Robinhood, the free stock trading app with 21 million active users, is about to hit the road for a college coffeehouse tour to attract new customers.

Where have we heard that before? Oh yes, the credit card industry.

The campus antics the card companies employed two decades ago were so egregious that they helped enact federal law in 2009 that made it harder for anyone under the age of 21 to get their products at all.

There are a few important differences. Credit card issuers can mark your file with tags that can keep you from qualifying for an apartment or other services years later. Robinhood is handing out just $ 15 to give every student a taste of investing.

But they have one thing in common: Both products take getting used to, and if you overstrain it, it can be expensive.

So let’s start with a history lesson.

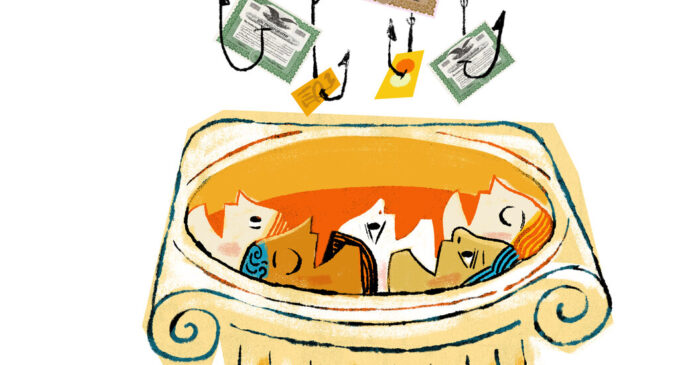

Freshman college students are a very sought-after pool of potential clients. They fill up by the millions each year, and most start school without a strong affinity for any particular peddler. And they’re fish in the barrel for the right pitch: A generation ago, card issuers and their marketing companies showed up on campus offering free food or college logo merch to people who had filled out an application.

“They really had children who signed up for exactly the wrong reason,” said Odysseas Papadimitriou, a former Capital One employee who familiarized himself with working with low-credit clients. “They had no idea how the products worked.”

MBNA, which Bank of America eventually acquired, went one step further. It signed contracts with the schools or their alumni chapters – valued at up to seven digits a year – in exchange for names, addresses, and phone numbers so the company could propose students directly.

Enterprising journalism students and others set the alarm bells to find that schools were leading their lambs to the slaughter. Politicians and consumer protection organizations inevitably became aware of this. US PIRG, a consumer group that started on campus, emerged on a counter-campaign. One of his visuals mimicked the Visa logo: Feesa, with a slogan that read “Free gifts now. Huge fees later. “

Then, in 2009, Congress passed the Federal Credit Cards Act. Among the many regulations was one that prevented most people under the age of 21 from getting a credit card without a co-signer.

Is Robinhood destined for a similar fate? This could especially happen if the markets collapse and many customers experience unexpected losses.

Like credit cards in the past, Robinhood’s service is easy to obtain and easy to use. (Robinhood’s original game-like interface was particularly appealing to younger investors; students who detach themselves from the screen long enough to attend class will no doubt continue to discuss his design skills in business schools for decades.) And, as with credit cards – another saturated industry, where removing customers from competitors is expensive – a lot depends on finding inexperienced people to try your offer.

That’s not necessarily a bad thing. By being responsible about credit early on – and so many people do – you are starting a permanent record that can lead to high credit scores. Similarly, for most people, exposure to the stock market is necessary to comfortably retire, and the sooner you start making prudent investments, the better off you will be.

Yet an avalanche of studies over the decades has shown that those who trade too often end up with less money than if they just left their investments alone. We lock up losses because we are fearful and because of our greed we reach for winners too much.

Less trade is a problem for Robinhood. Like some other brokerage firms, it makes money from what is known as “payment for the flow of orders”. Third parties pay Robinhood for the privilege of executing its clients’ trades as these parties can make money on their own through clever market maneuvers. However, you cannot make money from the flow of orders without orders.

And there are already signs that many younger Robinhood investors are being burned, as my colleague Nathaniel Popper reported last year. Robinhood has settled a lawsuit brought by the family of a college student who killed himself because he believed he suffered a loss of over $ 700,000. The frenzied trade with GameStop attracted even more newbies.

Warning flags and other pointers might help, and some of the Robinhood educational materials are pretty good. They repeat the necessary point that holding investments for a long period of time can earn you a pile of compound interest.

Even so, the company doesn’t offer individual retirement accounts that can help turn small investments into big distress. Roth IRAs offer tax benefits that are particularly useful for college-aged savers with lower incomes.

In July, Robinhood chief executive Vlad Tenev said he could add such offers. A company representative did not have to add any additional information to a decision or schedule.

Still, there is reason to be skeptical about Robinhood. It recently paid about $ 70 million in refunds plus a fine – the highest in the financial industry’s history – to settle allegations of misleading millions of customers and making others trade in investments that are inappropriate for them was. And late last year, it paid $ 65 million to pay the Securities and Exchange Commission fees that misled users about using payments for order flow.

In both cases, the company neither admitted nor denied the allegations and findings.

“Early investments are important to build long-term wealth, but research shows that the vast majority of young adults have never invested in the stock market,” the company said in a statement. “We want to help educate and empower all investors, including students, about investing.”

According to Robinhood’s own survey data, its clients are already more racially diverse than those of more established brokerage firms like Fidelity and Charles Schwab. Hats off for that.

But Robinhood has had great success in portraying itself as the champion of newer investors and boasting of the “democratization” of finance. It has even shaken critics who doubt it’s in the best interests of beginners.

“It is quite elitist to claim that the participation of small investors in the markets is gambling while the participation of the rich is investment,” the company said in a statement when I raised the issue.

That’s pretty rich considering that no serious person is claiming that low bankroll people are all gamblers. Hopefully the Robinhood employees and investors who raked in $ 31 billion in the company’s IPO in July won’t turn out to be elite types.

Robinhood said his campus tour would include community colleges and historically black colleges and universities, although he did not name them. Perhaps the teenagers who act aggressively in these institutions will somehow perform above average in the long run.

Undoubtedly, some Robinhood investors have prevailed so far. In a rising stock market, a lot of people do – which was a good opportunity for Fidelity to come up with its own plan to get its adult clients to open accounts for their teenagers.

I was curious if Robinhood’s coffee shop tour would include the same financial arrangements with schools as the credit card companies that paid for the student’s dates. The company said in a statement that it did not compensate schools for “this special” partnership. The company declined my suggestion to make a commitment not to do the same in future partnerships.

So let’s assume that these types of campus pitches don’t go away and that Robinhood remains a key player for a while.

If your future holds an experiment with a trading app, think about it as if you are or are a new driver.

Most people don’t learn to drive in a high-performance vehicle. Plus, they often take a week-long course and learn to be defensive. “I learned to drive in a slow car,” said Ed Mierzwinski, who led the US PIRG credit card counter-campaign.

Even beginners usually learn from mistakes. Smaller investment losses can be very good, as I noted in a column last year.

Mr Papadimitriou, who started the credit and personal finance website WalletHub after his stint at Capital One, found himself in the hole after losing large bets on Priceline stock during a tech stock crash two decades ago. Today, he said, he is much more conservative.

If history is a guide, today’s gunslingers will shoot themselves in the foot, lick their wounds, and sneak back into the market by buying and owning some basic index or exchange-traded funds.

Until then, however, every year there will be a new generation of teenagers graduating from high schools who have taught them little or nothing about personal finances – apart from any kind of parental supervision.

Robinhood wants to buy these students a latte. Well then good luck.