America’s weakest borrowers are beginning to default and default on their loans, and it’s showing up in a surprising place: Goldman Sachs.

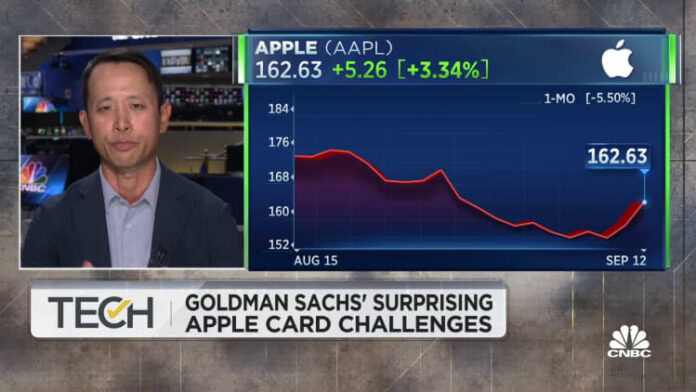

While peers like Bank of America are enjoying repayment rates at or near record levels, Goldman’s credit card loan loss ratio hit 2.93% in the second quarter. That’s the worst among major US card issuers and “well above subprime lenders,” according to a Sept. 6 statement from JPMorgan.

related investment news

How Apple’s new iPhone has sold so far, decipher delivery times

In fact, Goldman’s card customers have a profile similar to that of issuers known for their subprime offerings. More than a quarter of Goldman’s card loans went to customers with FICO scores below 660, according to filings. That could expose the bank to higher losses if the economy slows, as many forecasters expect.

“People are losing their jobs and you’ve had inflation at 40-year highs; this will hit the subprime cohort harder because they live paycheck to paycheck,” said Michael Taiano, senior director at Fitch Ratings, in an interview. “The question with Goldman is, have they entered a late-cycle phase too quickly?”

The momentum comes at a sensitive time for CEO David Solomon. Under pressure to improve the bank’s share price, Goldman’s loss-making consumer deals have drawn headlines and the ire of some investors and insiders. The investment bank began its foray into consumer finance in 2016 to diversify from its traditional strengths in Wall Street trading and advisory businesses.

But the journey has been bumpy, marked by leadership changes and staff departures, missed product dates, branding confusion, a regulatory investigation, and mounting losses.

Goldman Sachs CEO David Solomon performs at the Schimanski nightclub in Brooklyn, New York.

Trevor Hunnicutt | Reuters

According to people familiar with the matter, Solomon will take questions from directors about the consumer business at a board meeting later this week. There are internal disagreements over who Solomon picked to run key companies, and insiders are hoping he puts in stronger managers, the people said. Some feel Solomon, who DJs on the side at international festivals, was too outspoken and putting his own personal brand ahead of the bank, people said.

Goldman declined to comment on the article, and Apple did not immediately respond to a request for comment.

A viral hit

Goldman’s credit card business, which has been anchored by Apple Card since 2019, has been arguably the company’s biggest success to date at increasing retail lending. It’s the largest contributor to the division’s 14 million customers and $16 billion in loan balances, a number that Goldman says will nearly double to $30 billion by 2024.

But rising losses threaten to cloud this picture. Lenders consider bad loans “charges” after a customer has missed making payments for six months; Goldman’s net charge-off rate of 2.93% is double JPMorgan’s cards business rate of 1.47% and higher than Bank of America’s 1.60% rate, despite being a fraction of the size of these issuers .

Goldman’s losses are also bigger than those of Capital One, the largest subprime player among the big banks, which had a 2.26% write-down rate.

“If there’s one thing Goldman should be good at, it’s its risk management,” said Jason Mikula, a former Goldman employee who now consults for the industry. “So how can they have depreciation rates that are comparable to a subprime portfolio?”

Apple card

The main reason is that Goldman’s clients have been with the bank for less than two years on average, say industry insiders who are not authorized to speak to the press.

Charge rates tend to be highest in the first few years that a user owns a card; As Goldman’s customer pool ages and users with issues drop out, those losses should settle down, people said. The bank relies on third-party data providers to compare metrics with similar cards of the same vintage and is pleased with its performance, the people said.

Other banks also tend to be more aggressive when it comes to collecting debt, improving competitors’ net charge-off numbers, the people said.

But another factor is that Goldman’s biggest lending product, the Apple Card, caters to a broad swath of the country, including those with lower credit scores. At the beginning of the launch, some users were stunned to learn that they had been approved for the card despite changing credit histories.

“Goldman has to operate on a broader credit spectrum than other banks, that’s part of the problem,” said a person who once worked at the New York bank and asked not to be identified so he could speak openly about his former employer. “You don’t have a direct-to-consumer offering yet, and if you have the Apple Card and the GM card, look at Americana.”

spitting distance

After the 2008 financial crisis caused by undisciplined lending, most banks shifted to serving the wealthy, and competitors like JPMorgan and Bank of America tended to focus on higher-quality borrowers. The exception among the big banks was Capital One, which is more focused on subprime offerings after buying HSBC’s US card business in 2011.

According to Capital One, 30% of its loans are to clients with FICO scores below 660, a range that includes near-prime and subprime users. That’s in close proximity to Goldman’s share of customers under 660, which was 28% in June.

Meanwhile, JPMorgan said 12% of its loans were to users with a score below 660, and Bank of America said 3.7% of loans were tied to FICO scores below 620.

After a period when borrowers, bolstered by Covid pandemic stimulus checks, have been repaying their debt like never before, it is the industry’s “newer entrants” who are showing “a much more rapid weakening” in credit metrics, it wrote JPMorgan analyst Vivek Juneja last week.

“Goldman’s net credit card switching rate has risen sharply over the last three quarters,” he wrote. This is happening “although unemployment remained very low at 3.7% in August, similar to 2019”.

assembly losses

This has forced the bank to build more reserves for potential future loan losses. The consumer business is on track to lose $1.2 billion this year, according to internal forecasts, Bloomberg reported in June. The “vast majority” of consumer investment this year is tied to home loan reserves, thanks in part to new regulations forcing banks to front-load their loss reserves, Solomon told analysts in July.

That number could get worse if a recession forces them to set aside more money for ailing loans, executives have admitted.

The difficulties seem to confirm some of the skepticism Goldman faced when it bested established card players to win the Apple Card account in 2019. Competitors said the bank could struggle to achieve profitability with the fee-free card.

“Credit cards are a tough business,” said Taiano, director of Fitch Ratings. “Goldman is already facing higher losses because its books are young. But when you add worse unemployment, you exacerbate that trend.”