“Shrinkflation” is one of the terms that has entered the vernacular of consumers across Canada as they have grappled with – and rightly questioned – disproportionate increases in food prices and supermarket profits in recent years. But which products have been most affected by this trend?

People are taking to social media to share their price surprises on grocery staples and make comparisons between different stores, regions and even countries. Some have even gone so far as to create apps or offer tips on how other shoppers can save money on food during these tough economic times.

In addition to the sharp increase in the amount people have to spend at the checkout, the size of some products has also shrunk – and this has been done quite fraudulently, with minimal changes to the packaging and manufacturers and/or retailers maintaining or even increasing prices.

This has led some customers to create lists of the worst product and store losers or to get upset about prices from a few years ago – prices that a researcher has now taken a closer look at.

Rachel Lee, a computer science student from Toronto with a keen interest in food security, decided to analyze the flyers of various grocery chains between 2019 and 2024 to find out which categories experienced the worst shrinkflation.

While their results were not as devastating as some had expected, they did show many cases where items experienced both a decline in volume and an increase in price over time, sometimes by a significant amount.

According to Lee's analysis, six of twenty food categories experienced some shrinkflation, while five others experienced significant shrinkflation.

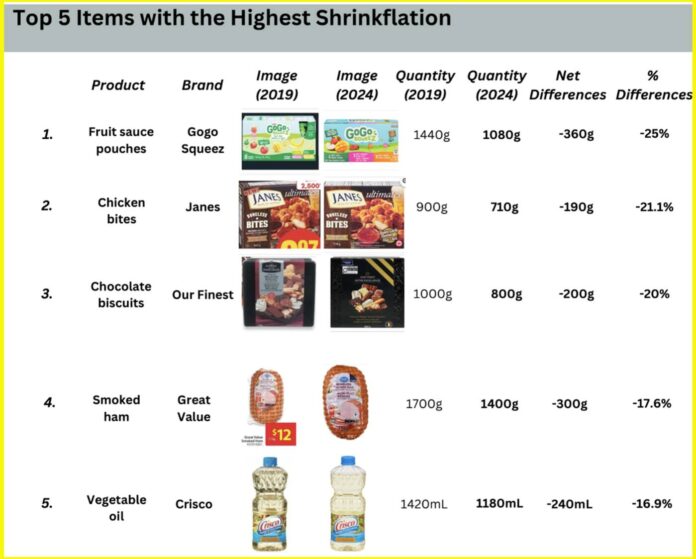

The most extreme examples were Gogo Squeez's fruit sauce pouches, which were reduced in quantity by 25 per cent over five years while the price increased; Janes' chicken bites boxes, which lost 21.1 per cent in weight despite being more expensive; and Our Finest's chocolate biscuits, which are more expensive in 2024 but 24 per cent smaller.

Also up were smoked ham from Great Value (minus 17.6 percent) and vegetable oil from Crisco (16.9 percent).

The worst categories of shrinkflation, according to Lee's data, are foods high in sugar and/or fat (such as packaged candy), whose size decreased by an average of 9.2 percent between the years studied while their price increased. Other categories include baby and toddler food (-8.3 percent), chicken (-7 percent), processed meat (-5.9 percent) and unsaturated fats and oils (-5.6 percent).

The worst categories of shrinkflation, according to Lee's data, are foods high in sugar and/or fat (such as packaged candy), whose size decreased by an average of 9.2 percent between the years studied while their price increased. Other categories include baby and toddler food (-8.3 percent), chicken (-7 percent), processed meat (-5.9 percent) and unsaturated fats and oils (-5.6 percent).

Meanwhile, saturated fats and oils, starchy vegetables, cheese, condiments and sauces, red meat and yoghurt all experienced moderate shrinkflation, with pack sizes decreasing by 2.2 to 4.2 percent while prices increased.

“Savvy consumers are easily fooled by subtle changes in package sizes, and Statistics Canada doesn't capture this. The data we collect can help shoppers pay more attention when shopping in the more difficult categories,” says Lee.

“Savvy consumers are easily fooled by subtle changes in package sizes, and Statistics Canada doesn't capture this. The data we collect can help shoppers pay more attention when shopping in the more difficult categories,” says Lee.

She points out that shrinkflation clearly does not occur evenly across all food categories and that in many cases the changes are “just large enough that they are barely noticeable in the shopping cart.”

Although not every available product was included in the flyers studied, Lee writes that “there were enough cases to create an unbiased dataset covering all 20 Canadian Food Guide groups, with examples within each

group of Metro, No Frills and Walmart.”