content of the article

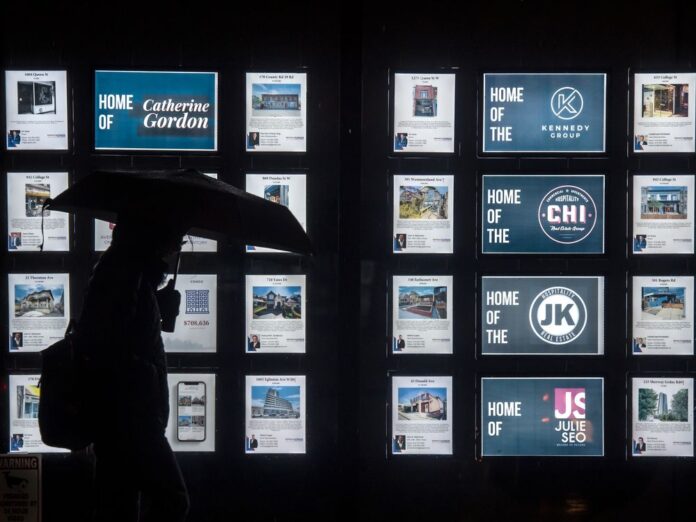

New registrations will rise for much of 2023 and into 2024, according to a new forecast from TD Economics, after Canada has seen supply contraction during the current downturn in housing markets.

content of the article

New registrations fell 19 percent peak to trough after the housing market began its correction in February last year and ended 2022 11 percent below their 10-year average, weighed down by particularly sharp falls in BC and Quebec. found the report.

content of the article

Home sales and prices have also declined since last February, but the report found that a lack of inventory saved home prices from an even sharper fall.

While inventories are expected to pick up again, rising demand should keep markets balanced and support positive home price growth, particularly in the second half of the year, according to the TD economist Rishi Sondhi wrote while noting that supply growth may be stronger than expected.

“There is some risk that supply will grow more than expected as homeowners face headwinds from record-high debt service costs and economic weakness,” Sondhi said, noting that such a scenario could keep prices under pressure.

content of the article

Price growth in December was positive in three-month moving average in half of all provinces, marking a trend reversal from earlier in the year, the report said.

-

Investors own a large portion of Canada’s housing market. Do we need to worry?

-

Toronto home prices are down 14% year over year, and sales are down 44%

-

Homeowners are better positioned to weather a downturn than they were a decade ago

The forecast is that prices will fall again in the first quarter, but resale supply will pick up thereafter as the market bottoms.

The increase in listings between the second and fourth quarters of 2023 will be higher than the previous forecast of 7 percent as listings fell further than expected in December. The report added that listings are then expected to slow to a more modest growth pace of 2 percent in 2024.

“Ultimately, the notion that the Canadian market will retrace only part of the pandemic-era price gains, coupled with the challenge of building enough new units to accommodate a rapidly growing population, should keep pressure on affordability and elevated and soaring prices based on a longer-term horizon,” wrote Sondhi.

• Email: [email protected] | Twitter: denisepglnwn