Breadcrumb trail links

The market recovery in Canada will be moderate and somewhat unpredictable over the next few years

Published July 17, 2024 • Last updated 4 hours ago • 3 minutes reading time

You can save this article by registering for free here. Or log in if you already have an account.

The real estate market in Canada has stalled because people who would buy homes now bought them during the pandemic to take advantage of extremely low interest rates. Photo by Postmedia

The real estate market in Canada has stalled because people who would buy homes now bought them during the pandemic to take advantage of extremely low interest rates. Photo by Postmedia

Article content

By Murtaza Haider and Stephen Moranis

The Canadian Real Estate Association (CREA) is Canada's most data-rich organization that tracks real estate sales and prices. CREA has revised its latest housing market forecast, lowering its expectations for sales and price increases.

At the beginning of April, CREA hoped for a recovery in the markets due to the expected interest rate cuts. However, these hopes were dampened by the latest sales figures and consumer surveys, which confirmed the lack of response from buyers.

Display 2

This ad hasn't loaded yet, but your article will continue below.

THIS CONTENT IS FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news from your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from the Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from the Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition for viewing on any device, sharing and commenting.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news from your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from the Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from the Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition for viewing on any device, sharing and commenting.

- Daily puzzles, including the New York Times Crossword.

REGISTER / LOGIN TO UNLOCK MORE ARTICLES

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Look forward to additional articles every month.

- Get email updates from your favorite authors.

Sign in or create an account

or

Article content

In early June, the Bank of Canada cut its benchmark interest rate by 25 basis points. However, this first rate cut, which came after ten consecutive rate hikes, was not enough to encourage previously unavailable buyers to re-enter the real estate market. While further rate cuts are expected, uncertainty about their magnitude and timing continues to contribute to market instability.

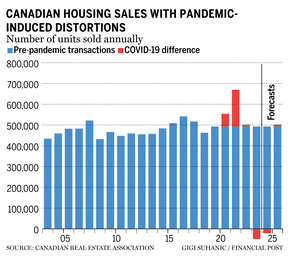

CREA forecasts that 472,395 homes will be sold through Canada's MLS systems in 2024. Although this forecast represents a six percent increase over last year's volume, it falls short of previous projections. In addition, expected transactions for 2024 remain below the long-term trend, as shown by the 10-year moving average. The forecasts for moderate sales growth also apply to next year, as CREA expects 501,902 sales in 2025.

On the surface, CREA's forecasts suggest a weakening market. However, if the COVID-19-induced housing boom is removed from the equation, sales volumes in 2024 and 2025 would be in line with longer-term average sales volumes.

In other words, the pandemic-related sales surge has distorted the market, primarily due to the phenomenon of “forward buying” – where consumers accelerate their purchases to take advantage of limited-time incentives such as significant discounts or low interest rates. By 2019, an average of 500,000 homes were bought and sold through the MLS system each year. However, the drastic rate cuts in 2020 and 2021 caused sales to accelerate significantly, resulting in an estimated 238,000 additional transactions that most likely would not have occurred otherwise.

Top Stories

Thanks for registering!

Article content

Display 3

This ad hasn't loaded yet, but your article will continue below.

Article content

Dr. Dogan Tirtiroglu, professor of real estate at Toronto Metropolitan University's Ted Rogers School of Management, explains that homeownership is a durable asset. Increased home buying in 2020 and 2021 has partially exhausted demand from a relatively limited pool of potential buyers. Consequently, the expected rate cuts may not significantly increase sales, as many of those who would have purchased a home in 2023 or later have already done so in 2020 and 2021 to take advantage of ultra-low mortgage rates.

Despite CREA's reduced revenue forecasts, there will still be 188,865 additional transactions in the system by the end of 2025 due to the extremely low mortgage rates of 2020 and 2021. This suggests that the recent decline in revenue has not been enough to offset the increase in transactions from those years.

Because demand for homes and homeownership is limited in any given period, excessive purchases in an earlier period can hurt sales in subsequent periods, even if the number of potential buyers increases. This phenomenon partly explains the current slowdown compared to the peak activity observed in the early pandemic years.

Display 4

This ad hasn't loaded yet, but your article will continue below.

Article content

While sales activity shows volatility, real estate prices tend to be more stable. CREA reported that average real estate prices fell by 3.6 percent in 2023. Forecasts for 2024 show an annual increase of 2.5 percent, followed by another increase of five percent in 2025.

Regional price differences are linked to changes in demand due to the economic recovery. In Alberta, real estate prices are expected to rise by almost eight percent annually this year and next. In contrast, relatively modest price increases are forecast for Ontario, Canada's largest real estate market.

Editor's recommendations

-

Homebuyers take the risk of waiting for interest rates

-

Interest rate cuts will not solve Canada's housing crisis

-

Higher mortgage payments will curb consumer spending

Uncertainty about the timing and magnitude of future interest rate changes, coupled with limited capacity for home purchases during certain periods, suggest that the recovery in Canada's housing market will be modest and somewhat unpredictable. Significant short-term fluctuations in one direction or the other are unlikely.

Murtaza Haider is associate dean for graduate programs and director of the Urban Analytics Institute at the Ted Rogers School of Management at Toronto Metropolitan University. Stephen Moranis is a real estate industry veteran. You can reach them through the Haider-Moranis Bulletin website, www.hmbulletin.com.

Article content

Share this article on your social network