Breadcrumb Trail Links

Higher borrowing costs are hitting prospective buyers as well as existing homeowners who are about to renew their mortgage

A house for sale. Home sales in Toronto fell in August compared to the same time last year. Photo by Peter J. Thompson/National Post

A house for sale. Home sales in Toronto fell in August compared to the same time last year. Photo by Peter J. Thompson/National Post

content of the article

Toronto’s housing regulator is asking the government to reconsider the stress test as home sales in the country’s most populous city showed signs of recovery in August, with prices and volumes rising in July.

advertising 2

This ad has not yet loaded, but your article continues below.

content of the article

The Toronto Regional Real Estate Board said higher borrowing costs not only affect whether Canadians can buy homes, but also hit existing homeowners who are about to renew their mortgages. In such a climate, the Office of the Superintendent of Financial Institutions (OSFI), Canada’s top financial regulator, should consider whether the current stress test is still applicable.

Financial Post top stories

By clicking the subscribe button, you agree to receive the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking the unsubscribe link at the bottom of our emails. Postmedia Network Inc | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for registering!

content of the article

“Does it make sense to test homebuyers two percentage points above the current hike in interest rates, or should a more flexible test be used that follows the interest rate cycle?” said its chief executive John DiMichele.

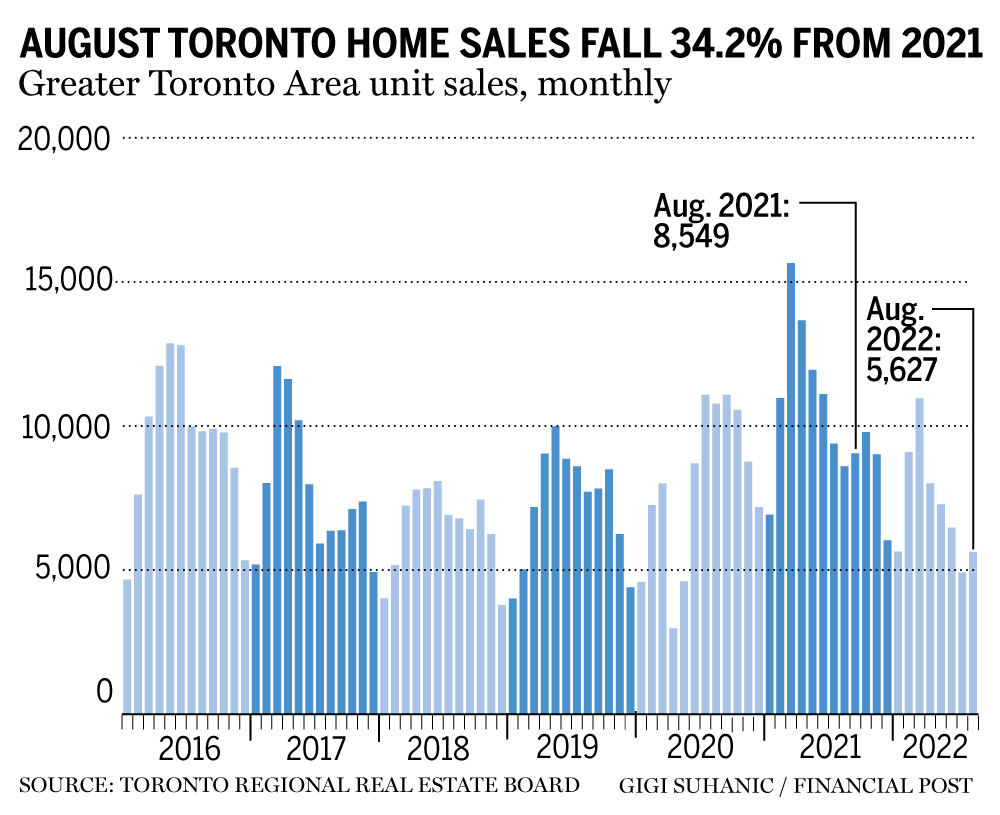

A report released on Friday showed that the number of homes sold in August rose by 5,627 from 4,912 in July. However, that is still 34.2 percent below the 8,549 home sales in 2021.

advertising 3

This ad has not yet loaded, but your article continues below.

content of the article

It turned out that sales accounted for a higher proportion of new registrations compared to the previous three months, possibly indicating some support for sales prices in the coming months.

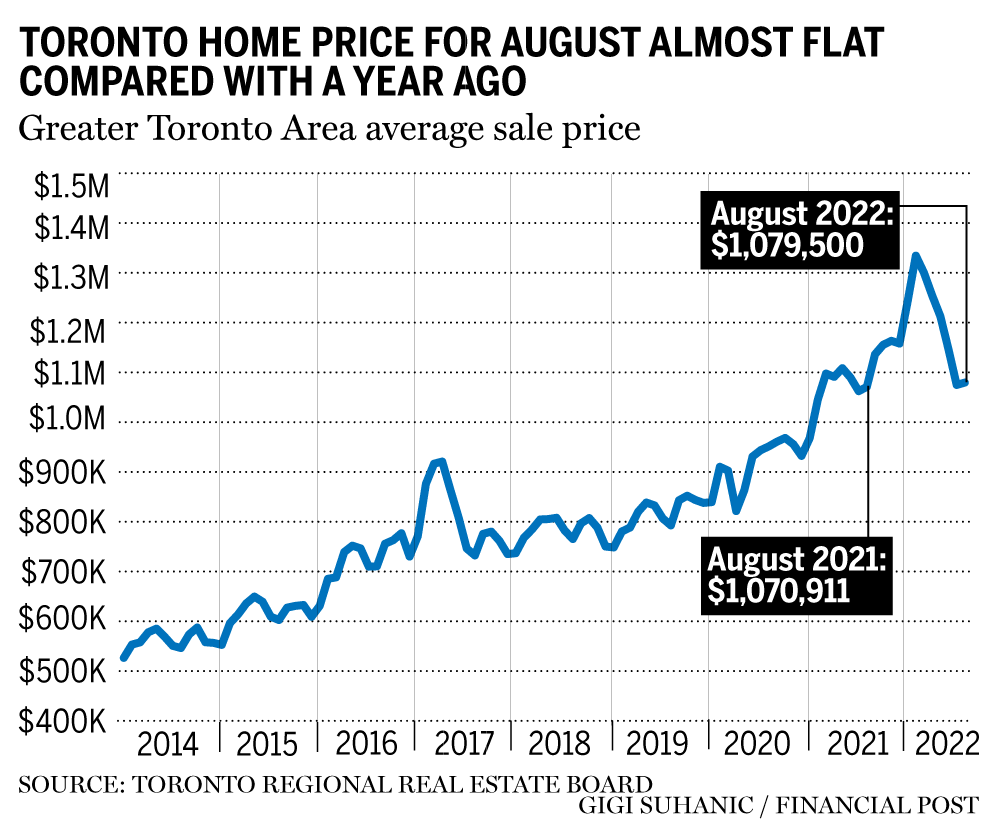

The data also shows that the board’s MLS Home Price Index is up 8.9 percent year-on-year, while the average selling price for all sales increased only slightly, 0.9 percent from $1,070,201 to $1,079,500 -dollar has gone up.

In an interview, the board’s lead market analyst said the year-on-year sales decline this year, as well as higher borrowing costs, are partly due to uncertainty.

Jason Mercer said they have asked OSFI, Canada Mortgage and Housing Corporation and the Treasury Department for clarity on the stress test, payback periods and price caps for mortgage insurance eligibility given the rapid rise in borrowing costs.

advertising 4

This ad has not yet loaded, but your article continues below.

content of the article

“It’s important to hear what these bodies have to say about housing affordability,” Mercer said, noting that the housing market is very interest rate sensitive and will continue to be affected.

-

Why Ottawa’s Rent-to-Own Program Won’t Do Much to Solve Canada’s Housing Problems

-

Rental fraud is on the rise and students are particularly vulnerable

-

Canada’s millennials continue to aspire to owning their own home, even if it means moving

-

“Softer” values for single-family homes bring buyers back to the market

The housing committee said removing the stress test when switching existing mortgages to a new lender may provide affordability for existing homeowners. It also called for longer payback periods on mortgage extensions to support the inflationary environment.

advertising 5

This ad has not yet loaded, but your article continues below.

content of the article

Not much has changed since the 2 percent stress test was introduced, Mercer said, adding that it’s important to have flexibility in applying that test, especially as the market moves through different stages of the interest rate cycle.

“Does the (current) stress test make sense in an interest rate environment that is very different from when it was first introduced, and also very different from the extremely low interest rate environment that we are seeing in 2020, in the first half of the 2021 or have experienced at all? the way to the first half of 2022?”

• Email: [email protected] | Twitter: denisepglnwn

Share this article on your social network

advertisement

This ad has not yet loaded, but your article continues below.

Comments

Postmedia strives to maintain a vibrant but civilized forum for discussion and encourages all readers to share their views on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve turned on email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update on a comment thread you follow, or when a user you follow comments follows. For more information and details on how to customize your email settings, see our Community Guidelines.