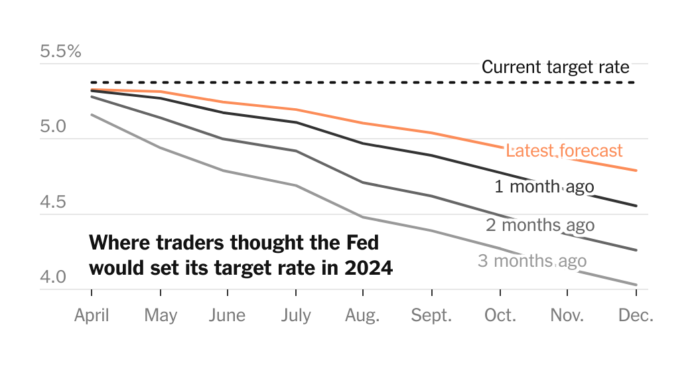

Investors were betting big on Federal Reserve interest rate cuts at the start of 2024, betting that central bankers would cut rates to around 4 percent by year's end. But after months of stubborn inflation and strong economic growth, the outlook is starting to look less dramatic.

Market prices now indicate that interest rates will be around 4.75 percent by the end of the year. That would mean Fed officials would have cut interest rates two or three times from the current 5.3 percent.

Policymakers are trying to strike a delicate balance as they consider how to respond to the economic situation. Central bankers don't want to risk hurting the labor market and triggering a recession by keeping interest rates too high for too long. But they also want to prevent borrowing costs from being reduced too early or too much, which could cause the economy to accelerate again and inflation to gain an even stronger foothold. So far, officials are sticking to their forecast for rate cuts in 2024, but are making it clear they are in no rush to lower them.

Here's what policymakers are paying attention to as they consider what to do with interest rates, how the incoming data could change the path ahead, and what it will mean for markets and the economy.

Which means “longer higher.”

When people say they expect interest rates to be “higher in the longer term,” they often mean one or both of two things. Sometimes the phrase refers to the near future: It could take longer for the Fed to start cutting borrowing costs, and make those cuts slower this year. In other cases, this means that interest rates will remain significantly higher in the coming years than was typical in the decade before the 2020 pandemic.

When it comes to 2024, top Fed officials have made it very clear that they are primarily focused on the trajectory of inflation while discussing when to cut interest rates. If policymakers believe price increases will return to their 2 percent target, they might feel comfortable cutting prices even in a strong economy.

Longer term, Fed officials are likely to be more influenced by factors such as labor force growth and productivity. If the economy has more momentum than before, perhaps because government infrastructure investments and new technologies such as artificial intelligence are boosting growth, interest rates may have to stay a little higher to keep the economy going even Kiel.

In a continued strong economy, the rock-bottom interest rates of the 2010s may prove too low. To use the economic term, the “neutral” interest rate, which neither heats nor cools the economy, could be higher than it was pre-Covid.

The concern for 2024 is continued inflation.

Some Fed officials have recently argued that interest rates could remain higher this year than the central bank's forecasts suggested.

Policymakers predicted in March that they would likely cut borrowing costs three more times in 2024. But Neel Kashkari, the president of the Federal Reserve Bank of Minneapolis, suggested during a virtual event last week that he could imagine a scenario in which the Fed would not cut interest rates at all this year. And Raphael Bostic, the president of the Atlanta Fed, said he doesn't expect a rate cut until November or December.

The caution comes after inflation – which fell steadily throughout 2023 – has moved sideways in recent months. And as new tensions emerge, including a rise in gas prices, mild pressure on supply chains after a bridge collapse in Baltimore and pressure on housing prices fading from official data for longer than expected, the stagnation risks continuing.

Still, many economists believe it is still too early to worry about inflation easing. While price increases in January and February came faster than many economists had expected, this may have been partly due to seasonal characteristics and came only after significant progress.

The Consumer Price Index inflation measure, due to be released on Wednesday, is expected to cool to 3.7 percent in March after controlling for fluctuating food and fuel costs. That's down from an annual rate of 3.8 percent in February and well below a peak of 6.6 percent in 2022.

“We think inflation is not stuck,” said Laura Rosner-Warburton, senior economist at MacroPolicy Perspectives. “Some areas are sticky, but I think they are isolated.”

The latest inflation data “does not significantly change the overall picture,” Fed Chairman Jerome H. Powell said in a speech last week, even as he signaled the Fed would be patient before cutting interest rates.

The longer term is also in focus.

Some economists – and increasingly investors – believe interest rates could remain higher in the coming years than Fed officials have predicted. Central bankers forecast in March that interest rates would fall to 3.1 percent by the end of 2026 and to 2.6 percent in the longer term.

William Dudley, a former president of the Federal Reserve Bank of New York, is among those who believe interest rates could remain elevated. He noted that the economy has been growing rapidly despite high interest rates, suggesting it can absorb higher borrowing costs.

“If monetary policy is as tight as Chairman Powell argues, then why is the economy still growing so quickly?” Mr. Dudley said.

And JPMorgan Chase Chief Executive Officer Jamie Dimon wrote in a letter to shareholders this week that major societal changes — including the green transition, supply chain restructuring, rising health care costs and increased military spending in response to geopolitical tensions — “could lead to a surge.” to more stubborn inflation and higher interest rates than markets expect.”

He said the bank was prepared for “a very wide interest rate range of 2 percent to 8 percent or even more.”

Borrowing would be more expensive.

If the Fed does indeed leave interest rates higher this year and in the years to come, that means cheap mortgage rates like those of the 2010s will not return. Likewise, credit card interest rates and other borrowing costs would most likely remain higher.

As long as inflation doesn't stagnate, that could be a good sign: Super-low interest rates were an emergency tool the Fed used to try to revive a struggling economy. If they don't come back because growth has picked up momentum, that would be evidence of a more robust economy.

But for would-be homeowners or business owners who have been waiting for borrowing costs to come down, that may provide limited comfort.

“If we're talking about interest rates that last longer than consumers expected, I think consumers would be disappointed,” said Ernie Tedeschi, a research scholar at Yale Law School who recently left the White House Council of Economic Advisers.