This section is Demonstrated

This section was created by the editors. The client was not given the opportunity to restrict the content or to check it before publication.

from HSBC

Breadcrumb Trail Links

Where it goes, the rest of the economy usually follows

Published on January 19, 2023 • Last updated 16 hours ago • 5 minutes read

Existing home sales in Canada fell 38 percent last year, according to the Canadian Real Estate Association. Photo by Mike Hensen /The London Free Press/Postmedia Network

Existing home sales in Canada fell 38 percent last year, according to the Canadian Real Estate Association. Photo by Mike Hensen /The London Free Press/Postmedia Network

content of the article

Brace yourself: After a long bull run, the Canadian real estate market is correcting.

advertising 2

This ad has not yet loaded, but your article continues below.

content of the article

This is evident on the road as well as in the numbers. Units are listed longer. Bid wars are rare now. The prices tumble. Housing is dominating conversations at the community center, at the water dispenser, networking events, social media and, of course, conference Q&A.

Financial Post top stories

By clicking the subscribe button, you agree to receive the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for registering!

content of the article

Is this just another temporary shock to the economy, or is there more to it?

content of the article

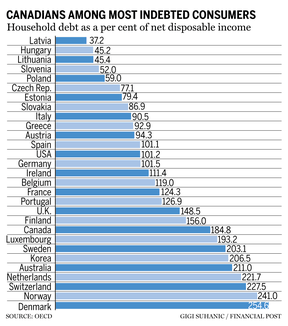

Housing is like an economic prankster. First and foremost, it’s probably the only asset in the system that we can all relate to. Second, most of the average Canadian’s wealth is tied up in it. Third, there has been a rush of homebuyers over the past two years as prices have soared and buyers feared being left behind. Buying at the peak — particularly by first-time buyers — is the most vulnerable to a correction. Fourth, consumer debt, at 185 percent of income, is among the highest in Organization for Economic Co-operation and Development (OECD) countries and has risen 29 percentage points since 2007. Most of it is mortgage debt.

advertising 3

This ad has not yet loaded, but your article continues below.

content of the article

The list goes on. Fifth, during the low interest rate environment, more buyers have turned to adjustable rate mortgages, and they were immediately reset by the sharp rise in interest rates this year. Changes in housing market conditions – especially selling prices – are like an uncomfortable double whammy for recent homebuyers. The list could be longer, but here’s another: Housing is a key leading indicator of economic activity. Where it goes, the rest of the economy usually follows. New homebuyers won’t be the only ones getting a jolt; they’re just the first to feel it.

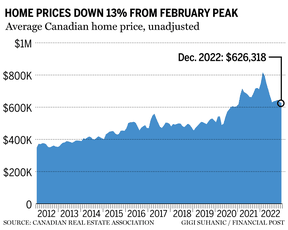

Figures released by the Canadian Real Estate Association (CREA) on January 16 are sobering. Existing home sales fell 21 percent in the second quarter of this year, then 14 percent in the third and another five percent in the fourth, falling 38 percent for the year as a whole. While this comes after an exceptional surge in 2020-21, sales levels are currently 16 percent below the three-year pre-pandemic average. From another perspective, recent sales have only been twice as far below the 10-year average since 2007, and the wedge currently is comparable to what we saw in the 2009 recession.

advertising 4

This ad has not yet loaded, but your article continues below.

content of the article

And then there are prices. On the surface, CREA’s numbers don’t look terrible. Prices are down 7.5 percent year-on-year, which keeps things pretty high considering the huge previous price hikes. Monthly movements paint a very different picture. Since peaking in February, Pan-Canadian prices are down 13 percent and the annualized rate of monthly decline was 17 percent in December. This is getting serious. Then consider that prices would have to fall a total of 21 percent to get back to a normal trend. Some of the regional numbers are much more serious. Even bleaker, this year’s rate hikes are likely to have a negative impact on the housing market that will extend at least into early 2024.

New housing activity seems to strongly contradict. In contrast to the US market, housing starts in Canada are in full swing. Temporary factors could be the reason. Last year saw a highly unusual wave of non-permanent residents, a large proportion of whom were Ukrainian immigrants fleeing the war. This is expected to further boost construction activity through 2023 as in 2022 there were over 135,000 arrivals from Ukraine by land and air, while the number of approved applications is over 470,000 at the last count.

advertising 5

This ad has not yet loaded, but your article continues below.

content of the article

Another important source of temporary demand is the waiting buyers: those who have postponed their initial purchase in hopes of lower future prices. These could further fuel demand for new homes, although potential buyers may well wait until the slump is over. Public programs aimed at the rapid creation of new units will also create temporary demand for new construction.

The conflict between the existing and new home markets, typically perfect substitutes, is a mystery. However, the solution could simply boil down to timing. Builders are under intense pressure to work hard while the market is scorching hot. But it takes time to buy land, zone it, clear it, maintain it, mine it, and then move on to building. If you want a home now, it’s probably easier to buy an existing one – assuming that the latter market is a better indication of true, immediate market conditions.

advertising 6

This ad has not yet loaded, but your article continues below.

content of the article

-

Anne McLellan and Lisa Raitt: Canada must unite to grow

-

Canada’s home prices will fall nearly 6% this year, CREA forecasts

-

‘One-two punch’ worries Canadians more than ever about debt, poll finds

The price movements of the market must also be taken into account. Average annual gains of 20 percent in 2020 and 2021 — which incidentally outperformed the S&P500 — went unnoticed, enticing even the most inexperienced speculators to get in on the action. The current fall in prices, favored by rising interest rates, should also reveal a market that has been operating far beyond the actual fundamental requirements for several years.

When misery loves company, we’re almost unlucky. While interest rates are rising almost everywhere, housing markets are not reacting like they have in Canada. Of the 14 countries included in a study by Oxford Economics late last year, Canada’s house price correction is the largest, with only Sweden and New Zealand coming close. Their peak-to-trough forecast puts Canada falling 30 percent, New Zealand 28 percent, Sweden 20 percent, and Australia and the UK each 11 percent. All others are in the single digits, averaging a relatively mild correction of four percent. We are clearly the outlier at the bad end of the distribution.

If homebuilding is still a reliable beacon of the broader economy – and there’s no good reason to believe it isn’t – then alarming weakness at the top of this forward-looking market spells trouble. I sincerely hope that those who are confident in predicting a slight correction are right. I’m afraid we’re about to do something much worse.

Peter Hall is Chief Executive of Econosphere Inc. and former Chief Economist of Export Development Canada.

Share this article on your social network

Remarks

Postmedia strives to maintain a vibrant but civilized forum for discussion and encourages all readers to share their views on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve turned on email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update on a comment thread you follow, or when a user you follow comments follows. For more information and details on how to customize your email settings, see our Community Guidelines.