The housing market is slowing down. Companies are pulling back on new hires and investments. But American consumers are keeping the economy out of a recession — at least for now.

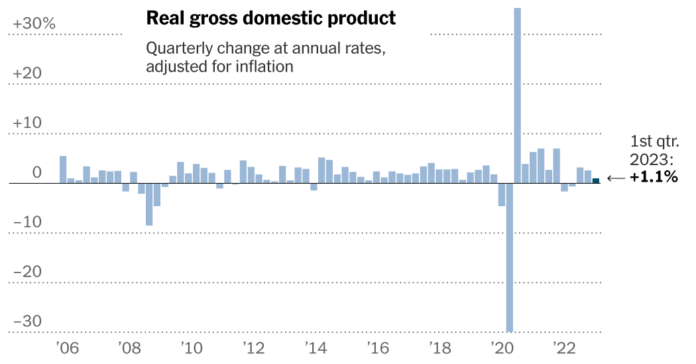

Inflation-adjusted gross domestic product rose at an annual rate of 1.1 percent in the first quarter, according to preliminary data released by the Commerce Department on Thursday. That was down from a 2.6 percent rate in the last three months of 2022, but still represented a third straight quarter of growth after production tumbled in the first half of last year.

The Federal Reserve’s efforts to cool the economy are having an effect. The real estate sector contracted for the eighth straight quarter and business investment in equipment fell for the second straight quarter. Both areas are heavily impacted by interest rates, which policymakers have repeatedly hiked over the past year to curb inflation.

However, those declines were more than offset by robust consumer spending, which rose at an annual rate of 3.7 percent, the fastest growth since mid-2021, when the launch of the Covid-19 vaccine boosted the economy. Consumers have been buoyed by a strong labor market and rising wages, which have helped them weather the combination of rising prices and higher borrowing costs.

“You never want to bet against the US consumer, you learn that all the time,” said Stephen Juneau, an economist at Bank of America.

Spending on services like travel and restaurant meals continued to recover from pandemic lows, while spending on goods also rose after four straight quarters of decline.

However, it is not clear how long this resilience can last. Spending slowed over the quarter and forecasters said they could weaken further amid headlines of layoffs, bank failures and warnings of a possible recession. Saving rates have risen slightly, a sign that consumers may be becoming more cautious, and that more Americans are defaulting on debt payments, suggesting they may be struggling to keep up with rising prices.

“Consumer spending is still increasing, but I don’t know how long that can last,” said Ben Herzon, an economist at S&P Global Market Intelligence. “Confidence is weak and has waned. You must be wondering if that will translate into a drop in spending any time soon?”

Many companies seem to think so. Companies didn’t increase inventories in the first quarter, an indication that they expect sales to fall in the coming months and don’t want to be stuck with products they can’t sell.

“Consumption is still strong, yet companies seem to think they don’t need to stock up on inventories because they probably think consumption will slow,” said Megan Greene, chief economist at the Kroll Institute. “So who’s right?”

At Nexgrill, a California-based seller of grills and other outdoor cooking equipment, sales of entry-level models under $500 have been strong so far this year, said Ramsay Hawfield, a company vice president. But sales of higher-priced products have started to slow in recent months, prompting Mr Hawfield to indicate some consumers are watching their budgets more closely.

“They don’t feel as rich as they did a year or two ago, and now they feel a little pinched and a little nervous,” he said. “The person who bought that $500 or $600 grill is like, ‘Maybe I’ll go for the $300 or $400 version.'”

Nexgrill isn’t laying off workers, Mr Hawfield said, and it’s still investing in new products. But it does so carefully, avoiding features that consumers might not find worth the extra cost. Retailers, he added, are pushing Nexgrill and other brands to keep prices down — something that was much less true a year ago, when consumers barely seemed to pay attention to price tags.

“They urge us, ‘let’s find a better price point,'” he said.

A gradual retreat by consumers would be welcomed by policymakers who fear continued free spending will fuel inflation. Consumer prices rose at an annual rate of 4.2 percent in the first quarter, faster than late last year and well above the Fed’s target of 2 percent, according to data released Thursday. Fed officials are set to gather in Washington next week and are expected to hike rates for the 10th straight meeting.

Policymakers will get a more updated read on the economy on Friday when the Commerce Department is due to release income and spending data for March, and the Labor Department is to release data showing whether wage growth has slowed further in the first quarter, a key target of the fed

What happens next may depend on the job market. Two years of high inflation and robust spending have eroded the savings many households built up at the start of the pandemic. But as long as companies keep hiring and wages keep rising, Americans will be able to keep spending. After-tax income rose 8 percent annually, adjusted for inflation, in the first quarter, although the big jump was partly due to an adjustment in the cost of living that led to an increase in Social Security payments in January.

But if companies start laying off workers, consumers’ willingness to keep spending could quickly evaporate, said Dana Peterson, chief economist at the Conference Board, a business group. That would almost certainly push the economy into recession.

“If you’re a consumer and you think you might lose your job, then you’re going to change your spending habits and that’s going to be a burden,” she said.

Unemployment insurance claims have risen slightly in recent months, although they fell last week, and companies have posted fewer job vacancies. So far, however, it’s “not a free fall,” Ms Peterson said. “It’s a controlled descent, and that’s what the Fed is trying to do with higher interest rates.”

Still, most of the data released Thursday predates the collapse of the Silicon Valley bank and the financial turmoil that followed. And other threats are looming, including a looming debt ceiling showdown that could further destabilize financial markets. Early forecasts suggest that GDP growth is likely to slow further in the second quarter, and many analysts say a recession is likely later this year.

“If we have a shock, if we have a debt ceiling debacle or something like that, I think that increases the likelihood that we’re going into a recession,” said Jay Bryson, Wells Fargo’s chief economist.