Breadcrumb trail links

Rising living costs and uneven income growth have also contributed

Published September 24, 2024 • Last updated 9 hours ago • 4 minutes reading time

You can save this article by registering for free here. Or log in if you already have an account.

A “For Sale” sign in front of a home in East Gwillimbury, Ontario. Photo by Cole Burston/Bloomberg Files

A “For Sale” sign in front of a home in East Gwillimbury, Ontario. Photo by Cole Burston/Bloomberg Files

Article content

Housing affordability challenges dominate Canada's political debates and media channels. But as Statistics Canada paints a more nuanced picture, this appears to be due not only to rapidly rising housing prices and rents.

Rising prices are undoubtedly part of the story, but another critical aspect is the growth in incomes and savings, which was bolstered by the government's financial support to households and businesses to combat the pandemic, according to the agency's newly released Canadian Housing Survey (CHS) data for 2022. This support helped counteract some price pressures, but did not receive the same attention.

Display 2

This ad hasn't loaded yet, but your article will continue below.

THIS CONTENT IS FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news from your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from the Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from the Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition for viewing on any device, sharing and commenting.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news from your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from the Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from the Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition for viewing on any device, sharing and commenting.

- Daily puzzles, including the New York Times Crossword.

REGISTER / LOGIN TO UNLOCK MORE ARTICLES

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Look forward to additional articles every month.

- Get email updates from your favorite authors.

Sign in or create an account

or

Article content

Much has changed since 2022, so the complexity and dynamics of the pressures on financial performance before and during the pandemic deserve renewed consideration. This complexity challenges the conventional view, which focuses exclusively on stories of financial hardship and often overlooks the financial windfalls that many have enjoyed thanks to government largesse.

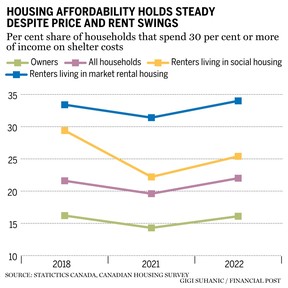

A household that spends more than 30 per cent of its income on housing costs is considered unaffordable, according to Statistics Canada. However, data shows that housing affordability burdens remained unchanged before and during the pandemic. In 2022, about 22 per cent of households lived in unaffordable housing, almost identical to the 21.5 per cent in 2018.

Housing affordability burdens are not felt equally by homeowners and renters. In 2022, 33 percent of renters lived in unaffordable housing, compared to 16.1 percent of homeowners. This discrepancy is primarily due to the significant income gap between these two groups. Renters often belong to unique demographic profiles, with a higher proportion of single-income households.

Top Stories

Thanks for signing up

Article content

Display 3

This ad hasn't loaded yet, but your article will continue below.

Article content

Statistics Canada's report further challenges the alarmist narrative of deteriorating housing conditions for social housing and affordable housing residents. The survey found that a smaller share of social housing residents faced unaffordable housing conditions in 2022 than in 2018. This improvement was driven by faster income growth, which rose 15.3 per cent between 2018 and 2022, outpacing the 12.4 per cent increase in rents.

Housing affordability was impacted by rising mortgage rates in early 2022, placing a greater burden on new homebuyers and those renewing their mortgages. This is in contrast to 2021, when rapid increases in home prices were the main reason for growing affordability concerns.

However, data from Statistics Canada shows that a smaller share of households lived in unaffordable housing in 2021 than in 2018. This relatively favourable outcome is mainly due to the temporary income support programs introduced by the government during the pandemic.

Rising housing prices are often cited as a reason why first-time buyers are being priced out of the market, but the data belies this narrative. Between 2018 and 2022, 8.6 percent of households, or about 1.3 million, in Canada purchased their first home. The same percentage of households purchased their first home from 2014 to 2018, suggesting that the share of first-time buyers remained unchanged despite significant fluctuations in housing prices.

Display 4

This ad hasn't loaded yet, but your article will continue below.

Article content

In addition, the proportion of first-time home buyers spending more than 30 percent of their household income on housing costs remained relatively stable, at 24.9 percent in 2018 compared to 24.4 percent in 2022. Nevertheless, many more first-time buyers expressed dissatisfaction with the affordability of their housing situation in 2022 – 21.3 percent compared to just 13.4 percent in 2018.

Of course, Canadians have been battling increasing housing affordability issues recently. In 2022, 30.9 per cent of households reported struggling to make ends meet, compared to 21.9 per cent in 2018 – an increase of 41.1 per cent. However, Statistics Canada data refutes the notion that this affordability crisis is primarily due to housing costs.

In particular, the proportion of mortgage-free homeowners experiencing financial difficulties increased by 48.2 percent between 2018 and 2022, while renters saw an increase of 29.2 percent.

As a result, affordability issues are more complex than a simple narrative of rising housing costs suggests. The latest data from Statistics Canada underscores that what is really at stake are broader pressures on household budgets, ranging from rising living costs to uneven income growth.

Display 5

This ad hasn't loaded yet, but your article will continue below.

Article content

Editor's recommendations

-

US election shows: Good housing policy is not made during the election campaign

-

Report warns: Greater housing supply could mean lower affordability

As policymakers and the public consider solutions, understanding these diverse realities is critical to making life more affordable for Canadians.

Murtaza Haider is associate dean for graduate programs and director of the Urban Analytics Institute at the Ted Rogers School of Management at Toronto Metropolitan University. Stephen Moranis is a real estate industry veteran. You can reach them through the Haider-Moranis Bulletin website, www.hmbulletin.com.

Want to know more about the mortgage market? Read Robert McLister's new weekly column in the Financial Post and find out the latest trends and details on financing opportunities you can't miss.

Bookmark our website and support our journalism: Don't miss out on the business news you need to know – bookmark financialpost.com and sign up for our newsletters here.

Article content

Share this article on your social network