Article content

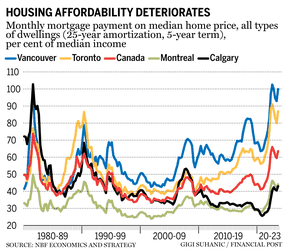

According to the National Bank of Canada’s latest housing affordability monitor, housing affordability in Canada took a major hit in the third quarter as rising prices largely wiped out gains made earlier in the year.

“If interest rates remain at their current levels, it would only take a 2 percent increase in home prices in the fourth quarter to surpass the worst affordability levels in a generation,” National Bank economists Kyle Dahms and Alexandra Ducharme said in an email . “The outlook remains particularly challenging for first-time home buyers.”

Article content

The report, which describes the affordability outlook as “dying”, showed a four-point increase in mortgage payment as a percentage of income (MPPI), reversing the 1.6-point improvement seen in the previous quarter.

This decline in affordability was driven by a 4.6 percent increase in seasonally adjusted house prices in the third quarter, coupled with a notable 32 basis point increase in the benchmark five-year mortgage rate. Although median household income rose 1.2 percent, it was not enough to offset higher housing costs and mortgage interest rates.

This decline in affordability was seen across all of Canada’s ten major real estate markets, with Vancouver, Toronto and Victoria experiencing the most significant deterioration. Condominium affordability fell 2.5 points, while the non-condo segment saw a more significant decline of 4.5 points.

Dahms and Ducharme attributed rising prices to supply shortages, population growth, and rising mortgage rates. They highlighted the upcoming immigration targets, due to be published on November 1, as crucial to determining the housing affordability outlook, which is currently bleak.

Article content

Dahms said his team is concerned about the housing shortage given high interest rates, noting that the current interest rate environment is dampening interest from builders despite strong demand.

“If this gap is not closed, the situation could continue where housing remains unaffordable for a long time,” he said.

similar posts

-

For real estate giant Hines, the office is more than just a place to work

-

Use solid wood construction to reduce emissions, says RBC

-

“Crushing” mortgage payments remain

Last year, the federal government’s goal was to admit 465,000 permanent residents by 2023, 485,000 by 2024 and 500,000 by 2025. According to Statistics Canada, immigration was largely responsible for the largest annual population growth in Canada since 1957, with the population increasing by over one million between July 2022 and July 2023.

• Email: [email protected]

Share this article on your social network