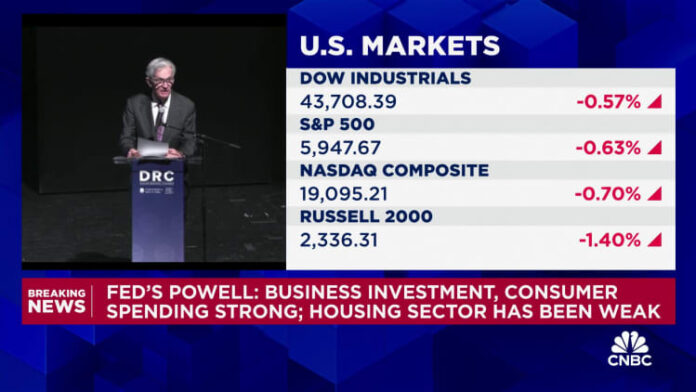

Federal Reserve Chairman Jerome Powell said Thursday that strong U.S. economic growth will allow policymakers to take their time deciding how far and how quickly to cut interest rates.

“The economy is not sending any signals that we need to rush to cut rates,” Powell said in his speech to business leaders in Dallas. “The strength we are currently seeing in the economy gives us the opportunity to approach our decisions carefully.”

(Watch Powell's remarketing live here.)

In an optimistic assessment of the current situation, the central bank chief described domestic growth as “by far the best of any major economy in the world.”

Specifically, he said the job market was holding up well despite disappointing job growth in October, which he attributed largely to storm damage in the Southeast and labor strikes. The number of non-agricultural employees only increased by 12,000 during this period.

Powell noted that the unemployment rate has been rising but has leveled off in recent months and is still low by historical standards.

On the question of inflation, he noted progress that has occurred “broadly” and noted that Fed officials expect inflation to continue to drift back toward the central bank's 2 percent target. However, this week's inflation data showed a slight increase in both consumer and producer prices, with 12-month interest rates moving further away from the Fed mandate.

Still, Powell said the two indexes would show a Fed-preferred inflation rate of 2.3% in October, or 2.8% excluding food and energy.

“Inflation is much closer to our longer-term target of 2 percent, but it is not there yet. We are committed to getting the job done,” said Powell, who noted that getting there could be “a sometimes bumpy road.”

The comments come a week after the Federal Open Market Committee cut the central bank's key interest rate by a quarter of a percentage point, bringing it down to a range between 4.5% and 4.75%. That followed a half-point cut in September.

Powell described the moves as a recalibration of monetary policy, which no longer had to focus primarily on containing inflation, but now also had a balanced goal of supporting the labor market. Markets largely expect the Fed to cut rates again by a quarter point in December and several more in 2025.

However, Powell was noncommittal when it came to offering his own forecast. The Fed is trying to cut its key interest rate to a neutral level that neither stimulates nor inhibits growth, but is unsure what the end point will be.

“We are confident that with an appropriate realignment of our policy stance, the strength of the economy and labor market can be maintained and inflation will sustainably fall to 2 percent,” he said. “We are moving politics to a more neutral environment over time. However, the path there is not specified.”

The Fed has also been allowing proceeds from its bond holdings to flow out of its massive balance sheet each month. There was no indication as to when this process might end.