This section is Presented

This section was created by the editors. The client was not given the opportunity to restrict the content or to check it before publication.

from RBC Mortgages

Breadcrumb Trail Links

High prices combined with higher interest rates could weigh on profits, says CREA

Publication date:

March 15, 2022 • 3 days ago • 2 minutes read • 14 comments  Home sales rose 4.6 percent from the previous month, thanks to a 23.7 percent increase in new registrations. Photo by National Post

Home sales rose 4.6 percent from the previous month, thanks to a 23.7 percent increase in new registrations. Photo by National Post

content of the article

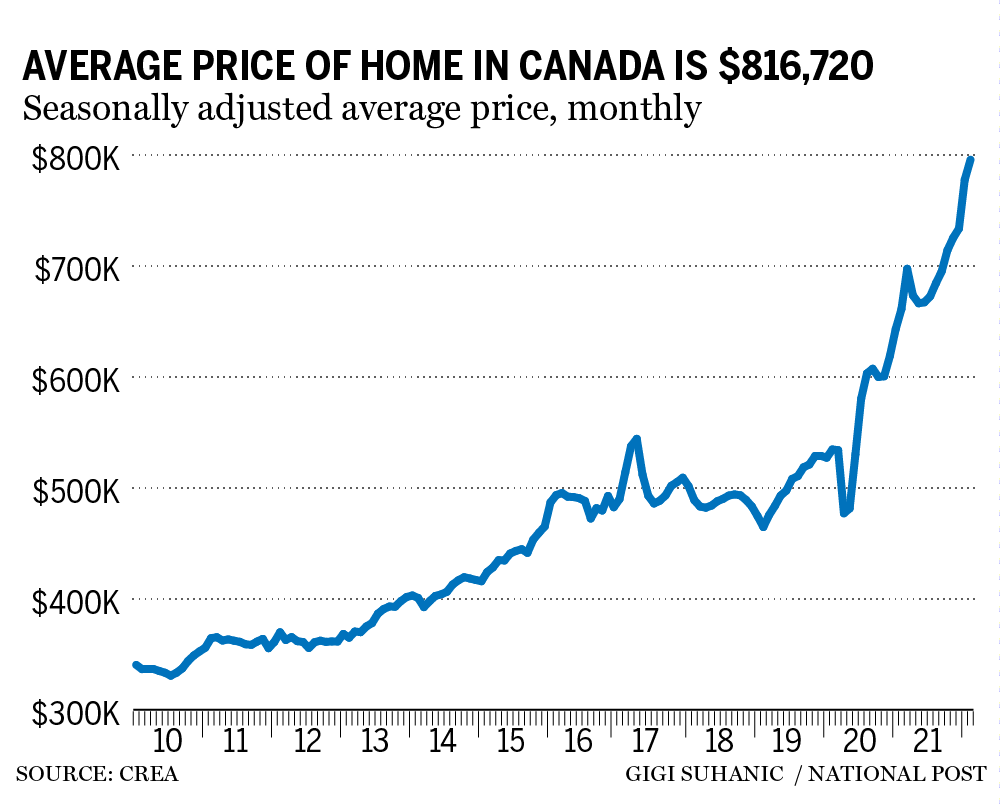

Canada’s median home price rose more than 20 percent year-on-year to $816,720 in February, according to data from the Canadian Real Estate Association.

advertising 2

This ad has not yet loaded, but your article continues below.

content of the article

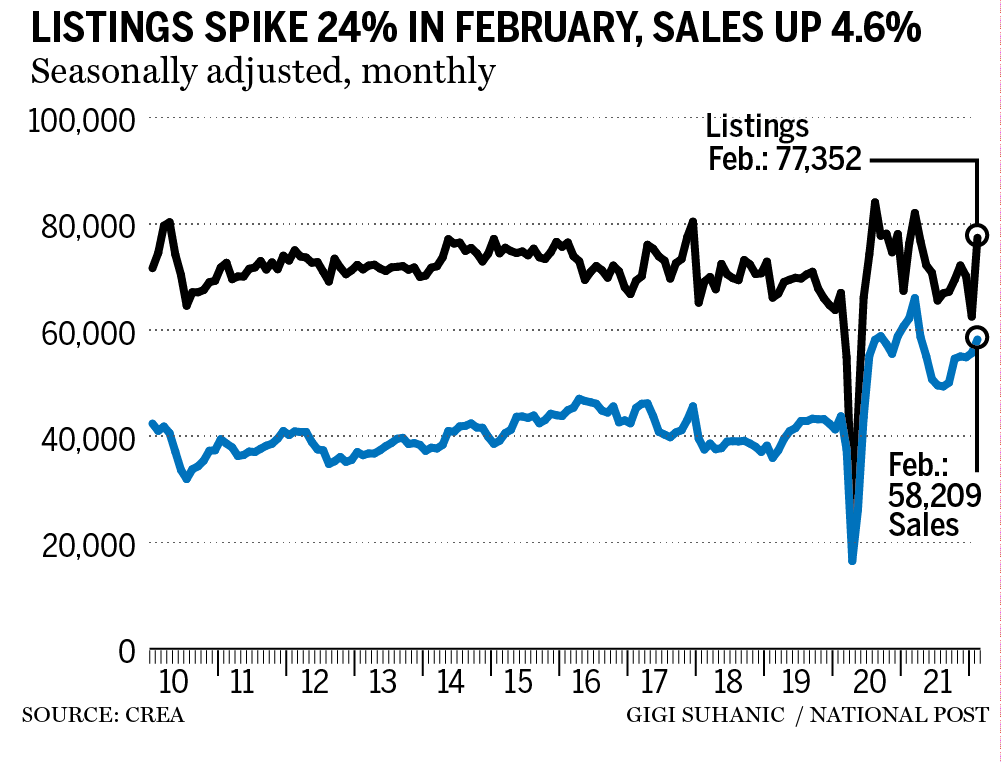

Sales rose 4.6 percent from the January doldrums, thanks to a 23.7 percent increase in new registrations. Though strong, sales fell 8.2 percent short of the February 2021 record.

The Greater Toronto Area, British Columbia’s Fraser Valley and Calgary led the gains.

CREA had expected an onslaught of new listings, but chairman Cliff Stevenson said it was unclear whether this would last into the spring.

content of the article

“New supply rose sharply in February, which is similar to what we’ve seen in 2020 and again in 2021,” Shaun Cathcart, senior economist at CREA, said in the press release. “The real question is, what’s next? Expect at least another month of stronger sales in the near term as most of these new offerings came out towards the end of the month so many of the associated sales will likely not happen until early March.”

advertising 3

This ad has not yet loaded, but your article continues below.

content of the article

CREA’s benchmark non-seasonally adjusted home price index rose a record 29.2 percent year-on-year in February. However, the market could be at an inflection point for prices.

“Combined with higher interest rates and higher prices, we could be at a tipping point where price growth starts to slow and inventories finally start to recover after seven years of decline,” Cathcart said. “To rebalance this market over the long term, building more new homes across the spectrum remains key.”

-

Canada housing starts up 8%, beating expectations

-

The rental market proves that the dynamics of the housing supply help people to find a home

-

What rising interest rates mean for housing and the economy

The need for more supply is shared by Re/Max executive vice president Elton Ash, who also said he expects the market to settle down this year.

“It’s definitely a lack of supply and inventory,” Ash told the Financial Post. “We’ve seen different levels of government trying to approach this from a fiscal perspective – in other words, to curb demand – which isn’t working. It’s really a supply problem. Housing starts need to increase, whether it’s single-family homes or condominium-style multi-family homes.”

• Email: shughes@postmedia.com | Twitter: StephHughes95

Share this article on your social network

advertisement

This ad has not yet loaded, but your article continues below.

Financial Post top stories

By clicking the subscribe button, you agree to receive the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking the unsubscribe link at the bottom of our emails. Postmedia Network Inc | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for registering!

Remarks

Postmedia strives to maintain a lively but civilized discussion forum and encourages all readers to share their opinions on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve turned on email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update on a comment thread you follow, or when a user you follow comments follows. For more information and details on how to customize your email settings, see our Community Guidelines.