Breadcrumb trail links

The industry veteran dismisses doomsday predictions and says demand for office space will rise again

Published on November 6th, 2023 • Last updated 1 day ago • 3 minutes reading time

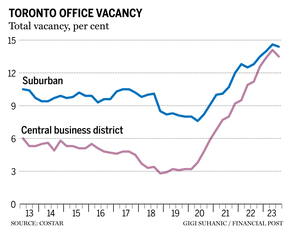

In Toronto, downtown vacancy rates reached 15 per cent in 2023, slightly lower than suburban vacancy rates. Photo by Andrew Lahodynskyj /THE CANADIAN PRESS

In Toronto, downtown vacancy rates reached 15 per cent in 2023, slightly lower than suburban vacancy rates. Photo by Andrew Lahodynskyj /THE CANADIAN PRESS

Article content

Downtown work centers have been the epicenters of office space demand for decades, comprising millions of square feet in major urban centers. But the COVID-19 pandemic dealt a significant blow to this demand and led to doomsday declarations about the demise of these areas.

However, testimonials in the real estate industry disagree, claiming that the city’s economy has weathered worse storms and that downtowns will undoubtedly return to their pre-pandemic splendor.

Advertising 2

This ad has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

Register to unlock more articles

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the discussion in the comments.

- Enjoy additional articles per month.

- Get email updates from your favorite authors.

Article content

Article content

One of those industry veterans is Jon Love, managing director of KingSett Capital Inc., a private equity real estate investment firm that manages more than $17 billion in assets. He has weathered past recessions and remembers similarly pessimistic predictions for downtowns during the late 1980s downturn, when office vacancies soared and there was a wave of commercial real estate loan defaults.

At the time, experts predicted that office space would become nearly obsolete and suggested converting it to residential or alternative uses, as is the case today. Futurists even discussed telecommuting, a concept that was still in its infancy at the time despite the rudimentary state of computer and communications technologies.

However, after a brief lull in the early 1990s, city center real estate markets experienced a resurgence in demand for office and residential uses in large urban markets. New office towers and dozens of high-rise residential buildings have transformed Toronto’s skyline over the past 25 years. Calgary and Edmonton have also seen significant investment in downtown real estate due to the boom in the oil sector.

Top stories

Thanks for registering!

Article content

Advertising 3

This ad has not loaded yet, but your article continues below.

Article content

Many economists say this time is different: The post-pandemic world will not return to pre-COVID-19 trends, at least in the short term. In Toronto, the office vacancy rate in the central business district was about five per cent before the pandemic, while the rate in the suburbs averaged about 10 per cent. Since the pandemic, vacancy rates in the city center have increased and are at 15 percent in 2023, slightly lower than vacancy rates in the suburbs.

The pandemic led to significant logistical and cultural changes in the way workers in the knowledge economy work. Partial work from home (WFH) arrangements allow employees to split their time at home and at work. Such hybrid work environments reduce demand for office space, leading to rising vacancy rates

Carl Gomez, chief economist at CoStar Realty Information Inc., expects there will be an extended period of overcapacity in office markets, largely due to historically low office occupancy. He adds that dense urban areas that rely on public transportation will continue to feel the greatest impact.

Advertising 4

This ad has not loaded yet, but your article continues below.

Article content

But Love seems to be more optimistic about the situation. During his speech at Toronto Metropolitan University’s Ted Rogers School of Management, he dismissed doomsday predictions about high-level hiring as “boring” and not unprecedented.

His optimism is based on the spatial structure of the urban economy in Canada, where prominent employers focus on education, finance and technology in core urban markets. He believes Toronto’s high vacancy rates are due in part to a development cycle that has created significant new office space. He continues to believe in the resilience of the financial sector and expects the technology sector to recover and create new demand for office space in due course.

Zoom video conferencing emerged as a symbol of WFH during the pandemic, enabling private companies, governments and educational institutions to quickly transition from in-person to online operations. Still, even Zoom Video Communications Inc. recently asked its employees to return to the office a few days a week, suggesting that remote work may have peaked and could potentially decline as employers encourage a return to physical workplaces .

Advertising 5

This ad has not loaded yet, but your article continues below.

Article content

The extent to which hybrid working models persist will have a lasting impact on the valuation of commercial and office properties. “Telecommuting leads to a decline in office valuation,” says a recent study from France published in Regional Science and Urban Economics. The long-term effects could result in a reduction in office space construction.

similar posts

-

Investors and investments are key to building more housing

-

Inner cities are still struggling, but there is a way to save them

-

What we can learn from green belt development in the UK

Historically, the downtowns of cities with adaptable, diverse and welcoming economies have recovered from previous economic downturns. Some European city centers have recovered from wars that destroyed buildings and infrastructure, as well as economic turmoil. The historic bazaars of Asia and the Middle East are a testament to the resilience of centrally located markets.

Much depends on how city centers welcome current and future workers. Optimized transportation options, favorable tax conditions and flexible planning systems are prerequisites for a full recovery of the real estate and other markets in the downtown core.

Murtaza Haider is a professor of real estate management and director of the Urban Analytics Institute at Toronto Metropolitan University. Stephen Moranis is a real estate industry veteran. They can be accessed on the Haider-Moranis Bulletin website at www.hmbulletin.com.

Article content

Share this article on your social network

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask that you keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. For more information and details on adjusting your email settings, see our Community Guidelines.