Breadcrumb Trail Links

Home prices are up 3 percent while home construction starts 3 percent slower in January than the previous month

Homes under construction in a development in Langford, British Columbia. Housing starts fell in January compared to the previous month. Photo by James MacDonald/Bloomberg

Homes under construction in a development in Langford, British Columbia. Housing starts fell in January compared to the previous month. Photo by James MacDonald/Bloomberg

content of the article

Canadian home prices rose nearly 3 percent mom in January and new home construction trended lower earlier in the year, compounding concerns about affordability and housing supply being felt across much of the country.

display

This ad has not yet loaded, but your article continues below.

content of the article

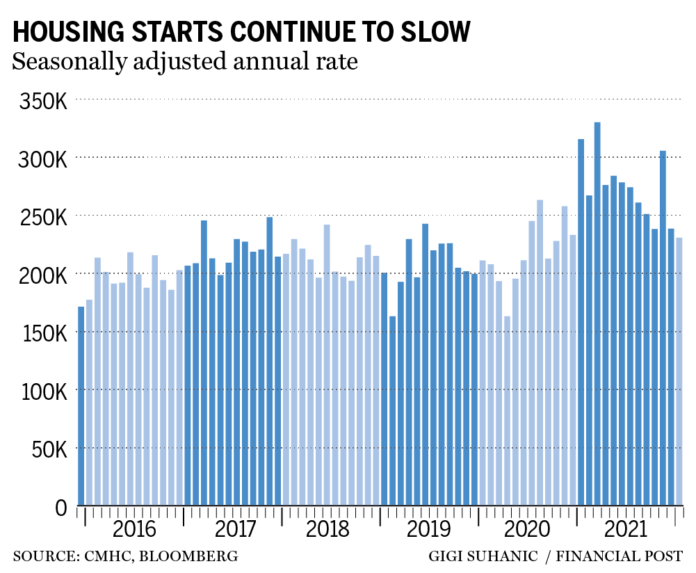

Housing starts hit a six-month moving average of 254,133 units earlier in the year, down about 3 percent from December’s 261,352 units, according to data from the Canada Mortgage and Housing Corporation.

CMHC chief economist Bob Dugan told the Financial Post that while both trend and starts for standalone housing have historically been high, a number of factors, including labor shortages, have weighed on new housing construction.

“If you take the standalone numbers for the month of January from (230,754), that’s a very high level historically, it’s not high compared to what we’ve seen over the past year,” Dugan said, referring to the reported single month figure for January. “Labour shortages, material shortages due to supply chain disruptions are certainly part of the story.”

display

This ad has not yet loaded, but your article continues below.

content of the article

Statewide, single-family home starts were higher overall, growing nine percent from December, while multi-family home starts lagged in January, falling eight percent. Dugan attributed the faster growth in the single-family home category in part to the speed at which these types of properties can be developed compared to apartment complexes, which take much more time from start to finish.

Montreal was the only one of the country’s three major urban areas to see rising housing starts, largely due to higher single-family and multi-family construction. Overall housing starts growth in Montreal reached 16 percent, while Toronto housing starts fell 27 percent and Vancouver 17 percent.

Low supply was one of the factors driving prices up across the country, and January data released by the Canadian Real Estate Association on Tuesday confirmed that.

display

This ad has not yet loaded, but your article continues below.

content of the article

CREA’s benchmark home price index rose a record 2.9 percent month-on-month and a record 28 percent for the year. That boost came as new home listings fell 11 percent and total national home sales rose 1 percent from December through January.

The actual, non-seasonally adjusted national median price rose 21 percent year-over-year to a record $748,450, the organization added.

A lack of supply is an often-cited culprit in the country’s housing affordability crisis. During a Feb. 3 interview with the Financial Post’s Larysa Harapyn, Christopher Alexander, president of RE/MAX Canada, pointed to record-low inventory levels as a factor keeping prices high, especially in recent months.

display

This ad has not yet loaded, but your article continues below.

content of the article

“The frenzy that we’ve been running for the past six, seven months with inventory so low and demand so strong has been hectic in many ways and in January we had less than 1.6 months of inventory nationwide across Canada,” Alexander said . “This is huge. We’ve never seen anything like it.”

Alexander added that high demand and low inventories put buyers in a difficult position when it comes to finding a home.

“If we can get that inventory down to just over two to three months on average, that would be a good thing for everyone,” Alexander said. “You don’t get into the buyer’s market territory unless you have more than six months of inventory, and we haven’t seen those levels in Canada for a very long time.”

display

This ad has not yet loaded, but your article continues below.

content of the article

Robert Hogue, chief economist at the Royal Bank of Canada, also identified the lack of supply as a problem in a report by RBC Economics in late January, in which he estimated that the Canadian market was short of between 180,000 and 250,000 listings at the end of 2021 and he was that It would take triple the number of active offers to bring it closer to balance.

“The supply side will continue to be critical to Canada’s real estate story. So far in the pandemic, supply has been dwarfed by over-demand,” he wrote.

-

Canada’s home prices are posting a record monthly increase in a historically strained market

-

The pandemic exodus of Canadian families from cities could fuel wage inflation

-

Ontario needs to double housing production to improve affordability, task force says

-

CMHC wants back market share, but some observers are wondering if the timing is right

display

This ad has not yet loaded, but your article continues below.

content of the article

RBC analysts expect increases in supply to cool the market in the second half of 2022, although activity is expected to remain strong throughout the year.

A recent RBC report revealed that Toronto recently took the top spot as the country’s most expensive market, held by Vancouver for decades. The composite MLS HPI benchmark of the Greater Toronto Area topped Vancouver with an average price of $1.260 million compared to Vancouver’s $1.255 million.

Supply problems prompted the recently formed Ontario Housing Affordability Task Force to recommend 55 new measures in a report released in early February. Some of the actions include overcoming NIMBYism (not in my backyard) to accelerate housing development, and overcoming municipal policies that prioritize maintaining “neighborhood character” over bringing new developments to market.

Overall, it would be a strategy to reduce bureaucracy and combat restricted zones. It’s a strategy that Alexander says is a step in the right direction.

“It sounds like thinking outside the box in terms of zoning,” Alexander told Harapyn. “On the surface, this all sounds very encouraging because we have such a backlog of getting projects approved for development and finding a way to expedite this is a big step in the right direction.”

• Email: [email protected] | Twitter: StephHughes95

Share this article on your social network

display

This ad has not yet loaded, but your article continues below.

Financial Post top stories

By clicking the subscribe button, you agree to receive the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking the unsubscribe link at the bottom of our emails. Postmedia Network Inc | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for registering!

Remarks

Postmedia strives to maintain a vibrant but civilized forum for discussion and encourages all readers to share their views on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve turned on email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update on a comment thread you follow, or when a user you follow comments follows. For more information and details on how to customize your email settings, see our Community Guidelines.