Housing rights activists and tenants protest outside the offices of landlord Broadway Capital in Chelsea, Massachusetts on April 25, 2022 against evictions and the poor condition of their apartments.

Brian Snyder | Reuters

The Biden administration on Wednesday announced new measures to protect renters across the United States, including trying to curb practices that prevent people from accessing housing and curbing exorbitant rent increases on certain properties with federally backed mortgages.

A “Blueprint for a Renters Bill of Rights” was included in the announcement. It lays out a set of principles that the federal government and other bodies can take, including “access to safe, quality, accessible and affordable housing” and “clear and fair leases.”

“It’s really significant that the federal government and the White House are speaking out and endorsing the need for a tenants’ bill of rights,” said Diane Yentel, president and CEO of the National Low Income Housing Coalition.

More from Personal Finance:

Tax filing season is here. This will give you a faster refund

Study shows Generation Xers bear the most credit card debt

Here’s what it takes to get near-perfect credit

According to the White House, over 44 million households, or about 35% of the US population, live in rented apartments.

While the coronavirus pandemic prompted a wave of new protections and relief measures for renters, including a historic pot of rental aid for those who had fallen behind, most of that aid has now dried up.

Advocates have long urged the government to respond to an affordability crisis facing renters. Almost half of renter households in the US spend more than 30% of their income on rent and utilities each month, and before the public health crisis, 900,000 evictions were being carried out annually.

Possible containment of “egregious rent increases”

As part of Wednesday’s announcement, the Federal Housing Finance Agency and state-owned mortgage giants Fannie Mae and Freddie Mac say they will study potential renters’ protections that limit “outrageous rent increases” on properties backed by certain federal mortgages.

According to a calculation by the Urban Institute, more than 28% of the nationwide rental housing stock will be financed by the federal government in 2020.

Rent protection for such properties “would be the most significant action the federal government could take,” Yentel said.

As part of the White House’s actions, the Federal Trade Commission said it will look at ways to expand its powers to crack down on practices that “unfairly prevent consumers from obtaining and retaining housing.”

Persistence of eviction information in certain background reports, as well as high application fees and bails, are some of these practices, Yentel said.

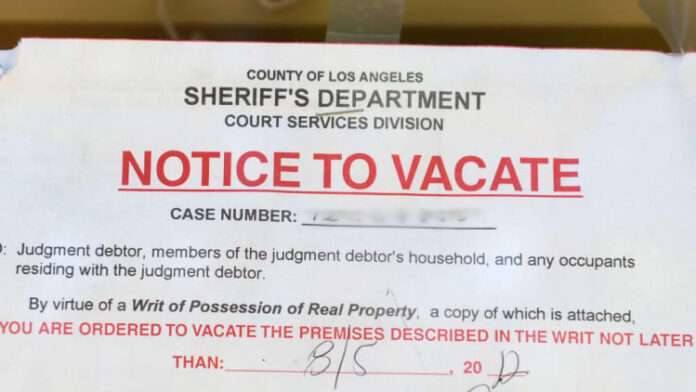

The U.S. Department of Housing and Urban Development also said it will begin requiring certain rental property owners to provide at least 30 days’ notice if they intend to terminate a tenant’s lease for non-payment of rent. The agency will award $20 million to the Eviction Protection Grant Program, which funds nonprofit organizations and government agencies to provide legal assistance to low-income renters at risk of eviction.

Bob Pinnegar, president and CEO of the trade group National Apartment Association, said the industry opposes expanded federal involvement in the landlord-tenant relationship.

“Complex housing policy is a state and local matter, and the best solutions use carrots rather than sticks,” Pinnegar said.

“Aggressive administrative action is so important”

While the moves announced by the Biden administration are historic, they will not solve the US housing crisis, Yentel said.

What it takes to resolve the pervasive problems, she said, is building affordable housing, creating permanent emergency and universal rent support, and establishing robust tenant protections.

However, Yentel added that because it is “hard to see where the opportunity for these investments will come from this Congress, aggressive administrative action is so important.”