Breadcrumb trail links

The condominium market is facing challenges as construction slows and sales slump

Published on April 23, 2024 • Last updated 13 hours ago • 4 minutes reading time

You can save this article by registering for free here. Or log in if you have an account.

The CN Tower behind condos in Liberty Village in Toronto. Photo by Cole Burston/The Canadian Press Files

The CN Tower behind condos in Liberty Village in Toronto. Photo by Cole Burston/The Canadian Press Files

Article content

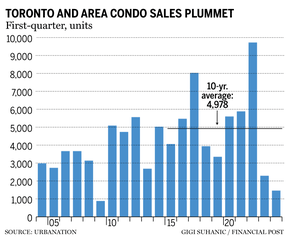

New condo sales in Toronto fell in the first quarter of 2024 as a rising inventory of unsold units and rising construction costs slowed the once-booming market.

A report from condo research firm Urbanation showed this week that new condo sales in the Greater Toronto and Hamilton Area (GTHA) reached levels reminiscent of the late 1990s in the first three months of the year, with just 1,461 new condos sold. That represented an 85 percent decline from the sales peak in the first quarter of 2022 and a 71 percent decline from the 10-year average for the first quarter.

Advertising 2

This ad has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and more.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic copy of the print edition that you can view, share and comment on any device.

- Daily puzzles including the New York Times Crossword.

REGISTER / LOGIN TO UNLOCK MORE ARTICLES

Create an account or log in to continue your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the discussion in the comments.

- Enjoy additional articles per month.

- Get email updates from your favorite authors.

Log in or create an account

or

Article content

Article content

At the same time, construction slowed dramatically, and only 2,361 new condos began construction, down 52 percent from the previous year.

With completions at a record high of 12,132 units, the total number of condos currently under construction is at its lowest level in more than two years at 91,590 units.

One of the factors that contributed to the decline in revenue was the decline in the launch of new projects by developers. In the first quarter, only four projects with a total of 958 units were brought onto the market, which is significantly lower than the figures from previous quarters.

Shaun Hildebrand, president of Urbanation, said this cautious approach from developers is a sign of current market conditions.

“After two years of sharp declines in pre-construction sales, construction activity has been severely affected,” Hildebrand said in the report. “While expected rate cuts in the second half of the year are expected to result in some improvement in market conditions for new condominiums, activity is likely to remain subdued as the industry works through current inventory levels and digests the numerous recently released government housing policies.”

Top stories

Thanks for registering!

Article content

Advertising 3

This ad has not loaded yet, but your article continues below.

Article content

Urbanation noted that these increased inventories weighed on prices.

The average opening price for a new condo fell to $1,168 per square foot (psf) in the first quarter of 2024, 12 percent less than the fourth quarter of 2023 and 17 percent less than the first quarter of last year. Unsold inventory remained high across all stages of development at 23,815 units, representing a supply of 22.8 months.

Market dynamics differed between the City of Toronto and the 905 Region in terms of unsold inventory and asking prices. In Toronto, the unsold inventory of new condos was equivalent to 30.6 months of supply, while in Region 905 the inventory was equivalent to 16.8 months of supply. Asking prices for unsold units in the 905 region continued to rise, increasing 2 percent annually to an average of $1,161 per square foot. In contrast, Toronto remnant prices fell four per cent year-over-year to an average of $1,522 per square foot. Overall, asking prices for unsold units in the GTHA fell 3 percent annually to an average of $1,373 per square foot.

Looking forward, a total of 17,076 units across 56 projects have released marketing materials for an upcoming launch in the next few quarters, with 70 percent of units located in the 905 region. However, the market remains uncertain as 60 projects totaling 21,505 units in the GTHA have indefinitely shelved their launch plans since the market began slowing in 2022.

Advertising 4

This ad has not loaded yet, but your article continues below.

Article content

A new condo construction site in downtown Toronto. Photo by Chris Young/The Canadian Press Files

A new condo construction site in downtown Toronto. Photo by Chris Young/The Canadian Press Files

Hildebrand noted that construction in Toronto is particularly limited.

“The market for new condo development in Toronto is currently in a difficult situation. In many cases, the cost of developing a new condominium project exceeds prices obtainable in today’s market,” he said.

Hildebrand said that while demand is strongest for units priced below $1,300 per square foot (psf), that price point is not economically viable for downtown development. As a result, developers are struggling to adjust prices to market demand, resulting in high unsold inventory and a lack of new projects available for pre-sales. To mitigate this problem, developers offer incentives instead of significantly lowering prices because high costs limit their ability to adjust prices downward.

Urbanation says incentives include discounted or free parking, discounted development fees, discounted deposits, rental guarantees and mortgage assistance programs.

Hildebrand said the incentives across the GTHA have had limited success, however, “developers in the suburbs have launched some projects closer to $1,000 per square foot that have generated strong sales; There are only a few of them because the calculation remains difficult.”

Advertising 5

This ad has not loaded yet, but your article continues below.

Article content

The absorption rate for pre-construction projects fell to 50 percent in the first quarter of 2024 and was therefore well below the typical construction financing requirement of at least 70 percent.

Recommended by Editorial

-

What's going on in Toronto's troubled $2 billion mega-tower?

-

The condominium market faces a “significant slowdown”

-

More and more condo investors are hitting the sell button

Hildebrand estimates that the decline in pre-sales and launches will lead to a sharp decline in supply in a few years.

Current completions are “less than 10,000 units on an annual basis – a remarkably low figure compared to the nearly 30,000 units that began construction in 2022 and population growth in the GTHA of over 200,000 last year.” said Hildebrand.

• Email: [email protected]

Would you like to learn more about the mortgage market? Read Robert McLister's new weekly column in the Financial Post for the latest trends and details on funding opportunities you won't want to miss

Bookmark our website and support our journalism: Don't miss out on the business news you need to know – bookmark Financialpost.com and sign up for our newsletter here.

Article content

Share this article on your social network