Breadcrumb Trail Links

The slowdown in the housing market could be reversed

Published on March 15, 2023 • Last updated 4 days ago • 3 minutes read

For sale signs outside three houses on Springmeadow Road in London, Ontario. Photo by Derek Ruttan/The London Free Press/Postmedia Network Files

For sale signs outside three houses on Springmeadow Road in London, Ontario. Photo by Derek Ruttan/The London Free Press/Postmedia Network Files

content of the article

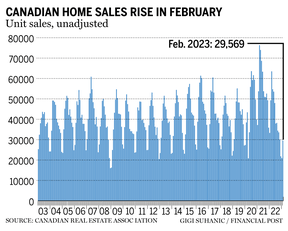

New figures released March 15 by the Canadian Real Estate Association (CREA) show the slowdown in Canada’s housing market may be reversing, with home sales up 2.3 percent monthly in February.

advertising 2

This ad has not yet loaded, but your article continues below.

THIS CONTENT IS FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Unlimited online access to articles from across Canada with one account

- Get exclusive access to the National Post ePaper, an electronic copy of the print edition that you can share, download, and comment on

- Enjoy behind-the-scenes insight and analysis from our award-winning journalists

- Support local journalists and the next generation of journalists

- Daily puzzles including the New York Times crossword

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Unlimited online access to articles from across Canada with one account

- Get exclusive access to the National Post ePaper, an electronic copy of the print edition that you can share, download, and comment on

- Enjoy behind-the-scenes insight and analysis from our award-winning journalists

- Support local journalists and the next generation of journalists

- Daily puzzles including the New York Times crossword

SIGN UP TO UNLOCK MORE ARTICLES

Create an account or log in to continue your reading experience.

- Access items from across Canada with one account

- Share your thoughts and join the discussion in the comments

- Enjoy additional articles per month

- Receive email updates from your favorite authors

content of the article

The agency, which represents more than 100,000 real estate agents nationwide, reported that February home sales fell 40 percent from a record-breaking February — just before the Bank of Canada began its cycle of interest rate hikes.

Financial post top stories

By clicking the subscribe button, you agree to receive the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for registering!

content of the article

New registrations in February were also down 7.9 percent from the previous month and the home price index (HPI) fell 1.1 percent to $704,300.

Traditionally, February isn’t a busy month for home sales or new listings, but it is a month when buyers are just beginning to explore the market. According to industry observers, this year’s traditionally busy spring housing market is among the most anticipated in recent history.

“February data held the potential for a more robust market going forward, but to reiterate last month’s bottom line, we won’t know what the market has in store for 2023 until spring,” said Jill Oudil, Chair of CREA Report. “While we’re not seeing it in sales or listing data just yet, I would expect homeowners to get their properties ready for the market and potential buyers to receive pre-mortgage approvals.”

content of the article

advertising 3

This ad has not yet loaded, but your article continues below.

content of the article

As CREA’s Senior Economist explains, there are parallels between 2019 and the spring 2023 forecast.

“The similarities between 2023 and the recovery year of 2019 continued to emerge in February, with increasing sales, a tightening of the market and a smaller month-on-month price decline,” CREA’s Shaun Cathcart said in the report. “But the biggest similarity was a sharp drop in seasonally adjusted new registrations. Future sellers, many of whom will also be buyers, are likely to wait until the optimal time to list and buy something else. For most, that’s in the spring. Will buyers jump off the fence to snap up homes in 2023 once they finally hit the market? They did that in 2019.”

While there is much optimism for the spring housing market, the shortage of inventory cannot be ignored. Christopher Alexander, President of RE/MAX Canada, said the drop in new registrations in February was the most worrying detail from the CREA report.

advertising 4

This ad has not yet loaded, but your article continues below.

content of the article

“We need more products,” the RE/MAX president said in an interview. “One worrying thing about the CREA report is that inventories have continued to decline month over month.”

One factor that could bring some relief on the supply front — albeit with other potential implications — is that homeowners hold a tremendous amount of housing debt.

Although lenders are doing their due diligence to keep their customers in their homes, rate hikes have left many with more debt than they can handle, raising the possibility of a surge in distressed home sales.

-

RELPs and REITs offer exposure to commercial real estate, but they are different

-

Canada’s rental housing market lags behind the US, causing many problems

-

Home mortgage risk is being reported by regulators amid growth in shadow banking

advertising 5

This ad has not yet loaded, but your article continues below.

content of the article

But that alone wouldn’t be enough to meet demand, Alexander said.

The market would still need a rush of new listings from potential sellers who have been sitting on the sidelines, which some economists have predicted.

“Even if we get what economists predicted… I think it will just be enough to create an equilibrium where some houses will sell on demand, some will undersell and some will oversell,” Alexander said. “The balance right now would be really good for homeowners who are considering moving but feel trapped because there just aren’t enough properties that fit their criteria – and obviously interest rates are higher so it’s a lot more expensive to buy what you want.”

• Email: [email protected]

Share this article on your social network

Comments

Postmedia strives to maintain a vibrant but civilized forum for discussion and encourages all readers to share their views on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve turned on email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update on a comment thread you follow, or when a user you follow comments follows. For more information and details on how to customize your email settings, see our Community Guidelines.