Article content

Average home prices rose slightly by 0.4 percent in August as sales slowed and new listings returned to more normal levels. This is a sign that demand and supply are continuing to come into better balance, according to monthly data from the Canadian Real Estate Association.

National home sales fell 4.1 per cent in August compared to July, driven by declines in Greater Vancouver and the Fraser Valley in British Columbia, Montreal, Ottawa, Hamilton and Burlington, Ont., as well as London and St. Thomas . Ontario, they said.

Article content

Shaun Cathcart, senior economist at CREA, said the drop in activity in August was expected since it was the first full month of data following the Bank of Canada’s rate hike in July.

“Sales are currently slightly below average, which is better than at the beginning of the year,” he said. “And that’s not bad considering how interest rates have developed since last spring.”

The non-seasonally adjusted statewide median home price was $650,140, an increase of 2.1 percent from August 2022.

According to CREA, prices are stabilizing nationally, but regional differences are re-emerging, with price growth remaining solid in Quebec and the East Coast and Ontario now showing a mixed picture with some larger increases but also some larger declines regionally.

CREA said year-on-year comparisons are likely to continue rising in the coming months, although prices will settle near current levels as prices declined in the second half of 2022.

Actual transactions, not seasonally adjusted, were 5.3 percent higher than the previous year.

“Demand is obviously still there and it will come back, but with the housing affordability crisis becoming a major policy issue again, the slowdown on the buyer side is likely to help keep prices under control for now,” said Cathcart.

Article content

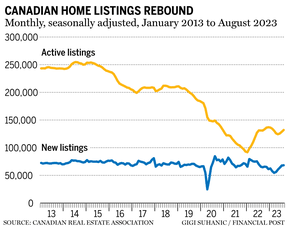

The number of newly listed houses rose by 0.8 percent in August compared to the previous month. This is a small increase compared to the cumulative increase of more than 24 percent over the past five months.

“New listings began 2023 at a 20-year low but are now closer to average levels,” CREA said.

The ratio of sales to new listings fell to 56.2 percent, bringing the metric back to its long-term average of 55.2 percent. This compares to 59 percent in July and a high of 67.4 percent in April.

Cathcart said the “big drama” surrounding the housing crisis was more in the rental market. Given high prices and interest rates, households are unable to move from renting to owning, increasing rental demand, he added.

Although they have leveled off now, sales prices at this point have recouped about 40 percent of last year’s losses, Cathcart said.

-

7 years is not enough to build the millions of houses needed

-

The average rent in Canada is currently $2,117 per month

-

Canada still needs 3.5 million more homes

“Obviously it doesn’t really help affordability to offset all those losses, but it’s good news for people who bought at the peak of the market,” he said.

• Email: dpaglinawan@postmedia.com

Bookmark our website and support our journalism: Don’t miss out on the business news you need to know – bookmark Financialpost.com and sign up for our newsletter here.