It’s no secret that COVID-19 is having a huge impact on small businesses. A recent survey by SCORE shows how big the impact has been so far.

Overall, the report, which included responses from 3,500 different business owners, found that more businesses are facing financial problems. And many black- and Hispanic-owned businesses face even greater challenges. However, it was also found that companies were able to move quickly in key areas. And many are still optimistic about the future.

SCORE Survey – COVID Impact on Small Businesses

Specifically, the report found that the majority of companies failed to make a profit that year. In fact, only 34 percent of small business owners said their business is currently profitable. But 55 percent were profitable at this point last year.

Travel, art and culture companies suffered the biggest losses this year. But construction companies, restaurants, professional services, health services and retailers also had problems.

Many of these industries have been hardest hit by government shutdowns. However, these are also areas that have been classified as “not material”. Consumers with less disposable income may also simply choose to reallocate their income. And of course, many of these industries require at least some face-to-face interaction, which many consumers want to avoid.

Fight for minority owned businesses

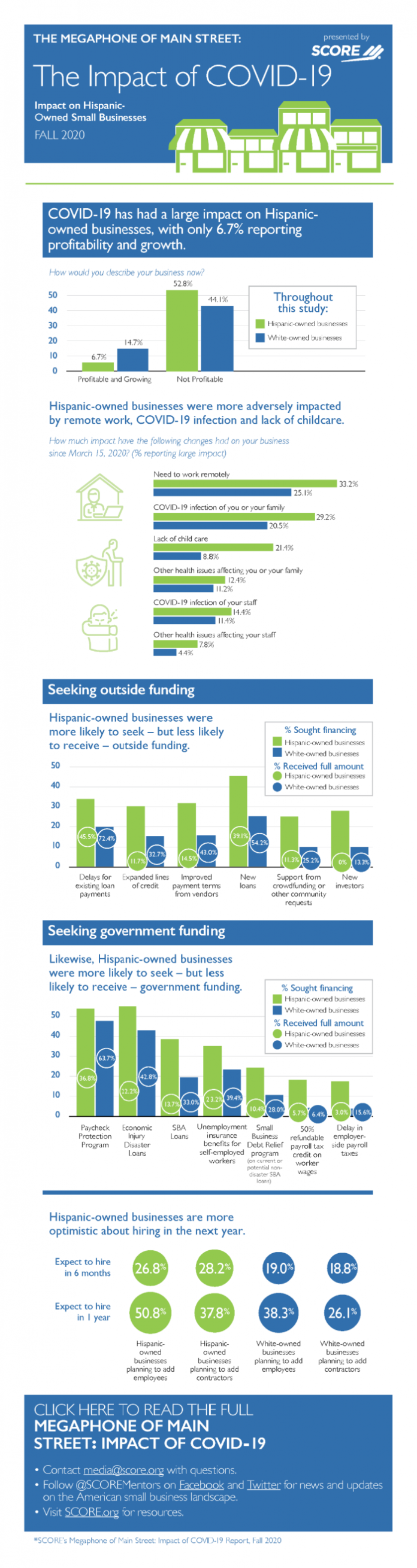

These numbers are even more pronounced for Black and Hispanic owned businesses. Only 26.5% of black business owners said their businesses are currently profitable. That’s a 40% decrease in 2019. Among Hispanic business owners, 29.2% said their business was profitable that year. And 51.2% of them had profitable businesses in 2019.

Why is this inequality present? Much of the answer could be in access to resources. Paycheck Protection Program (PPP) loans and Disaster Damage Loans (EIDL) have served as a lifeline for many businesses. But white business owners were three times more likely to receive these funds than black and Spanish business owners. These business owners were also more likely to have problems with credit and securing investors. COVID-19 infections, remote working and inadequate childcare also affected these companies more in 2020.

Before COVID, there were certainly inequalities in corporate ownership and access to resources. But the pandemic made them even more prominent. In addition, corporate ownership has increased among Black and Hispanic people in recent years. Eliminating these inequalities can therefore be key to helping small business economies recover quickly.

Companies are adapting due to COVID

Although many struggled with profits this year, small businesses are still struggling. Many were able to stay afloat with just a few changes and protect customers and employees. In particular, 43 percent of employees made PPP available, 34 percent allowed teleworking, and 29 percent updated policies.

In addition, during that time, 20 percent of businesses added new services to help their communities. Some of these may have been just to show support. However, other companies have clearly identified the needs of their target customers. And that ability to pan quickly may have helped a small number of businesses stay profitable, or at least avoid large losses.

Unfortunately, one of the areas where companies have had to adapt the most this year has been human resources. Around 12 percent said they had to lay off employees permanently. And 56 percent either had to take employees off or shorten their working hours in order to make ends meet. These changes allowed many companies to stay afloat. But it almost certainly got in the way of operations for many. And it could have lasting effects on the entire economy.

However, 20 percent hired new employees during the pandemic. And 41 percent expect to hire more team members in the next year. With a little hard work and careful planning, many teams can potentially recover quickly. Increasing the number of employees can help companies increase production in the years to come and give more individuals access to regular paychecks. And that’s one of the greatest things that will help small businesses thrive in the future.

How companies think about the future

It’s not all bad news for small businesses this year. Despite the financial challenges, 22 percent of small businesses are currently very optimistic about the future. Another 33 percent are somewhat optimistic.

Of course, some policy changes can help small businesses even more. Some are hoping for more PPP loans and higher unemployment benefits. However, 66 percent agree that stimulus checks are the most influential for individuals. Putting money in the hands of small business customers can be the most effective way to move forward.

Overall, the negative economic effects of the pandemic cannot be denied. And the exaggerated impact on minority companies makes even more problems apparent. However, the report also contains some bright spots. Small businesses that are spinning fast can help people stay safe and keep their operations going. Ideally, all of this will lead to a quick rebound in 2021 – at least that’s what many business owners seem to believe.

Image: score.org