’s balance sheet is one of the strongest among its industry peers, which will help guide the company through tough times.

Additionally, given the growing demand from data centers, Nvidia’s key end market, the company is expected to see tremendous growth over the coming years. “We believe the data center, the end market that we see as NVDA’s biggest growth driver, is seeing a rebound as hyperscaler sales have surged in recent quarters and visibility has improved,” noted Gil.

Gill reiterated a buy rating on the stock with a price target of $185. Gill’s five-star rating and 176th place among around 8,000 analysts tracked on TipRanks make his beliefs worth considering. Each of its 252 out of 402 successful reviews has generated an average return of 14.9%.

Micron technology

Micron (MU) is another of the largest US microchip companies. The company lowered its forecast, citing weak end demand and unfavorable storage conditions.

However, Mizuho Securities analyst Vijay Rakesh, another five-star TipRanks analyst, pointed out that Micron’s management-provided full-year DRAM revenue estimate is for mid- to high-single-digit percentage growth year over year ; and NAND’s is in the low to mid teens year over year. Still, the long-term perspective was encouraging. Micron expects long-term growth to be in the mid-teen percentile for DRAM and about 28% for NAND.

In addition, Rakesh expressed optimism about Micron’s positioning to benefit from long-term growth trends driven by cost declines in NAND and DRAM and content growth in various emerging technologies. (See Micron Dividend Date & History on TipRanks).

Although the analyst lowered his price on MU shares from $84 to $75, he reiterated his longer-term vision for the company with a Buy rating.

Rakesh was ranked 94th out of nearly 8,000 analysts followed on TipRanks. Additionally, 59% of its reviews were profitable, with 22% average returns on each review.

ACM Research

Wafer fabrication equipment provider ACM Research (ACMR) has significant operations in China, benefiting from the easing of lockdown restrictions in the country. The company’s second-quarter performance was better than expected, and earnings commentary pointed to numerous upsides to the company’s growth prospects

According to Needham analyst Quinn Bolton, the increase in full-year revenue guidance from $365 million to $405 million and the possibility of reaching the high end of the range was “the most notable takeaway from the conference call.” (See ACM Research Stock Investors’ opinion on TipRanks)

Bolton also noted that ACM Research is expected to increase shipments in the second half of the year thanks to the lifting of Covid-19-related restrictions in China. This will help the company’s new products gain traction.

The analyst also expressed optimism about the company’s progress in selling its products to territories outside of China.

“Investors have been wary of ACMR’s high exposure to China, but we believe this thesis will change over time with ACMR’s globalization efforts. In Q4 21 alone, the company announced design wins with four global IC manufacturers, including one in the US,” Bolton said.

Bolton reiterated a buy rating on ACM Research with a price target of $25. Ranked #1 among approximately 8,000 analysts tracked on TipRanks, Bolton’s opinions are highly valued by investors. Additionally, the analyst was successful with 72% of its ratings, with each rating yielding an average 45% return.

vimeo

Video hosting, sharing and services platform Vimeo (VMEO) failed to turn a profit last year. Additionally, the stock price has fallen nearly 78% over that period.

As dejected as it seems, Wells Fargo analyst Brian Fitzgerald is very bullish on the company. Satisfactory second quarter results were accompanied by mixed guidance from management. The company expects revenue growth to slow in the second half of the year, but also expects EBITDA to be higher than previously expected. (See Vimeo Blogger Opinions and Sentiment on TipRanks)

Vimeo’s focus on optimizing marketing spend is also a solid move, according to Fitzgerald. Though the company has trimmed outstanding spending, management said it will monitor multiple performance indicators to determine when and where to make additional investments. Fitzgerald believes such operational discipline will finally result in positive EBITDA in 2023.

Additionally, Fitzgerald expects this earnings season to be the last with a string of lowered forecasts.

The analyst reiterated a Buy rating on the stock with a price target of $12 (down from $16). Ranked 141st among approximately 8,000 analysts in the TipRanks database, Fitzgerald has managed to provide 58% profitable reviews, with each review generating an average return of 19%.

Take Two Interactive Software

Interactive software provider Take-Two (TTWO) has large format video games under its belt, including Grand Theft Auto and Red Dead Redemption. However, along with the rest of the broader market, the company has also lost quite a bit of valuation as its share prices have fallen nearly 31% year-to-date.

Despite this, this company remains on Brian Fitzgerald’s shopping list. Take-Two’s recently released results for the first quarter of fiscal 2023 were quite encouraging, helped by recurring customer spending.

In addition, the recent acquisition of mobile games giant Zynga is expected to boost the company’s games portfolio, leading to higher revenues. (See Take Two stock chart on TipRanks)

Noting TTWO’s positive earnings commentary, the analyst noted that the process of integrating Zynga into its operations appears to be seamless. Indeed, Fitzgerald recalled that “management expects to realize $100 million in annual cost synergies within two years of closing.”

“We remain confident that the ZNGA acquisition will prove wise. TTWO now has the strongest mobile games catalog of its competitors, with plenty of leverage to increase margin and the opportunity to expand its existing intellectual property as quickly as possible – growing gaming platform,” noted Fitzgerald, who recommended buying for reiterated the stock with a price target of $185.