Article content

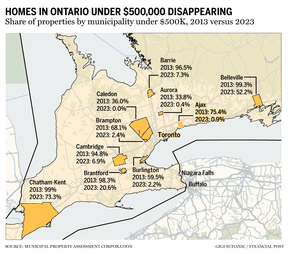

Homes priced under $500,000 are becoming increasingly rare in Ontario. Fewer than one in five homes fall below that threshold, new data from a government property valuation group shows.

A decade ago, 74 per cent of residential properties in Ontario were valued under $500,000 and 91 per cent were under $750,000. Today, those numbers have dropped to 19 percent and 48 percent, respectively, according to figures released last week by the Municipal Property Assessment Corporation (MPAC).

Article content

As of December 2023, the average home value in Ontario has increased to $765,000, with the Greater Toronto and Hamilton Area (GTHA) seeing an even steeper increase to an average of $1,031,000.

Even in smaller communities outside the Greater Toronto and Hamilton Area (GTHA), affordability is dwindling.

In St. Catharines, for example, the percentage of homes priced under $500,000 fell from 96.9 percent to 30.1 percent.

Options under $500,000 are now mostly limited to cities like Sudbury, Sault Ste. Marie, North Bay, Thunder Bay and Windsor, with slightly more options available under $750,000 in cities like Ottawa, London, Kitchener, Kingston, Barrie and Peterborough.

MPAC Vice President Greg Martino said no single factor caused the change.

“The reality is that current housing prices are a reflection of various economic forces,” Martino said in the group’s assessment. “Factors such as supply and demand, increased construction and labor costs, and inflation are all factors that determine today’s real estate prices.”

Condominium markets experienced a similar decline in affordability. In 2013, 88 percent of the GTHA's condominiums were valued at less than $500,000, with the average price hovering around $325,000. Today, the situation has changed dramatically: Just over 11 percent of condos in the GTHA cost less than $500,000. The median condo value in the area has now risen to over $645,000.

Article content

In Toronto, the share of condos priced under $500,000 has fallen from nearly 85 percent to less than 11 percent over the past decade.

Semi-detached houses and terraced houses have not been spared from this trend. In 2013, the vast majority – 94 percent of semi-detached homes and 97 percent of townhouses – were available for $750,000 or less. Today only 33 percent of semi-detached houses and 46 percent of townhouses are in this price range.

“At $500,000 or less, inventory drops to just 13 percent for semi-detached homes and four percent for townhomes,” the estimate says.

Meanwhile, the average home value for a single-family home in Ontario has increased 128 per cent, from nearly $378,000 in 2013 to more than $862,000 today.

Recommended by Editorial

-

CMHC removes incentive for first-time homebuyers

-

Ontario's housing supply has been overstated by almost a million

-

The average house price in Toronto will rise again in 2024

Currently, 41 percent of single-family homes in the province are valued at over $1 million, a significant increase from just six percent in 2013. In the GTHA in particular, the increase is even more significant, with over 78 percent of single-family homes now exceeding the 1- million dollar mark, compared to almost 12 percent ten years ago.

The Municipal Property Assessment Corporation is responsible for managing a database of over five million properties. Its primary role is to accurately determine property value for homeowners, local governments and businesses.

• Email: [email protected]

Share this article on your social network