Breadcrumb trail links

Sellers must navigate price cuts, lukewarm buyers and mortgage approval challenges

Published on March 25, 2024 • Last updated 6 days ago • 5 minutes reading

You can save this article by registering for free here. Or log in if you have an account.

A “For Sale” sign is posted outside a home in Toronto's Riverdale neighborhood. Photo by Evan Buhler/The Canadian Press Files

A “For Sale” sign is posted outside a home in Toronto's Riverdale neighborhood. Photo by Evan Buhler/The Canadian Press Files

Article content

Home sellers are facing a new, sobering reality as the spring real estate market springs into action: The era of frantic bidding wars and soaring profits in urban centers appears to be receding, replaced by a landscape in which they must contend with price drops, lukewarm buyers and challenges in mortgage approval.

Sellers have held the reins for years, dictating terms and watching the value of their properties skyrocket. But the tide is turning and many are faced with a market that demands a reset of their expectations.

Advertising 2

This ad has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

REGISTER/LOGIN TO UNLOCK MORE ARTICLES

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the discussion in the comments.

- Enjoy additional articles per month.

- Get email updates from your favorite authors.

Log in or create an account

or

Article content

Article content

As a result, Darren Cabral, a real estate agent in York Region north of Toronto, said the need for sellers to reduce their home prices below initial expectations is increasing.

“Someone will come to me and say, 'Oh, my agent didn't do enough.' Our property was not sold. “We didn’t get any offers,” he said. “Usually we discover that the price was wrong, which is what I end up explaining to the seller. The prices are way, way, way, way too high. There’s not enough trading because it’s way above the market.”

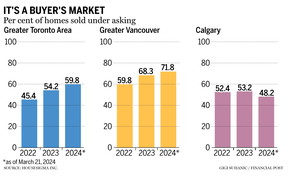

Nearly 60 per cent of all homes sold in the Greater Toronto Area (GTA) so far this year have sold below listing, according to real estate website HouseSigma Inc. as of March 21.

About 54 per cent of homes in the GTA sold below offer in 2023, compared to 45.4 per cent in 2022. In Vancouver, 71.8 per cent of homes have sold below offer so far this year.

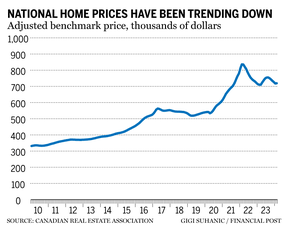

However, national benchmark home prices remained stable at $719,400 in February compared to the previous month, according to the Canadian Real Estate Association (CREA). Since the fall, prices have been in a downward trend for five months in a row.

Top stories

Thanks for registering!

Article content

Advertising 3

This ad has not loaded yet, but your article continues below.

Article content

However, prices are trending downward rather than upward in several key markets across the country. However, this is not the only challenge for sellers, as experts say potential buyers are reluctant to sign a contract.

While buyers were once eager to secure their dream home, many are now taking a more cautious approach and taking time to weigh their options given economic uncertainty and higher interest rates.

Vancouver real estate agent Cheryl Davie said fewer people are willing to engage in a bidding war these days.

“It used to be common for buyers to have to compete on every offer,” she said. “Today there is no expectation that they have to compete and so buyers will hear that there is another offer on the table and sometimes they will just back out altogether.”

Davie said buyers won't leave to find significant savings elsewhere. Instead, their offers are often based on your maximum budget. Given the current high interest rate environment, buyers often expect the sales price to rise in a bidding war and simply can't afford to pay more, so they back out.

Advertising 4

This ad has not loaded yet, but your article continues below.

Article content

Additionally, the challenges associated with getting a mortgage approved add further complexity. Tighter lending criteria and increased interest rates are making it increasingly difficult for buyers to secure financing, resulting in longer closing times and increased uncertainty for sellers.

Homes in Langley, BC Photo by Darryl Dyck/The Canadian Press Files

Homes in Langley, BC Photo by Darryl Dyck/The Canadian Press Files

“It is currently difficult for buyers to obtain approvals. They come with a lot more conditions, whereas two years ago I remember offers coming in and there were never any conditions,” Cabral said. “Now they have the financing clause, they have an inspection clause and then other things to buy time because a lot of people are having difficulty getting financing.”

He said all of these conditions would slow the pace of the market.

According to the Toronto Regional Real Estate Association, the average number of days a property in the GTA spends on the market has increased 13.6 per cent since February 2023.

Financing clauses that allow buyers to walk away from a deal if they cannot secure a mortgage are becoming increasingly common, leaving sellers in a precarious position as even a seemingly strong offer can fall through at the last minute.

Advertising 5

This ad has not loaded yet, but your article continues below.

Article content

Home inspection clauses are also becoming increasingly common, giving buyers the right to back out of a deal if significant problems are uncovered. These clauses provide peace of mind for buyers, but can also pose a challenge for sellers who may need to resolve issues or make concessions to keep the deal going.

Despite these challenges, real estate agents advise sellers to remain pragmatic and flexible during this spring selling season.

“The market is evolving and sellers need to adapt,” Cabral said. “Seller properties won’t get the hype they were used to two years ago. People just have to be content with that.”

However, Calgary is bucking this trend. According to the Calgary Real Estate Board, which represents more than 7,600 licensed real estate agents, the region's reference price and sales were on an upward trend for most of 2023, and that trend continued into 2024. Additionally, more homes are still selling above asking price in the region than in the GTA and Vancouver.

Calgary real estate agent Karen Fawcett believes these trends will continue.

“It just seems like the interest rate being held at five per cent and the feeling that it will come down means that buyers have become accustomed to the new normal and are not as worried about the interest rate now .” She said. “They think now is the time to get in.”

Advertising 6

This ad has not loaded yet, but your article continues below.

Article content

Anthony De Toma, a real estate agent in the GTA, said the local market has the potential to gain momentum as spring ends, but agrees buyers are adjusting to current interest rates. This makes it all the more important for sellers to correctly state the price of their property.

Recommended by Editorial

-

Paying off your mortgage early could cost you money

-

Ontario leads the nation in cottage price increases

-

Rent controls affect the rental supply

“If you price your property at the price you want and it makes sense in the market, sell within seven days,” he said. “And the main reason for this is that inventory is so low that buyers don’t want to waste their time with sellers playing games. Buyers appreciate sellers who price homes on paper and make the sale if everything works out.”

• Email: [email protected]

Would you like to learn more about the mortgage market? Read Robert McLister's new weekly column in the Financial Post for the latest trends and details on funding opportunities you won't want to miss

Bookmark our website and support our journalism: Don't miss out on the business news you need to know – bookmark Financialpost.com and sign up for our newsletter here.

Article content

Share this article on your social network