We all have Nvidia (NVDA) to thank for the S&P 500 (SPY) finally breaking the 5,000 mark. Truly one of the most impressive earnings reports in years. But valuations for NVDA and the rest of the mega-cap tech space are getting higher, raising questions about whether a bubble is forming. Find out what investment expert Steve Reitmeister thinks about the current market and preview the 12 best stocks to buy now. Read below for more.

Artificial intelligence is very trendy. And no one is doing it better than Nvidia (NVDA). This was FULLY evident in their huge earnings beat on Wednesday after the market, which caused a stir in stocks on Thursday…particularly AI-related tech stocks.

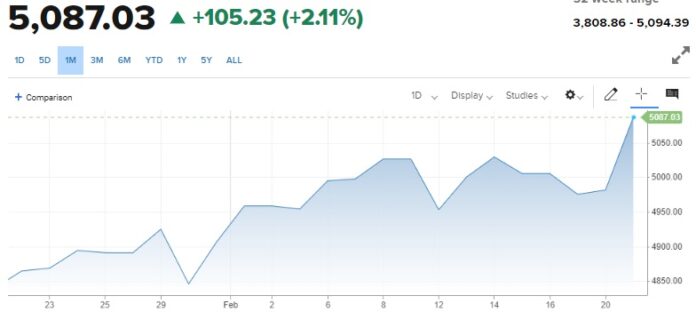

This led to an impressive breakout above 5,000 for the S&P 500 (SPY), closing the session at 5,087. However, investors should be concerned that not all stocks are participating in this rally. For example, that the small caps in the Russell 2000 are still in the red this year???

We'll discuss this and more in today's market commentary.

Market commentary

February was marked by a sustained test of the 5,000 point mark for the S&P 500.

Twice before shares briefly closed above 5,000 only to fall back below. But there is a feeling that this third time is the charm, with another breakout likely on the way.

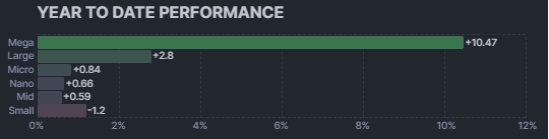

But just like in 2023, the gains in mega-cap tech stocks appear to be far too isolated, as shown in this year-to-date chart that focuses on my market cap gains:

If history is any guide, in a healthy bull market, small caps lead the way. That's because these smaller companies tend to have better growth prospects, which pushes their stocks to the top.

This is why small cap returns are typically 20% better than large caps over 100 years. For clarity, this means that if large caps have an average return of 10%, small caps with a 12% return (not a 30%) return would be around 20% better.

One theory goes: “The trend is your friend.” Therefore, it is best for investors to play the large-cap tech game until the party is over.

Looking back to the late 1990s, this was a great idea as long as you sold in the early 2000s when the first signs of the bubble bursting emerged. Unfortunately, investors rarely take such prudent steps. Instead, they tell themselves seemingly sound logic like selling if stocks return to previous levels. This flawed thinking leads to disastrous results at the end of the bubble, as stocks can very quickly fall 50-80% in a relatively short period of time.

To be clear, I'm not suggesting that mega caps or AI stocks are as big a mania as we saw with internet stocks in 1999. Nvidia and others are profitable companies that are growing at a phenomenal pace. However, its P/E ratio approaching 40 times earnings is a premium that history suggests the chances of future success are very slim.

This means that the price of these stocks is perfect. They are likely to remain high as long as this perfection continues to unfold with each successive earnings report. But as soon as the profit prospects show the first blemish, then “watch out below!”

Note that when I was at Zacks Investment Research, we conducted a number of studies that looked at P/E ratios and forecast growth rates of companies. Most assume that the higher the expected growth, the higher the returns. And yet it was exactly the opposite: the highest-growth companies offered the lowest future returns.

This is precisely because of the higher PE and price-for-perfection problem mentioned above. Growth never lasts over time. Whether it's the industry situation or tough competition: at some point the growth party ends. And when that happens, stocks implode and PE shrinks.

I expect almost everyone has an allocation to these Magnificent 7 stocks to take advantage of while this AI party lasts. This ownership is held either directly by the individual companies or through ownership of SPY or QQQ, which is dominated by these stocks.

The question is, what will you do with the rest of your money, since it is unwise to have too many eggs in this increasingly fragile basket?

For me, it means using my best investment advantage. The focus is on the proven outperformance of the stocks covered by our POWR Ratings system.

Analyzing each stock against 118 factors that indicate future outperformance is why the coveted A-rated stocks have returned an average of +28.56% per year since 1999. And this outperformance is evident again this year in abundance.

What POWR Ratings Top Stocks Do I Recommend Today?

Read below for the answer…

What do you do next?

Explore my current portfolio of 12 stocks packed to the brim with the superior benefits of our exclusive POWR Ratings model. (Nearly four times better than the S&P 500 since 1999)

These include five under-the-radar small caps that were recently added with huge upside potential.

I also have a dedicated ETF that is incredibly well positioned to outperform the market in the coming weeks and months.

This is all based on my 43 years of investing experience in which I have seen bull markets, bear markets and everything in between.

If you are curious and want to learn more and see these 13 hand-picked trades, please click the link below to get started now.

Steve Reitmeister's trading plan and top tips >

We wish you much success in investing!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Publisher, Reitmeister Total Return

SPY shares traded at $507.66 per share on Friday morning, up $0.16 (+0.03%). Year-to-date, SPY has gained 6.81%, while the benchmark S&P 500 index has increased by % over the same period.

About the author: Steve Reitmeister

Steve is better known to StockNews audiences as “Reity.” In addition to being CEO of the company, he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity's background, plus links to his latest articles and stock recommendations.

More…

The post Is a stock bubble forming? appeared first StockNews.com