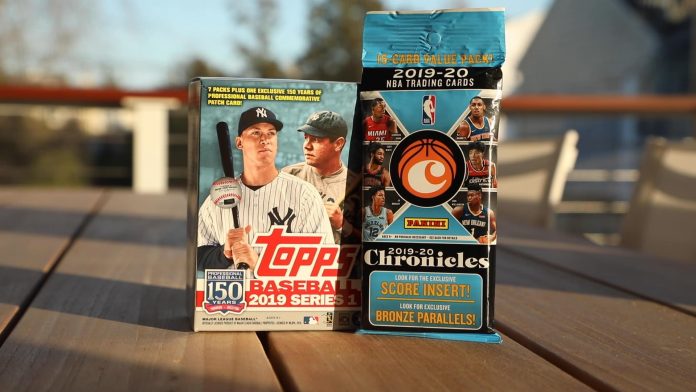

Packs of 2019 Topps cards spread out on a table.

Sam Rega

Interest in collecting and in values has grown steadily over the past decade, and prices went up really faster sometime around 2016 or 2017. With the outbreak of the pandemic earlier this year, card collecting reached new heights. These individuals were largely driven by people in their thirties and forties collecting at a young age and were at home revisiting their card collections.

Then came ESPN’s release of the Michael Jordan documentary series “The Last Dance”. Auction houses and eBay saw an increase in Michael Jordan cards and memorabilia, followed by even greater interest in basketball cards and beyond.

“It brought back nostalgia. It brought back memories of the greatness of Michael Jordan, and his maps and memorabilia grew. And in our industry, it’s definitely one case where rising tides raise all boats,” said Ken Goldin, Founder and CEO of Goldin Auctions said CNBC.

A 15 card pack of Panini Chronicles basketball tickets for the 2019-2020 period.

Sam Rega

As sports cards increase in value, many collectors collect high value collections as part of a diversified investment portfolio. What sets this era apart from the previous one is the recognition that these cards are a legitimate alternative good. Alt, a Silicon Valley startup founded by Leore Avidar, aims to create clarity and security for alternative assets, especially sports cards.

Collectors and investors see a bright future for sports cards. Card companies are aware of their past mistakes and collectors have more information than ever before. If growth continues, Leore Avidar expects records to continue to be broken.

“I’ll say we’ll see our first $ 10 million card in the next two years,” Avidar says.

Check out the video above to find out why sports cards are a popular alternative.