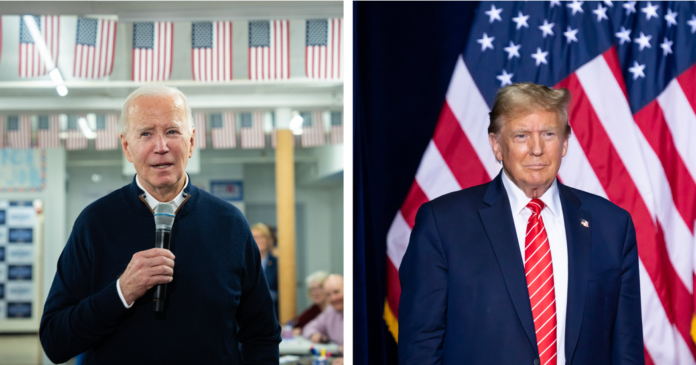

President Biden staked out key economic battle lines in his budget this week with former President Donald J. Trump, the presumptive Republican presidential nominee. The proposal offers the nation a glimpse into the different directions pension programs, taxes, trade and energy policy could take depending on the outcome of the November election.

Over the past three years, Mr. Biden has enacted major legislation aimed at boosting the green energy economy, making infrastructure investments and strengthening America's domestic supply chain through subsidies for microchips, solar technology and electric vehicles. Few of these priorities are shared by Mr. Trump, who has promised to cut more taxes and raise new trade barriers if re-elected.

The tipping point will come as the economy enters the final stages of what economists now expect to be a “soft landing” after two years of high inflation. However, the prospect of a second Trump administration has increased uncertainty in the economic outlook as businesses and policymakers around the world brace for a potentially dramatic shift in the United States' economic leadership.

Here are some of the most striking differences in the economic policies of the two presidential candidates.

Sparring for the social safety net

At first glance, Mr. Biden and Mr. Trump appear to have similar positions on the country's social security programs. In 2016, Mr. Trump broke with his fellow Republicans and refused to support cuts to Social Security or Medicare. Mr. Biden has long insisted that the programs should be protected and has criticized Republicans who have suggested cutting or scaling back the programs.

In his budget proposal on Monday, Mr. Biden reiterated his commitment to preserving the country's entitlement system. He called for new efforts to improve the solvency of Social Security and Medicare, including requiring wealthy Americans to pay more into the health care program. However, its plans contained few details about how to ensure the long-term sustainability of both programs.

Separately, Mr. Trump appeared to indicate on Monday that he was open to entitlement cuts. He said on CNBC that “a lot can be done in terms of reducing claims, and also in terms of theft and poor administration of claims, tremendously poor administration of claims.”

The Trump campaign clarified that the former president was referring to waste reduction, but the Biden campaign seized on the comment. An ad was quickly released comparing Mr. Trump's comments to Mr. Biden's State of the Union pledge to stop anyone who tries to cut Social Security or Medicare or raise the retirement age.

Although Mr. Trump never signed cuts to Social Security or Medicare as president, he has flirted with the idea before. When asked about entitlement cuts in a CNBC interview in 2020, he said, “At the right time, we'll look at it.”

To tax or not to tax?

One of the biggest differences between Mr. Biden and Mr. Trump revolves around who, if anyone, should pay more taxes.

The president this week proposed more than $5 trillion in tax hikes on corporations and the wealthy, including a new 25 percent minimum tax on the wealthiest Americans and an increase in the corporate tax rate from 21 percent to 28 percent.

Mr. Biden linked his proposed tax increases on the rich to tax cuts for the middle class. He called for an expansion of the child tax credit, which many Republicans opposed, an expansion of eligibility for the earned income tax credit and new tax credits aimed at making housing more affordable for first-time buyers.

Mr. Trump signed the Tax Cuts and Jobs Act of 2017, which included nearly $2 trillion in tax cuts, much of which benefited corporations and the wealthy. Many of these tax cuts expire in 2025, meaning whoever is president has a big say in whether they are extended or allowed to expire.

Mr. Biden wants to undo much of the 2017 law, except for portions that benefit taxpayers earning less than $400,000.

Mr. Trump has offered few details about his tax plans, but suggested at a rally in February that he envisioned another round of tax cuts.

“You are all getting the biggest tax cuts because we are making additional tax cuts and creating a brand new Trump economic boom like you have never seen before,” Trump said.

Speaking to CNBC on Monday, Mr Trump said it would be “very bad for this country” if the Trump tax cuts were not extended.

The Friendshorer vs. the Tariff Man

While polarization between Democrats and Republicans has increased in recent years, trade policy is one of the few areas where views appear to have converged.

For all their differences, Mr. Biden has largely left the trade agenda that Mr. Trump put before him intact. Tariffs on hundreds of billions of dollars worth of Chinese imports that Mr. Trump imposed have yet to be rolled back. Mr. Biden has stepped up scrutiny of Chinese investment in the United States and American investment in China, and the Biden administration's industrial policy has strained relations with some European countries.

If re-elected, Mr Biden is likely to continue his policy of deepening trade ties with American allies – a policy known as “friendshoring” – and reducing supply chain dependence on adversaries such as China. The Biden administration is expected to complete a review of China tariffs in the coming months and could cut some levies on consumer products and increase others, which would further protect the emerging U.S. electric vehicle sector.

Mr Trump has indicated he is preparing for a new round of trade wars. The former president and self-proclaimed “tariff man” has talked about imposing a 10 percent tariff on all imports and a 60 percent or more tariff on Chinese goods in a second term.

Controversy over clean energy

The Inflation Reduction Act of 2022 has become Mr Biden's signature legislation, and its future – and the evolution of US climate policy – depends on who wins the election.

Mr. Biden's economic team is racing to introduce regulations related to the tax and climate law to anchor investments in clean energy and the electric vehicle supply chain in the economy. The Biden administration hopes the law could prove lasting because many of these investments are in states run by Republicans.

But Mr. Trump, who has long derided electric vehicles as overpriced, underpowered and a threat to American jobs, cannot be expected to support much of the law if elected.

“We are a nation whose leaders are demanding all electric cars even though they don't go far, cost too much and their batteries are made in China,” Trump said at a rally in New Hampshire in January.

The former president, who withdrew the United States from the Paris climate accord, is unlikely to prioritize other clean energy investments.

Mr. Trump has argued for years that solar energy is ineffective and that wind turbines are responsible for the slaughter of birds.