Article content

Despite adding a record 16.3 million square feet of new industrial space to the Canadian market in the final quarter of 2023, demand continues to outstrip supply, according to a new report.

According to a new report from Altus Group Ltd. The nationwide availability rate rose 0.7 percentage points to 4.3 percent, with increases in all major markets. The record increase in new industrial space, 62 percent of which is available, beat fourth-quarter average completions of less than 10 million square feet, but supply is not catching up with demand, the company said.

Article content

“In addition, tenants continued to be proactive in securing suitable space before their lease expired, and in response, landlords advertised their space ahead of vacancy,” the report said.

Ray Wong, vice president at Altus, said the increase in project completions represents only a small fraction of what is needed in the industry.

“Although the overall availability rate increased from 3.6 to 4.3 percent from the third quarter to the fourth quarter on a national basis, we have a very low availability rate for the industry,” Wong said. “The challenge for tenants is that as their needs change and they consider renewing, availability and choice in the market is limited.”

He added that when some of those tenants say they have secured other locations, landlords begin marketing the space immediately.

“You definitely want to make sure there’s no gap in desired rental payments,” Wong said.

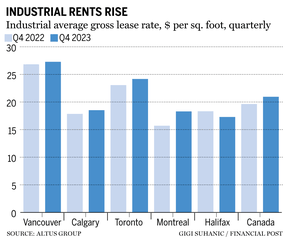

Despite a slight increase in availability rates, rental prices continued to increase compared to the fourth quarter of 2022. Montreal had the largest average year-over-year increase at 16 per cent, followed by Toronto at 4.8 per cent and Calgary and southwestern Ontario tied at 3.7 per cent. Halifax was the only region to see a decline, falling 5.6 per cent. Nationwide, the average rental price rose by 7.7 percent.

Article content

According to Altus, of the 79 completed buildings totaling 16.3 million square feet, 38.3 percent were pre-leased. The bulk of this new supply was in Toronto (8.7 million square feet), Calgary (2.9 million) and Southwestern Ontario (2.5 million).

E-commerce demand accounts for most of the inventory demand in the market, Wong said.

“The Amazons of the world, the Walmarts, need very large distribution warehouses, from half a million to almost a million square feet of space,” he said. “Warehouse distribution locations were the most sought after.”

Wong added that demand in Canada's industrial sector remains strong despite the challenges of higher interest rates and inflation.

Recommended by Editorial

-

In Calgary, incentives to convert old offices into new housing will pay off this year

-

The CEO of Colliers Canada sees “wonderful” opportunities in commercial real estate this year

-

Industry observers say WeWork's bankruptcy won't mean the end of the co-working trend in Canada

“Your rental prices are going up, as are your sales prices,” he said. “Even though the availability rate has increased slightly, there is still strong demand for purchasing and leasing among both investors and users.”

em>• Email: shcampbell@postmedia.com

Share this article on your social network