Goran Babic | E+ | Getty Images

Building a $1 million nest egg may seem like an impossible task.

However, building such retirement wealth is within the reach of almost anyone – provided they take certain steps, financial advisors say.

“You might think, 'Well, I have to become a Silicon Valley entrepreneur to get rich,'” said Brad Klontz, a financial psychologist and certified financial planner.

In fact, you can be a fast food worker your whole life and accumulate wealth, said Klontz, a member of the CNBC Financial Advisor Council and the CNBC Global Financial Wellness Advisory Board.

The calculation is simple, he said.

Every time you receive a dollar, save and invest a percentage toward your “financial freedom,” Klontz said.

With that attitude, “you can take almost any job and retire a millionaire,” he said.

It is not necessarily a “Herculean task”

Saving a million dollars may sound like a “Herculean task,” but it “may not be as hard as you think,” wrote Karen Wallace, CFP and former director of investor education at Morningstar, in 2021.

The key is to start saving early, perhaps in a 401(k) plan, an individual retirement account or a taxable brokerage account, experts say. This allows investors to enjoy the magic of compound interest for decades to come. In other words, you “let your investments do as much of the heavy lifting as possible,” Wallace wrote.

According to a Northwestern Mutual survey released in September, about 79% of American millionaires say their net worth is “self-created.” According to the survey of 4,588 U.S. adults conducted January 3-17, 2024, only 11% said they inherited their wealth, while 6% got it through a random event such as winning the lottery.

More from Personal Finance:

IRS: An important deadline is approaching for RMDs

Egg prices could soon “flirt with record highs”

The Federal Reserve is likely to cut interest rates next week

As of Sept. 30, there were 544,000 Americans with 401(k) balances of more than $1 million, according to Fidelity Investments, the largest manager of corporate retirement plans. There were also more than 418,000 IRA millionaires.

In fact, the number of 401(k) millionaires increased by 9.5%, or 47,000 people, between the second and third quarters of 2024, largely due to gains in the stock market.

This is how you get to $1 million

Vera Rodsawang | moment | Getty Images

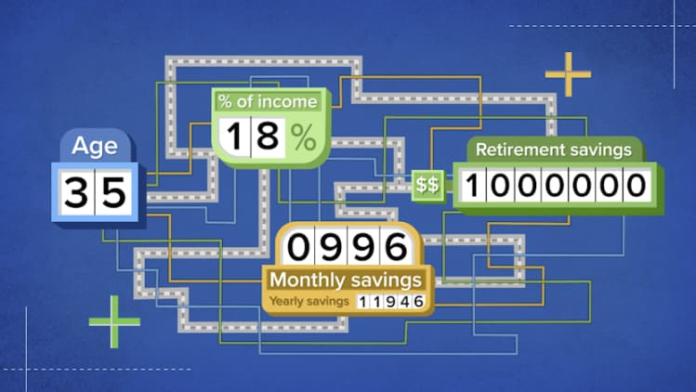

Winnie Sun, a financial advisor, provides an example of the math that connects a million-dollar fortune to consistent savings.

Let's say a 30-year-old makes $60,000 a year after taxes. If they saved $500 a month — or 10% of their annual income — they would have $1 million by age 70, with an average market return of 7%, she said.

Financial factors that could increase savings during this period, such as: This does not take into account benefits such as a company 401(k) match, bonuses or raises.

You can take almost any job and retire a millionaire.

Brad Klontz

Financial psychologist and certified financial planner

“In 40 years, you will have over $1 million, and that means nothing more than $500 a month,” said Sun, co-founder of Irvine, California-based Sun Group Wealth Partners and a member of the Financial Advisor Council from CNBC.

It is also important to avoid debt, which is likely to be the “biggest void” for savings, and to try not to increase spending too much, Sun said.

Timing is more important than being perfect, Sun said.

She recommends starting with a low-cost index fund — such as one that tracks the S&P 500, which spreads savings across the largest publicly traded U.S. companies — and building up from there.

“Waiting even a year can make a dramatic difference in reaching the $1 million mark,” Sun said. “Stop and take action.”

What is the right savings?

Damircudic | E+ | Getty Images

Of course, $1 million may not be the right amount for everyone in retirement.

An often-quoted rule of thumb – known as the 4% rule – states that a typical retiree can draw about $40,000 a year from a $1 million nest egg to ensure they don't run out of money in retirement. (This annual payout is adjusted annually for inflation.)

For many, this amount would be supplemented by Social Security.

Fidelity suggests a savings goal based on income. For example, an employee should have saved 10 times their annual salary by age 67 to ensure a comfortable retirement.

Ideally, households would try to save 15% to 20% of their income, Sun said. This is a rule of thumb often cited by financial planners.

How much wealth you want — and how quickly you want to get rich — will determine the percentage, Klontz said.

He personally aims for a savings rate of 30%, but knows people who are aiming for close to 90%. Saving such large portions of one's income is a common thread of the so-called FIRE movement, which stands for “Financial Independence, Retire Early.”

How do they do that?

“They haven't moved out of their parents' house, they've minimized everything, they're not buying new clothes, they're riding the bus, they're shaving their heads instead of paying for haircuts,” Klontz said. “There are all kinds of hacks you can use if you want to get there faster.”

So enjoy today and save for tomorrow

Of course, there is tension here for people who want to enjoy life today and save for tomorrow.

“We shouldn’t just survive and save money,” Sun said. “There has to be that good quality of life and that happy medium.”

One strategy is to allocate 20% of household spending to the things that matter most to you — perhaps big vacations, fancy cars or the latest technology, Sun said.

Make some concessions on the other 80% of household costs – e.g. B. “save” – she said. This makes savers feel like they are not compromising their quality of life, she said.