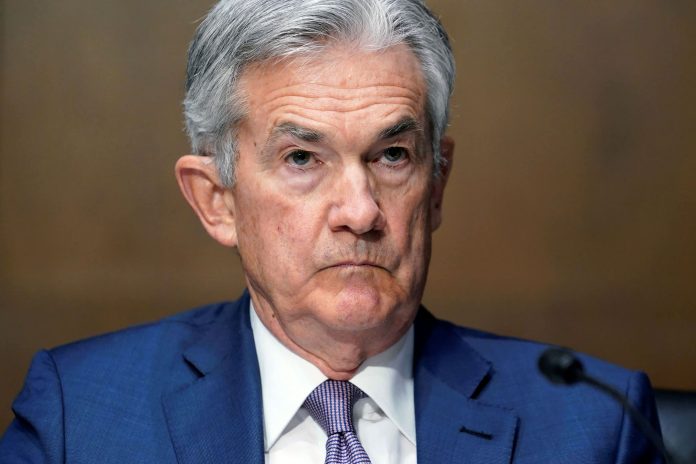

Federal Reserve Chairman Jerome Powell testifies before the Senate Banking Committee hearing on the Quarterly CARES Act Report to Congress on Capitol Hill, Washington, December 1, 2020.

Susan Walsh | Pool | Reuters

The Federal Reserve is heading to its meeting in a familiar location next week, with a volatile economy that could be at further risk if Congress stops approving dollars to aid those still ravaged by the coronavirus pandemic .

Also familiar: The Fed has limited policy options to stimulate activity and it has language to think about what it will take to raise interest rates in the future and what it can do to reduce them Propelling things through their asset purchase program.

Markets must therefore pay more attention to political nuances and impulses than to the brave steps the central bank has taken earlier.

The menu includes $ 120 billion worth of monthly bonds through quantitative easing, adjusting the maturity of those purchases, or providing the “results-based” guidelines needed to tighten policies from their current historically loose levels.

Interest rate cuts are not part of this policy buffer, as the Fed’s key interest rate is already anchored near zero.

“You need to gradually become more cautious next week,” said Brian Nick, chief investment strategist at Nuveen’s Global Investment Committee, terming the looser policy. “I think they will continue to extend the life of the QE program. This is the first step you would take. As you increase the size of the QE, it may send out a slightly more alarming signal than you would like right now would perform. “

Exiting the duration curve would increase the focus of the recent QE segment from its original purpose of keeping markets functioning to lowering longer-term interest rates. According to the Fed, this will lead to a reduction in the cost of borrowing for consumers and spurs on risk-weighted assets, both of which focus on broader economic growth rather than just keeping liquidity moving.

A full expansion of borrowing with the Fed’s nearly $ 7.3 trillion inventory could, as Nick has indicated, signal an even more troubled economy, an alarm the Fed may not want to raise. Most of the Fed’s holdings are government bonds and mortgage-backed securities, which are the target of current purchases.

Fed officials will lose some of their other instruments if they are granted special lending powers during the pandemic. This leaves them with limited options for some potentially difficult days, especially when there is no congressional tax package coming up.

“I’m not sure they are ready to do anything to introduce any new monetary policy stimulus. I think they will hope that this will put more pressure on the fiscal side,” said Tom Graff, Head of Fixed Income, Brown Advisory. “They really hope this spate of rough job numbers gets Congress going to help, and they don’t have to do anything more” at the Fed.

The number of non-agricultural workers in November was below expectations and unemployment claims rose last week to their highest level since September.

The most important thing to do

In addition to adjusting the duration, the Fed will also discuss the introduction of “results-based language,” which would tie a resolution of the current arrangements to specific goals. The Fed already has an inclusive full-employment mandate that requires inflation to stay above the 2% target for a period of time.

However, adding more guidelines would be “the most important innovation” the Fed can adopt at the moment, wrote Matthew Luzzetti, chief US economist at Deutsche Bank.

He anticipates that the language of the Federal Open Market Committee’s statement after the meeting will be that current bond purchases and interest rates will remain close to zero until “substantial progress” is made towards the inflation / employment mandate.

“This allows the FOMC to make it clear to market participants that asset purchases will stop at some point before launch, while also giving a rough indication of the time horizon over which they are planning asset purchases through their SEP projections,” said Luzzetti in a note.

“While expectations for future rejuvenation are undoubtedly an important contributor to the committee’s forward-looking discussions, we anticipate Powell will avoid any signal to consider moving away from financial housing anytime soon,” he added.

However, there is considerable uncertainty in the market as to whether the Fed will actually make any significant changes at the Tuesday-Wednesday meeting or wait until 2021.

Members of the November meeting expressed their willingness to adopt the results-based approach. Robert Kaplan, president of the Dallas Fed, recently told CNBC that he was happy with the policy where it was and saw no need for change.

The Fed might be better off waiting until the January meeting, which will take place after the Georgia Senate elections on Jan. 5, to determine the balance of power in the upper chamber, said Quincy Krosby, chief marketing strategist at Prudential Financial .

“Wouldn’t it be wise of you to wait until January 5th to see what happens to the number of Covid cases and what happens to the elections to see if Democrats take control? Why go now and offer something specific if you can? ” do it according to the choice? “Said Krosby.” Patience in the market must go on. “

Indeed, the FOMC meeting takes place at a volatile time when the cross-currents of virus cases occur along with the initial implementation of vaccines. While 2021 is expected to be a tough start to the economy, the presence of the vaccine should help growth accelerate sharply in the second half of the year.

“Monetary policy is currently running smoothly and we see no reason to change the policy setting or provide additional guidance on what to do in the future,” wrote Chris Rupkey, chief economist at MUFG Union Bank. “Fed policies depend on the economy and the economy depends on the course of the virus.”