House prices are still higher than a year ago, but profits are shrinking at an unprecedented rate, according to a key metric, as the housing market struggles amid soaring interest rates.

According to the S&P CoreLogic Case-Shiller Home Price Index, prices in August were 13% higher nationwide than in August 2021, down from a 15.6% annual gain the previous month. The 2.6% difference in these monthly comparisons is the largest in the history of the index, which was launched in 1987, meaning gains are slowing at a record pace.

The 10-city federation, which tracks the largest housing markets in the United States, rose 12.1% year over year in August, up from a 14.9% increase in July. The 20-city cluster, which encompasses a broader range of metropolitan areas, rose 13.1% compared to a 16% increase in the previous month.

House for sale by owner, Forest Hills, Queens, New York.

Lindsey Nicholson | UCG | Universal picture group | Getty Images

“The sharp decline in US home prices that we noted a month ago continued in our August 2022 report,” wrote Craig Lazzara, managing director at S&P DJI, in a press release. “Price increases slowed down in each of our 20 cities. This data clearly shows that the rate of growth in house prices peaked in spring 2022 and has been declining ever since.”

Leading the August gains were Miami, Tampa, Fla., and Charlotte, North Carolina, with annual gains of 28.6%, 28%, and 21.3%, respectively. All 20 cities reported lower price increases for the year ended August than for the year ended July.

The West Coast, which includes some of the most expensive real estate markets, saw the largest monthly declines, with San Francisco (-4.3%), Seattle (-3.9%) and San Diego (-2.8%) declining the most.

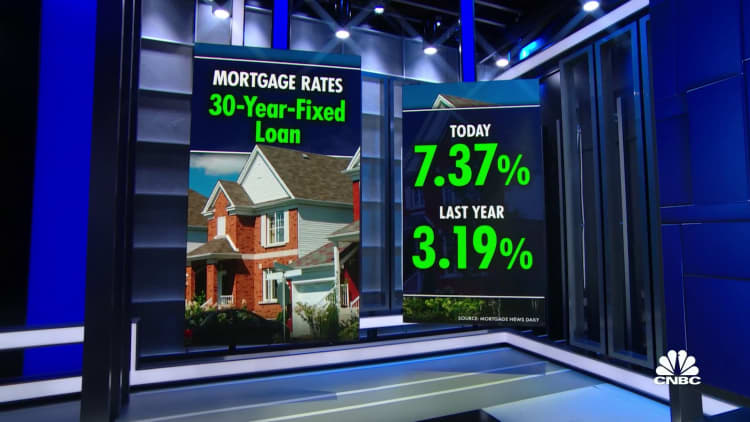

A rapid rise in mortgage rates from record lows this year has turned the once red-hot housing market on its head. The average interest rate on the popular 30-year fixed home loan started this year at around 3%. According to Mortgage News Daily, it was over 6% in June and is now just over 7%.

“With monthly mortgage payments 75% higher than last year, many first-time buyers are locked out of the housing markets and unable to find homes on budgets that have lost $100,000 in purchasing power this year,” said George Ratiu, Senior Economist at Realtor.com.

He also noted that higher home prices coupled with higher interest rates discourage potential sellers from listing their homes. They seem locked into their lower rates.