Breadcrumb trail links

TRREB says lower mortgage rates next year could ease affordability issues

Published on December 5, 2023 • Last updated 1 day ago • 3 minutes reading time

Toronto real estate prices fell again in November. Photo by Tyler Anderson/National Post

Toronto real estate prices fell again in November. Photo by Tyler Anderson/National Post

Article content

The Toronto region’s benchmark home price declined in November and new listings fell month-over-month as high interest rates continued to drive a slowdown that is likely to intensify in the winter months.

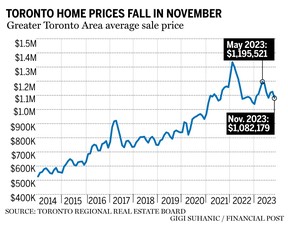

Monthly data released by the Toronto Regional Real Estate Board (TRREB) on December 5 showed the benchmark composite sales price in November was $1,081,300, down two per cent from October. On a seasonally adjusted basis, reference prices fell 1.7 percent, the fourth consecutive month of declines. Meanwhile, the average sales price fell by 2.2 percent month-on-month to $1,082,179, well below the monthly high of the year of $1,195,521 in May.

Advertising 2

This ad has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

Register to unlock more articles

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the discussion in the comments.

- Enjoy additional articles per month.

- Get email updates from your favorite authors.

Article content

Article content

There were a total of 4,236 sales in November, nine percent less than October and more than six percent less than last year. New listings fell 27 percent compared to the previous month, but increased almost 20 percent compared to the previous year.

Financial contribution

Financial contribution

TRREB President Paul Baron said inflation and rising borrowing costs have hurt affordability but relief could soon come.

“Bond yields, which form the basis for fixed-rate mortgages, have trended lower and a growing number of forecasters expect Bank of Canada rate cuts in the first half of 2024,” he said in the report. “Lower interest rates will help alleviate affordability issues for existing homeowners and those looking to enter the market.”

TRREB chief market analyst Jason Mercer said prices have adjusted downward from their highs, although the reprieve may only be temporary.

“This has brought some relief to buyers from an affordability perspective. With mortgage rates trending lower next year and the population continuing to grow at record rates, demand relative to supply is expected to increase. This will ultimately lead to a renewed increase in property prices,” Mercer said in the report.

Top stories

Thanks for registering!

Article content

Advertising 3

This ad has not loaded yet, but your article continues below.

Article content

However, before this forecast comes true, real estate experts believe that the typical winter cold will cool the markets even further.

Tim Syrianos, principal registered broker and owner of Re/Max Ultimate Realty Inc., said with seasonal patterns reasserting themselves after pandemic-related lockdowns disrupted the market, no one should expect much activity in the next few months.

“It’s the first time in three years that we actually have a real seasonal market, in the sense that there is nothing that can close us down or lock us down and open us back up,” Syrianos said. “It is the first Christmas season when there is no reason why the market should behave differently than traditionally.”

Toronto real estate agent Cailey Heaps is also expecting a subdued winter after a lackluster fall.

“I think what we saw this fall was definitely that the market fell short of our expectations,” Heaps said. “And we are now in a normally quiet time. December and early January are usually quite quiet in the real estate market.”

similar posts

-

Vancouver real estate prices fall in November

-

Global investors see opportunities in the housing shortage

-

Home buyers are looking for homes with rental potential

Advertising 4

This ad has not loaded yet, but your article continues below.

Article content

To buyers who are hesitant to continue looking, she said that despite the increased interest rates, there are still options as prices have come down.

“When you look at affordability, there are some very good opportunities in the market to get more home for your money,” Heaps said. “If you take a longer-term view and maybe pay the higher rates for a year or so and then renegotiate the rates, I think there are some really good buying opportunities.”

• Email: [email protected]

Bookmark our website and support our journalism: Don’t miss out on the business news you need to know – bookmark Financialpost.com and sign up for our newsletter here.

Article content

Share this article on your social network