This section is Presented

This section was created by the editors. The client was not given the opportunity to restrict the content or to check it before publication.

from RBC Mortgages

Breadcrumb Trail Links

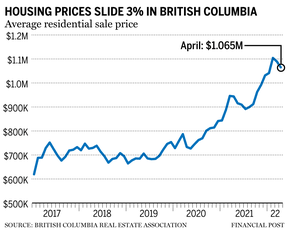

The median home price fell almost 3% last month to $1.065 million

A condominium building is seen under construction surrounded by homes while condominium towers can be seen in the distance in Vancouver, BC, Friday March 30, 2018. The local housing authority says the benchmark price of a single-family home in Metro Vancouver has fallen nearly 10 times a year as more sellers listed properties but home seekers continued to take their time. THE CANADIAN PRESS/Darryl Dyck Photo files by THE CANADIAN PRESS/Darryl Dyck

A condominium building is seen under construction surrounded by homes while condominium towers can be seen in the distance in Vancouver, BC, Friday March 30, 2018. The local housing authority says the benchmark price of a single-family home in Metro Vancouver has fallen nearly 10 times a year as more sellers listed properties but home seekers continued to take their time. THE CANADIAN PRESS/Darryl Dyck Photo files by THE CANADIAN PRESS/Darryl Dyck

content of the article

Rising interest rates put British Columbia’s housing market on hold as prices and sales cooled from their pandemic highs in April.

advertising 2

This ad has not yet loaded, but your article continues below.

content of the article

The median price for a home in the province fell nearly 3 percent month-on-month last month to $1.065 million, according to data from the British Columbia Real Estate Association. While prices are marking an ongoing decline, the association noted that prices are still around 13 percent up from last April’s $943,765.

content of the article

Home sales in April fell about 35 percent year-on-year to 8,939 units sold and were down 22 percent month-on-month. Sales in dollars have also collapsed by 26.5 percent to 9.5 billion US dollars since last year.

“Canadian mortgages have risen sharply, surpassing four percent for the first time in ten years,” BCREA chief economist Brendon Ogmundson said in a press release. “Demand across BC is now on the path to normalization as interest rates rise. However, given the existing supply, market conditions remain tight.”

advertising 3

This ad has not yet loaded, but your article continues below.

content of the article

Active entries across the province were also down about 7.5 percent at the latest reading compared to last year.

BC joins other major markets in seeing a slowdown in the housing market as rising interest rates reduce demand. According to data from the Toronto Regional Real Estate Board, prices in Toronto fell about three percent month-on-month to $1.254 million as exuberance was drained from the market.

-

Reverse mortgages gain momentum in Canada as more seniors ‘age in place’

-

Equitable posts best-ever earnings as mortgage business remains strong

-

Blackstone opens Toronto office in Canadian real estate market

It’s a trend Don Kottick, president and chief executive officer of Sotheby’s International Realty Canada, discussed during a May 5 interview with The Financial Post’s Larysa Harapyn.

“(If) you look at where we’ve been lately, we’ve had a very seething market,” Kottick said. “I think the best way to sum it up is that the foam really comes out of the market. The sale of the property takes a little longer, the days on the market are increasing. But compared to historical trends, it’s really almost a return to a normalized market.”

• Email: [email protected] | Twitter: StephHughes95

Share this article on your social network

Advertisement

This ad has not yet loaded, but your article continues below.

Financial post top stories

By clicking the subscribe button, you agree to receive the above newsletter from Postmedia Network Inc. You can unsubscribe at any time by clicking the unsubscribe link at the bottom of our emails. Postmedia Network Inc | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for registering!

Remarks

Postmedia strives to maintain a lively but civilized discussion forum and encourages all readers to share their opinions on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve turned on email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update on a comment thread you follow, or when a user you follow comments follows. For more information and details on how to customize your email settings, see our Community Guidelines.