European bank stocks sold off sharply in early trade on Friday as jitters spread around the world surrounding US bank SVB Financial – which fell 60% on Thursday.

This was followed by an announcement by the tech-focused lender of a capital increase to offset losses from bond sales.

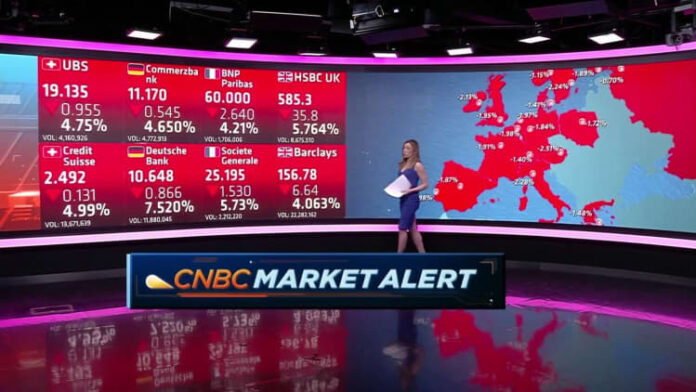

The Euro Stoxx Banks Index was on track for its worst day since June, led by a more than 8% drop for Deutsche Bank. General society, HSBC, ING group And Commerzbank all fell more than 5%.

Silicon Valley Bank caters heavily to startups, particularly venture-backed technology and life science companies in the US. The 40-year-old company was forced into an emergency sale of its securities on Thursday, selling $21 billion worth of holdings at a $1.8 billion loss while raising $500 million from venture firm General Atlantic , according to a financial update late Wednesday.

The company said Wednesday in a letter from CEO Greg Becker that it had sold “substantially all” of its available-for-sale securities and is aiming to raise $2.25 billion through common stock and convertible preferred stock.

The Federal Reserve has aggressively raised interest rates over the past year, which may cause long-term bond values to fall, and the SVB plans to reinvest proceeds from its sales in shorter-term assets.

Billionaire investor and Pershing Square CEO Bill Ackman said in a tweet early Friday that if SVB fails, it could “destroy an important long-term engine of the economy as VC-backed companies depend on SVB for loans.” receive and hold their assets”.

“If private capital cannot provide a solution, a highly dilutive government bailout should be considered.”

Russ Mold, investment director at UK investment platform AJ Bell, said SVB’s announcement should not have come as a “big surprise” after a period in which “lenders’ and investors’ appetite for this part of the market has dried up”.

“However, in a highly interconnected banking industry, it is not so easy to segment these types of events, which often indicate weaknesses in the wider system. The fact that SVB’s share placement was accompanied by a distressed sale of its bond portfolio is a cause for concern,” Mold said.

“Many banks hold large portfolios of bonds and rising interest rates are making them less valuable – the SVB situation is a reminder that many institutions are sitting on large unrealized losses on their fixed income holdings.”

This is breaking news and will be updated shortly.