Article content

The housing crisis in the Greater Toronto Area (GTA) is worsening: New data shows that high municipal fees and lengthy approval processes are driving up the cost of new homes.

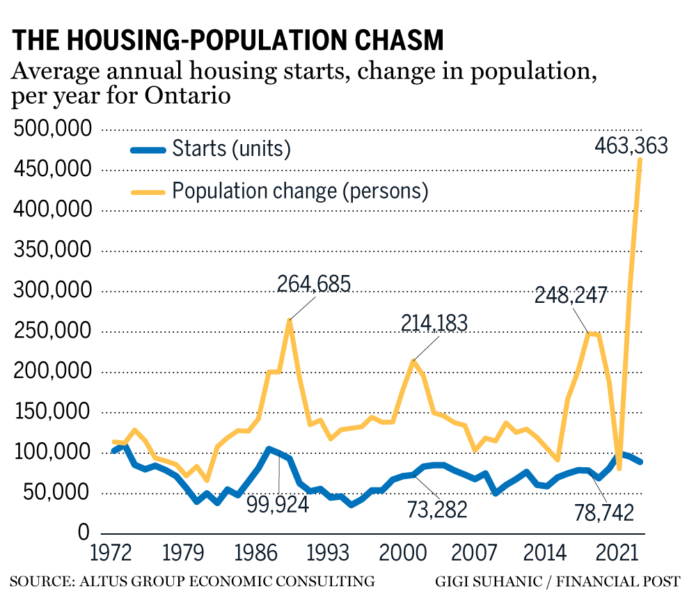

The latest municipal benchmarking study by the Construction Industry and Regional Development Company (BILD), which was carried out by the business consultancy Altus Group, warns that the housing supply in the region is lagging dangerously behind population growth. This is a sign of an impending crisis if immediate action is not taken.

Article content

According to the study, the gap between housing stock and population growth in the GTA is at its largest in over 50 years.

“This is a bright red warning light on the dashboard of all levels of government,” said BILD President and CEO David Wilkes in a press release.

“Without bold steps, the housing crisis in the Greater GTA will worsen significantly in the coming years.”

A major factor contributing to this problem is the length of time it takes for new housing projects to receive municipal approval. The study found that on average, it takes 20 months for housing projects to be approved, imposing significant costs on developers and ultimately homebuyers. For every month of delay, the cost of each unit increases by $2,673 to $5,576. Based on average approval timelines, this works out to an increase of $43,000 to $90,000 per new home.

Added to this are high municipal fees, taxes and charges, which account for nearly 25 percent of the cost of a new home in the GTA. The study finds that since 2022, municipal fees alone have increased by an average of $42,000 per unit for low-rise buildings and $32,000 for high-rise buildings. As a result, municipal fees now increase the cost of a condominium in the GTA by an average of $122,387 and the cost of a single-family home by $164,920.

Article content

“The GTA housing market faces structural challenges that have driven up construction costs, including prohibitively high government fees and taxes – among the highest in Canada,” Wilkes said.

The study highlights that these rising costs are not only putting pressure on developers, but are also pricing potential homeowners out of the market as they become increasingly unable to afford the properties. It warns that the decline in building applications is a sign of an impending deterioration in the GTA's already tight housing supply and will exacerbate the region's housing crisis.

Wilkes said that without significant intervention, the region's housing crisis could worsen.

“Without bold and immediate action, the region's housing crisis will deepen,” he said. “This will lead to less housing, fewer jobs and even greater affordability problems in the years to come.”

Editor's recommendations

-

Most investors in new condos in the Greater Toronto Area are losing money

-

Record number of offers on Toronto's condo market

The report calls on all levels of government to proactively address the approval delays and high fees that hamper new developments.

“To improve housing affordability, governments must take action to speed up approvals and reduce the overall tax burden they impose on new home buyers,” Wilkes said.

• Email: [email protected]

Bookmark our website and support our journalism: Don't miss out on the business news you need to know – bookmark financialpost.com and sign up for our newsletters here.

Share this article on your social network